Infrastructure Financing through Islamic

Finance in the Islamic Countries

126

Charter under Vision 2030 provides the direction of the financial sector from 2016 to 2020.

The goal is to expand the size of the financial sector from SAR 4.7 trillion in 2016 to SAR 6.3

trillion (USD 1.68 trillion) in 2020.

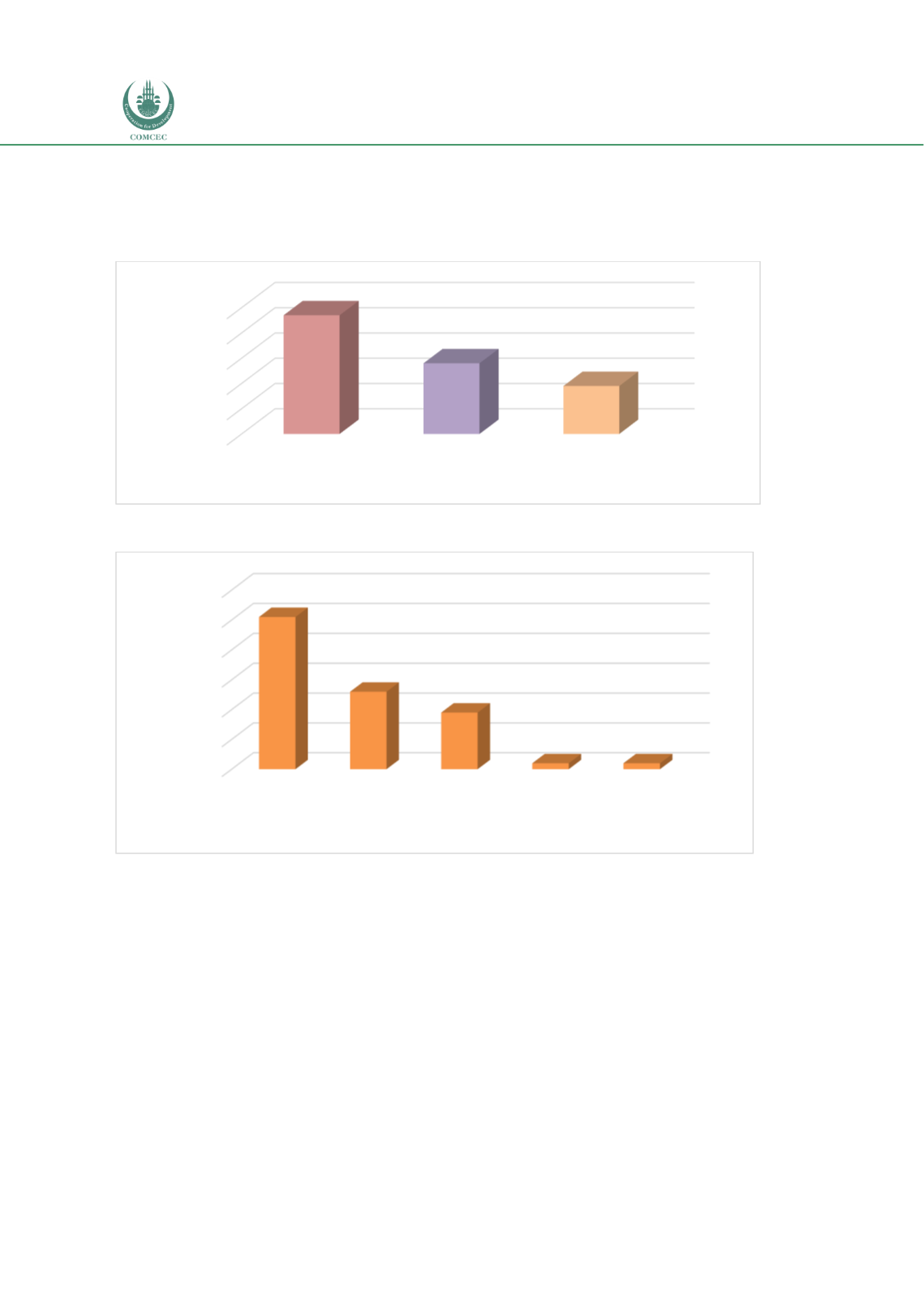

Chart 4.4. 2: Financial Sector Size in Saudi Arabia (2016) (SAR trillion)

Source: Saudi Vision Financial Sector Development Program Charter Delivery Plan 2020 (p. 14)

Chart 4.4. 3: Composition of Financial Institutions in Saudi Arabia (2016) (%)

Source: IMF (2017:8)

Chart 4.4.4 shows the different sectors of the Islamic financial industry in Saudi Arabia which

form a significant part of the overall financial industry in the country. Among the financial

institutions, the Islamic banking sector dominates the industry with assets valued at USD

371.23 billion. The takaful sector assets are worth USD 15.12 billion, followed by other Islamic

financial institutions that have assets valued at USD 13.16 billion. Sukuk forms a significant

part of the sector with the value of issuances in 2016 being USD 52.55 billion and the Islamic

funds industry being worth USD 20.60 billion.

0

1

2

3

4

5

Financial sector assets Banks & financial

institutions

Capital (equity and

bebt) market assets

4.7

2.8

1.9

SAR trillion

0%

10%

20%

30%

40%

50%

60%

Commercial

banks

Pension funds Specialized

credit

institutions

Investment

funds

Other

51%

26%

19%

2%

2%

Percentage