Infrastructure Financing through Islamic

Finance in the Islamic Countries

130

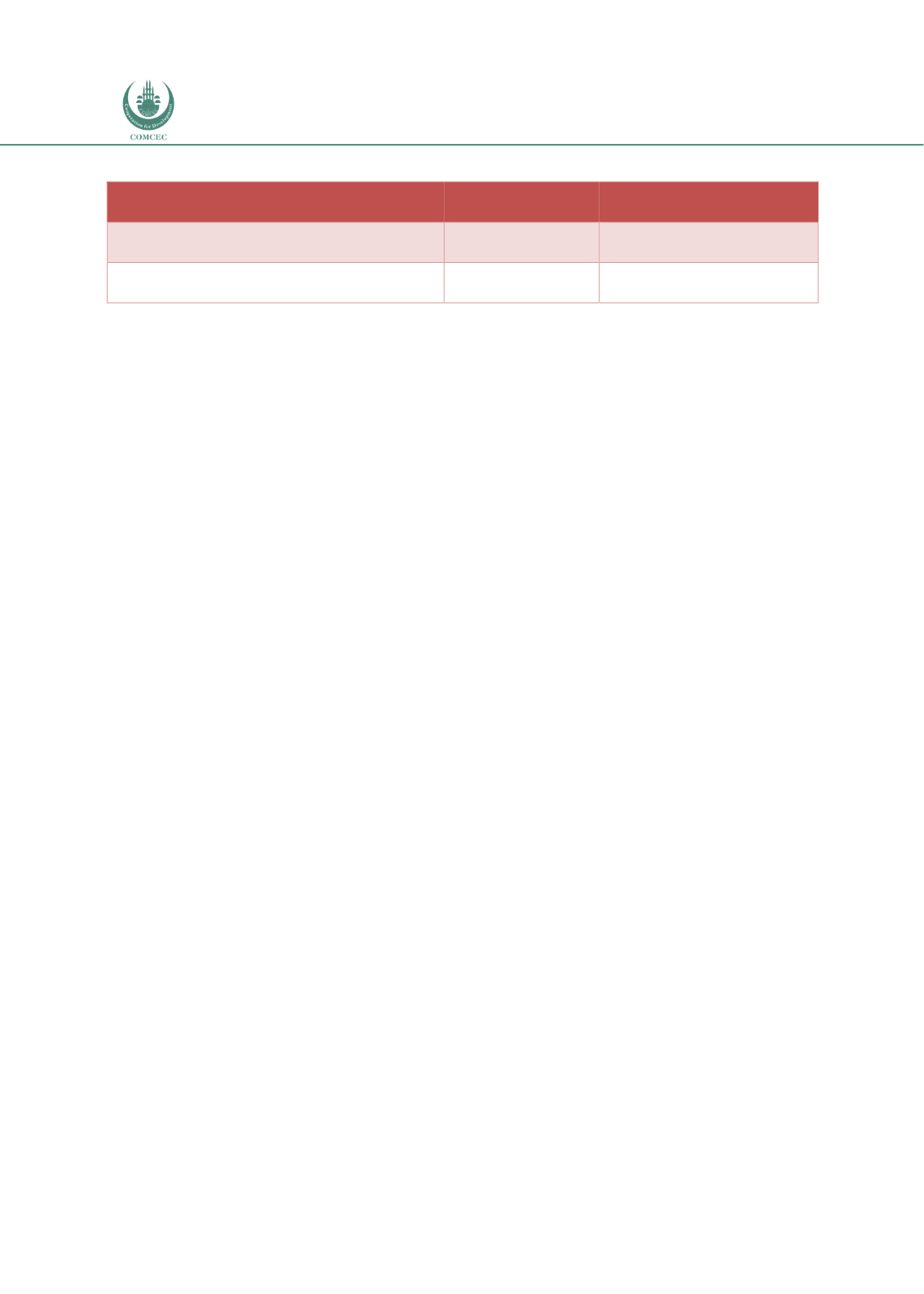

Table 4.4. 2: Targets of Vision 2030 in Introducing PPP Projects

2016

2020 Target

Total no. of PPP investments

0

14

Total value of PPP investments

0

SAR 24-38 billion

Source: Saudi Vision 2030: Privatization Program (Delivery Plan 2020)

.

Initiatives of the Public Investment Fund Program (2018-2020) as part of Vision 2030 include

developing infrastructure projects and undertaking certain giga-projects. The former includes

investments in air transport infrastructure hubs (Developing King Khalid International Airport

City in Riyadh and King Abdulaziz International Airport City in Jeddah), social infrastructure

(establishing a Housing Community Development Company), and infrastructure to facilitate

pilgrimage (developing the Hajj and Umrah facilities and capacity in Makkah and Madinah).

4.4.4.

The Legal and Regulatory Framework for Infrastructure Investments

While Sharia is the main source of law in Saudi Arabia, many economic and financial activities

are governed by legislations in the form of royal decrees, royal orders, ministerial resolutions,

circulars, and resolutions by the Council of Ministers

(Jaballah et al., 2018). Since the

government of Saudi Arabia was the main player in the development of infrastructure in the

past, the country did not have any laws related to PPP until very recently. As indicated, key

features of Vision 2030 include diversifying the economy to non-oil sectors and enhancing the

role of the private sector in the economy, including the infrastructure sector. In order to

achieve these targets, the National Centre for Privatization & PPP (NCP) initiated the

Privatization Program that has three strategic pillars.

A key strategic pillar to promote private sector involvement in infrastructure is to develop the

general legislative frameworks for Private Sector Participation (PSP). The first step in this

regard was the issuance of Resolution No. 665 on 8/11/1438H by the Council of Ministers

which approved the Rules of Conduct of the Supervisory Committees of PSP-targeted sectors

(GSA 2018) The resolution also instructed the National Centre for Privatization & PPP (NCP) to

come up with a draft law that encompasses all rules governing PSP. Accordingly, NCP

published a draft of the

Private Sector Participation Law

for public consultation to address the

challenges and legislative gaps that exist in the regulatory environment for private sector

involvement in the economy (Government of Saudi Arabia, 2018). When the PSP Law was

finally approved in accordance with the legislative procedures, it would not prejudice the

existing PSP projects or any decisions made by the Supervisory Committees. This is important

in order to preserve the laws governing the land and not hinder the current infrastructure

development programmes in the Kingdom. The NCP Board of Directors also issued the

Privatization Projects Manual

through resolution No. (2/5/2018) dated 03/08/1439H and

The

Rules Governing the Work of the Supervisory Committees, their Teams and Advisors

through

resolution No. (3/5/2018) dated 03/08/1439H.

There are laws and regulations that govern the specific infrastructure sectors in Saudi Arabia.

The Electricity & Cogeneration Regulatory Authority (ECRA) (ECRA 2005) was established

through Royal Decree No. M/56 dated 20th Shawwal 1426 / 22/11/2005 with the law aiming

at promoting consumer-oriented electricity services and also protecting consumer rights as