Infrastructure Financing through Islamic

Finance in the Islamic Countries

124

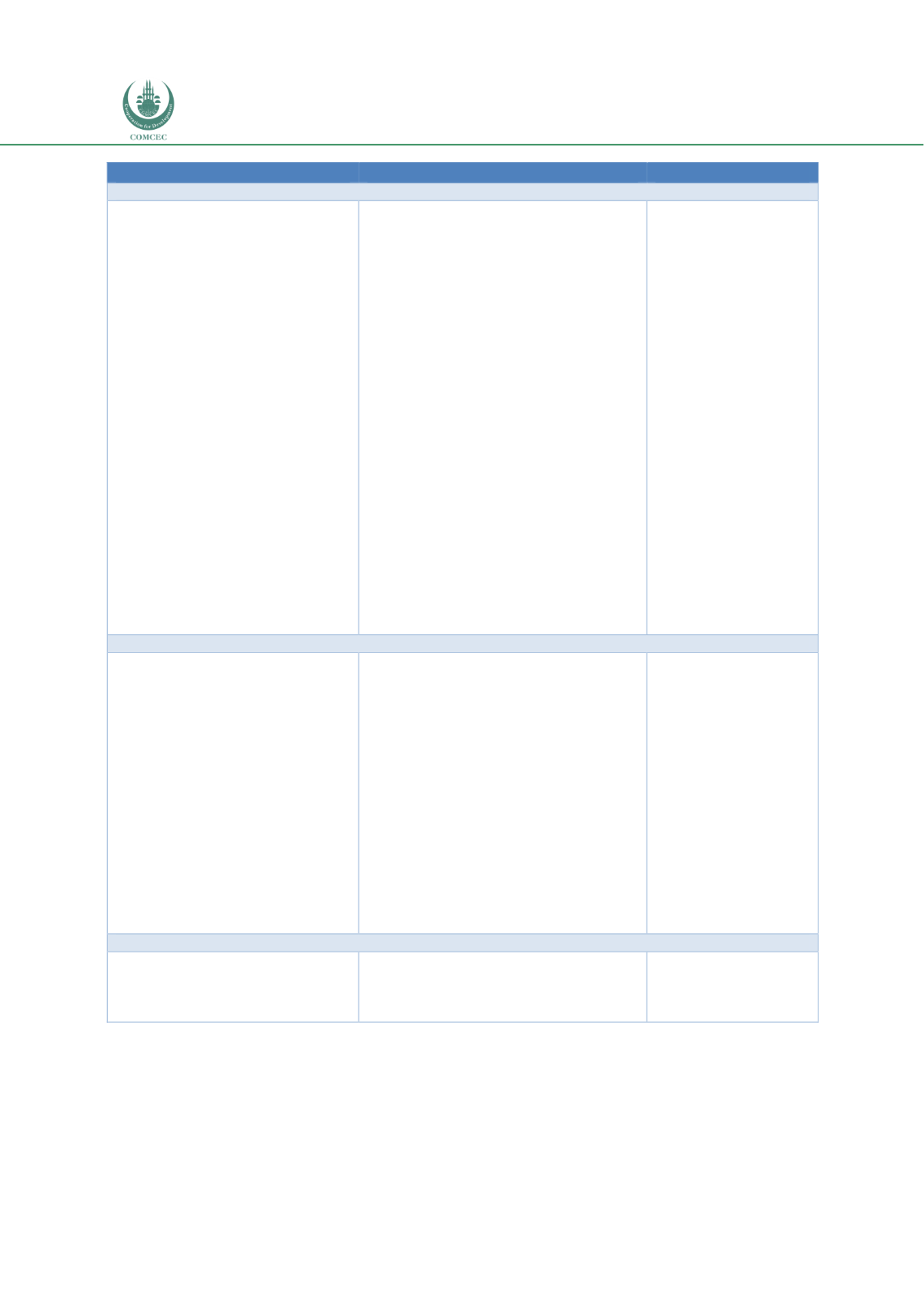

Issues

Recommendations

Implemented by

Islamic Financial Institutions

The short-term and liquid liability

structure of Islamic banks makes it

difficult for Islamic banks to invest

in long-term infrastructure

projects. Since the investors of

investment accounts bear the risks

of the investments, Islamic banks

would hold relatively less capital

for investments made from these

accounts.

Nigeria has an underdeveloped

Islamic money market with few

liquidity management instruments.

The Islamic nonbank financial

institutions sector in Nigeria is

insignificant, limiting investments

in the infrastructure sector.

Introduce long-term risk-sharing

investment accounts in Islamic banks

that can be used for infrastructure

projects.

Develop a well-functioning Islamic

money market and instruments to help

Islamic banks to mitigate liquidity risks

that may arise from long-term

investments.

Introduce takaful companies, Islamic

investment banks and Shariah-compliant

pension funds.

Establish an Islamic infrastructure

fund/bank that can pool resources from

different investors to increase

investments in infrastructure projects.

Relevant ministry and

regulators

Islamic banks

Central bank

Other stakeholders

such as Islamic

financial institutions

Regulatory authorities

Islamic nonbank

financial institutions

Islamic Capital Markets

Since the sukuk issued in Nigeria

for infrastructure projects were

over-subscribed, there is potential

for the issuance of more sukuk to

fund the huge infrastructure needs

of the country.

Sukuk structures are complex and

new in the country.

Retail sukuk can be an alternative

source of funds for infrastructure

projects.

Issue

more

sukuk

to

finance

infrastructure projects.

Develop a market and infrastructure for

Islamic capital market/sukuk.

Provide advice on the issuance of sukuk

and develop templates for issuing sukuk

for infrastructure projects.

Issue retail sukuk

Introduce financial literacy programs to

increase the literacy of Islamic finance

Introduce efficient mechanisms for the

delivery and redemption of sukuk issues.

Issuers (sovereign and

corporates)

Capital markets

authority

Capital markets

authority

Capital markets

authority

Issuers (sovereign and

corporates)

Financial institutions

Islamic Social Sector

Developing innovative models of

zakat and waqf can potentially

provide

social

infrastructure

services.

Increase the proceeds from zakat and

waqf by using innovative structures that

can help develop social infrastructure

sectors.

Zakat and waqf

institutions