Infrastructure Financing through Islamic

Finance in the Islamic Countries

122

infrastructure in the education and social sectors. However, the contribution of Waqf to

infrastructure financing is quite insignificant.

4.3.5.5. International Sources

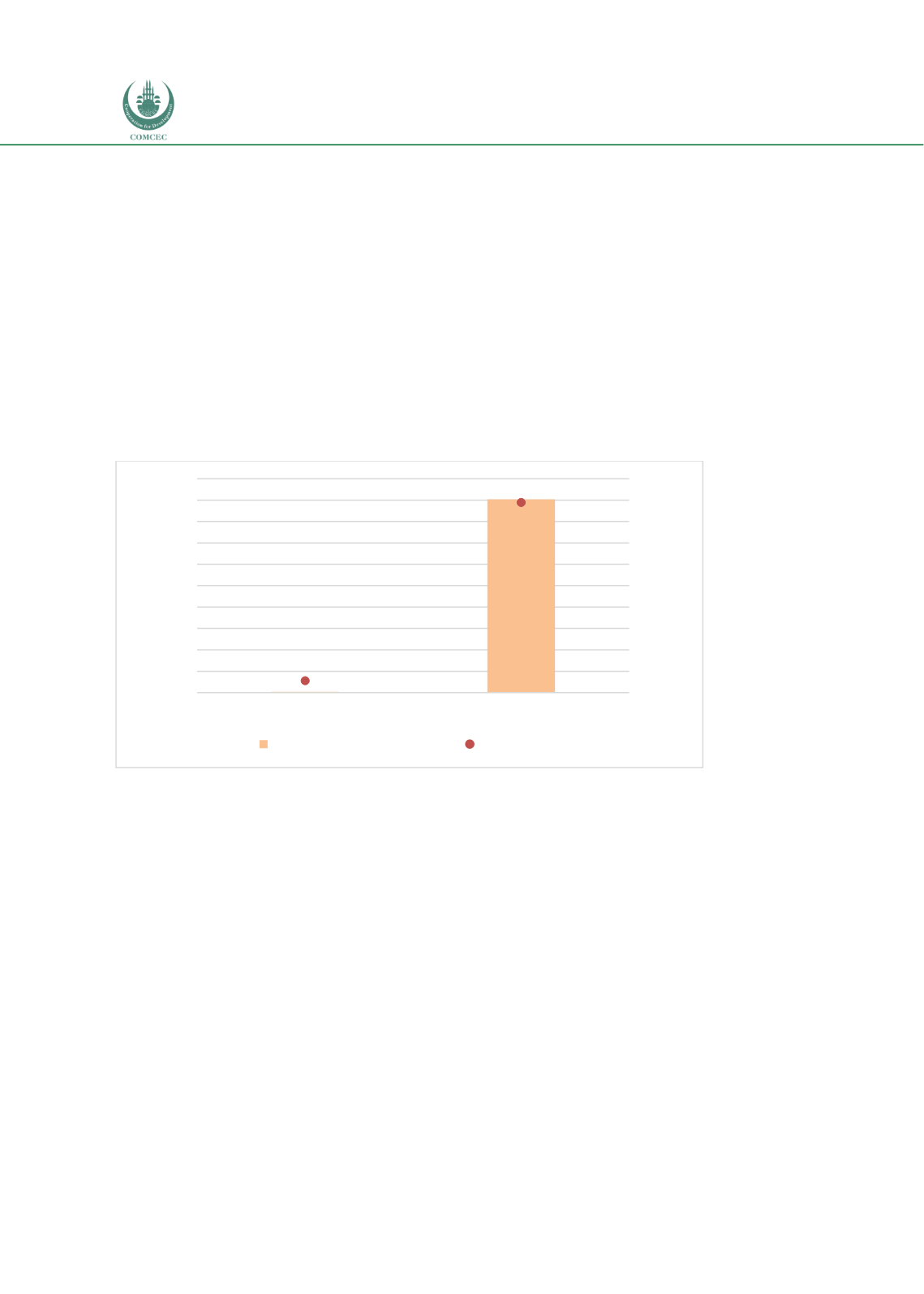

The IDB has been involved in infrastructure financing in Nigeria since 1991. It has been

involved mainly in Petrochemical, Energy, Educational, Health, Water, and Agricultural

infrastructure financing. Chart 4.3.5 shows the project financing provided by IDB to Nigeria

during 1976-2016 and 2016 onwards. While 16 projects worth USD 452 million were financed

by IDB during 1976-2016, one project valued at USD 1.6 million has been funded since 2016.

Currently, the active projects in the country financed by IDB include the Bilingual Education

Project in nine (9) States of the Federation and the Kano State Agro-Pastoral Development

Project.

Chart 4.3. 5: No. of Projects and Financing from IDB: Nigeria (USD million)

Source:

https://isdbdata.github.io/monograph2017.html4.3.7.

Conclusion and Recommendations

Nigeria has a poor infrastructure in all sectors of the economy. In 2014, a National Integrated

Infrastructure Master Plan was developed to provide a blueprint for the infrastructure

transformation of the country. The blueprint identified the infrastructure gap and estimated

that Nigeria needed to make a total infrastructure investment of $3 trillion by 2043. The

blueprint highlighted the national policies and framework for infrastructure development,

particularly the PPP framework and other funding models. It identified the Infrastructure

Concession Regulatory Commission (ICRC) Act (Establishment) 2005 as the key legislation in

the infrastructure development framework as well as some other general laws and sector-

specific laws which provide the enabling environment for investment in infrastructure

development.

The government is, however, constrained by budgetary deficits if required to solely finance the

infrastructure needs. Hence the need for the PPP framework as well as domestic and external

borrowings in order to finance the infrastructure needs is recognized. The financing options

advanced by the blueprint present a great opportunity for Islamic finance. Despite this great

1.6

452

1

16

0

2

4

6

8

10

12

14

16

18

0

50

100

150

200

250

300

350

400

450

500

Total Project Financing 2016+ Total Project Financing (1976-2016)

No. of Projects

USD Million

Total Financing (US$ Million)

No. of Projects