Infrastructure Financing through Islamic

Finance in the Islamic Countries

107

Case 3: Green SRI Sukuk Tadau

Although the Sustainable and Responsible Investment (SRI) Sukuk Framework was issued in

2014, the first green sukuk under this framework was issued in July 2017. Valued at RM 250

million (USD 59.2 million), the Green SRI Sukuk Tadau were issued by Tadau Energy Sdn

Berhad as Islamic, medium-term notes to finance two solar power plants that would produce

50 MW of electricity in Kudat, Sabah. The investment in green energy is a private sector

initiative of Tadau Energy which is a Malaysian private limited company established with the

goal of constructing and operating solar projects by two other companies Kagayaki Energy and

Edra Solar. While the former is a Malaysian renewable energy and sustainable technology

investment firm, the latter is a wholly owned subsidiary of Edra Power Holdings which is an

independent power producer with a diversified portfolio of renewable and fossil fuel power

plants and is a subsidiary of CGN, a Chinese energy company involved in constructing and

operating nuclear and renewable plants (CICERO 2017).

58

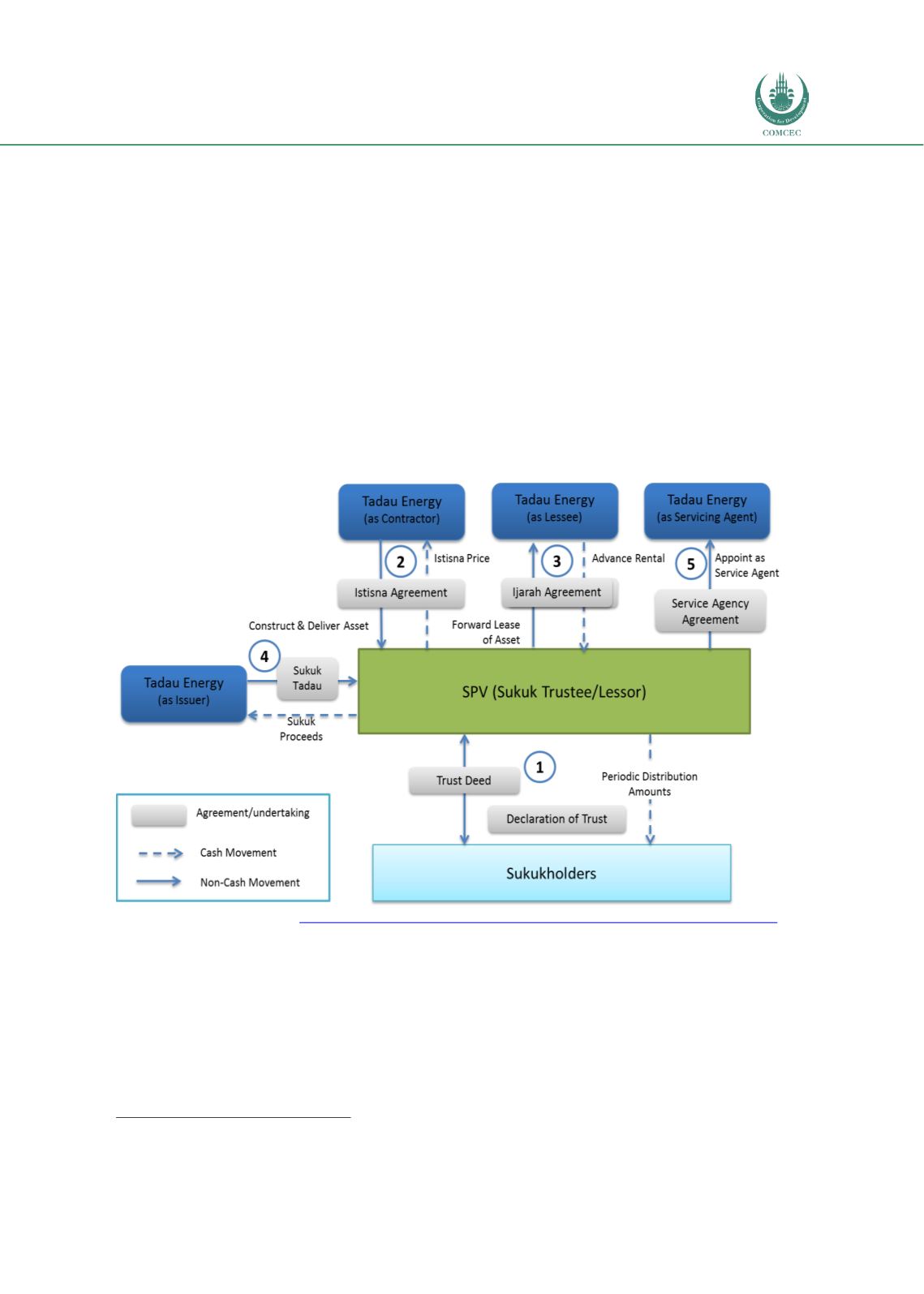

Chart 4.2. 14: Structure of Green SRI Sukuk Tadau (Construction Stage)

Source: PTC SRI Sukuk Tada

u http://issuance.sc.com.my/MemberAccessIssuance/documents/view-file/5079Green SRI Sukuk Tadau was issued in 15-tranches of two to 16 years maturities with coupon

payoffs ranging from 4.8% for the RM14 million two-year component to 6.2% for the RM10

million 16-year piece. The sukuk structure was based on the principles of istisna, ijarah and

ijarah mawsufah fi zimmah. The risks were mitigated by securing legal assignments of the

issuer’s right, title and benefits in all the licenses and permits related to the project and two

21-year power purchase agreements with Sabah Electricity Sdn Bhd, an entity owned by state

government of Sabah (Boey 2017). Rated at AA3 by RAM, Affin Hwang Investment Bank was

the principal advisor, lead manager and arranger, underwriter and facility agent of the issue.

58

http://www.tadau.com.my/second-opinion-on-tadau-energy-green-sukuk-framework-final24072017.pdf