Infrastructure Financing through Islamic

Finance in the Islamic Countries

120

distributions to the Sukuk investors. A Purchase Undertaking was executed by the OSG in

favour of the Issuer to give assurances that, at the end of the lease/maturity of the Sukuk, or

upon the occurrence of an event of default or early termination of the lease under the Ijara

Agreement, the OSG would purchase the Sukuk assets. The Purchase Undertaking was meant

to eliminate market risk on the part of the investors. Similarly, a Sale Undertaking was also

executed by the Issuer in favour of the OSG. The Sukuk structure was certified as Shari’ah-

compliant by the Shari’ah Advisers

62

(Oladunjoye (2014)). The basic features of Osun sukuk

are shown in Table 4.3.4.

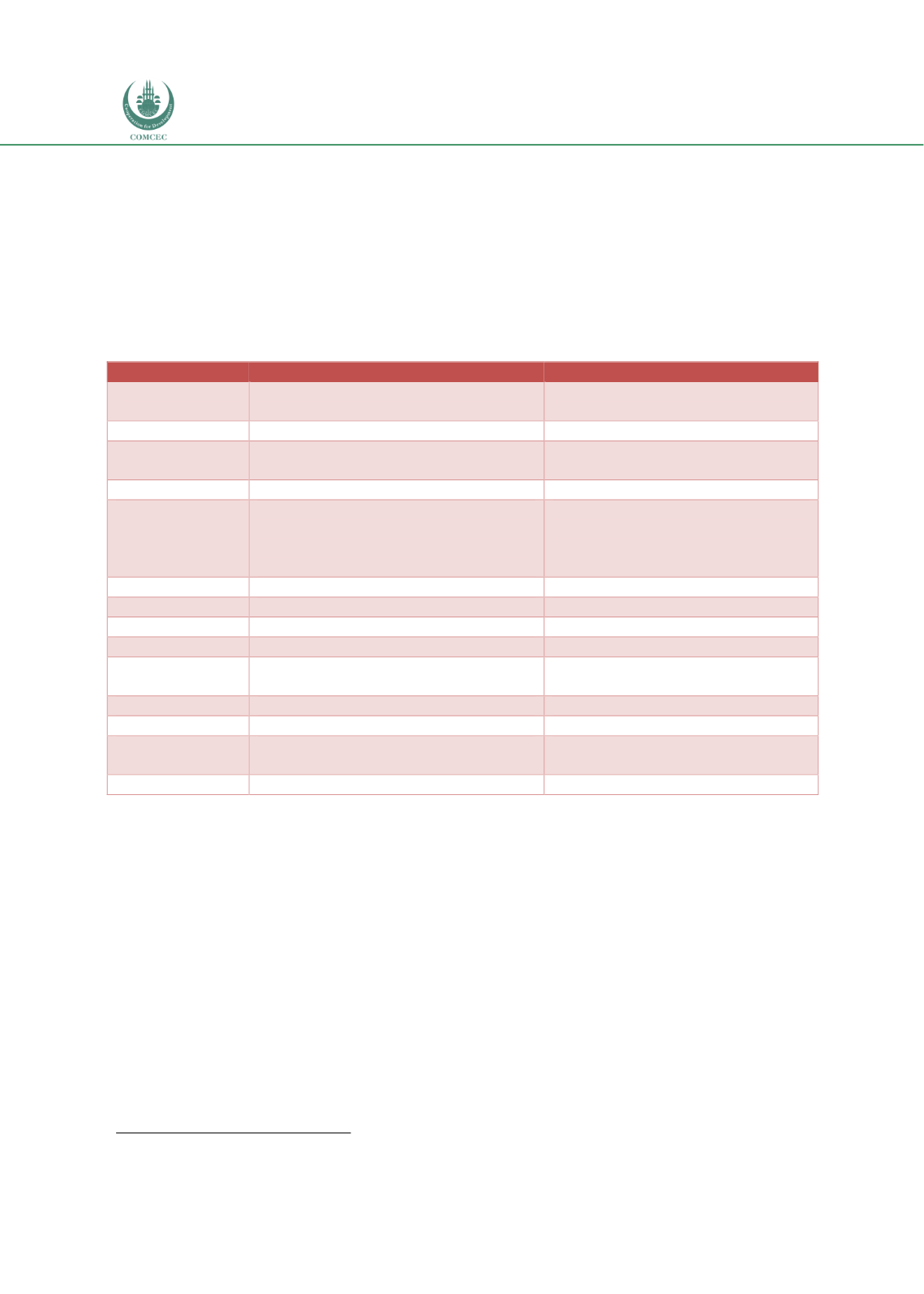

Table 4.3. 4: Summary of Sukuk Features Issuance in Nigeria

Features

Osun Sukuk

FGN Roads Sukuk

Issuer

and

Trustee

Osun Sukuk Company Plc

FGN Roads Sukuk Company 1 Plc

Obligor

Osun State Government (OSG)

Federal Government of Nigeria

Nature

of

Instrument

Subnational Sukuk – Medium Term

Sukuk (the Osun Sukuk)

Sovereign Sukuk – Medium Term

(the FGN Roads Sukuk)

Structure Type

Ijarah

Ijarah

Purpose

To raise funds for the development of

20 High

Schools, 2 Middle Schools and 2

Elementary Schools in Osun State

To raise funds for the execution of

25 road projects in the six

geopolitical zones of the country

Issue Size

N11.4 billion ($31.67 million)

N100 billion ($278 million)

Issue Date

8

th

October 2013

22

nd

September 2017

Maturity

8

th

October 2020

22

nd

September 2024

Rental Rate

14.75%

16.47%

Redemption

Sukuk will be redeemed in a lump sum

at Maturity

Sukuk will be redeemed in a lump

sum at Maturity

Listing

NSE and FMDQ

NSE and FMDQ

Ijarah Assets

Schools

Roads

Governing Laws

Laws of the Federal Republic of Nigeria

Laws of the Federal Republic of

Nigeria

Rating

Bbb+ (Augusto & Co)

B (Fitch)

Sources: Oladunjoye 2014, COMCEC 2018, Prospectus 2017

The Osun Sukuk was fully subscribed and was mainly taken up by local banks, fund managers,

insurance companies and high-net-worth individuals. The tax incentives which were approved

by the federal government in March 2010 entitled the Sukuk holders to payments that were

free from withholding, state and federal income and capital gains taxes, with no deductions at

source. Additionally, proceeds from the disposal of the Sukuk and stamp duty on its sale or

transfer are exempted from taxation. The tax incentive was seen as a motivator to the

subscription of the Sukuk (COMCEC, 2018).

Case Study: Sovereign FGN Roads Sukuk

The N100 billion (about $327.01) Sovereign Sukuk was issued by the FGN in 2017 to raise

funds for the construction/rehabilitation of 25 roads across the six geopolitical zones of the

country. The offer was subscribed by investors across a broad spectrum. Pension funds, banks,

62

Shari’ah Advisers were Dr. Mohamed El-Gari, Prof Monzer Kahf and Prof. M.L Bashar