Infrastructure Financing through Islamic

Finance in the Islamic Countries

103

project that IAP has invested in is the RM 10 million term financing provided to Perak Transit

Berhad for its working capital requirements.

57

4.2.5.3. Capital Markets

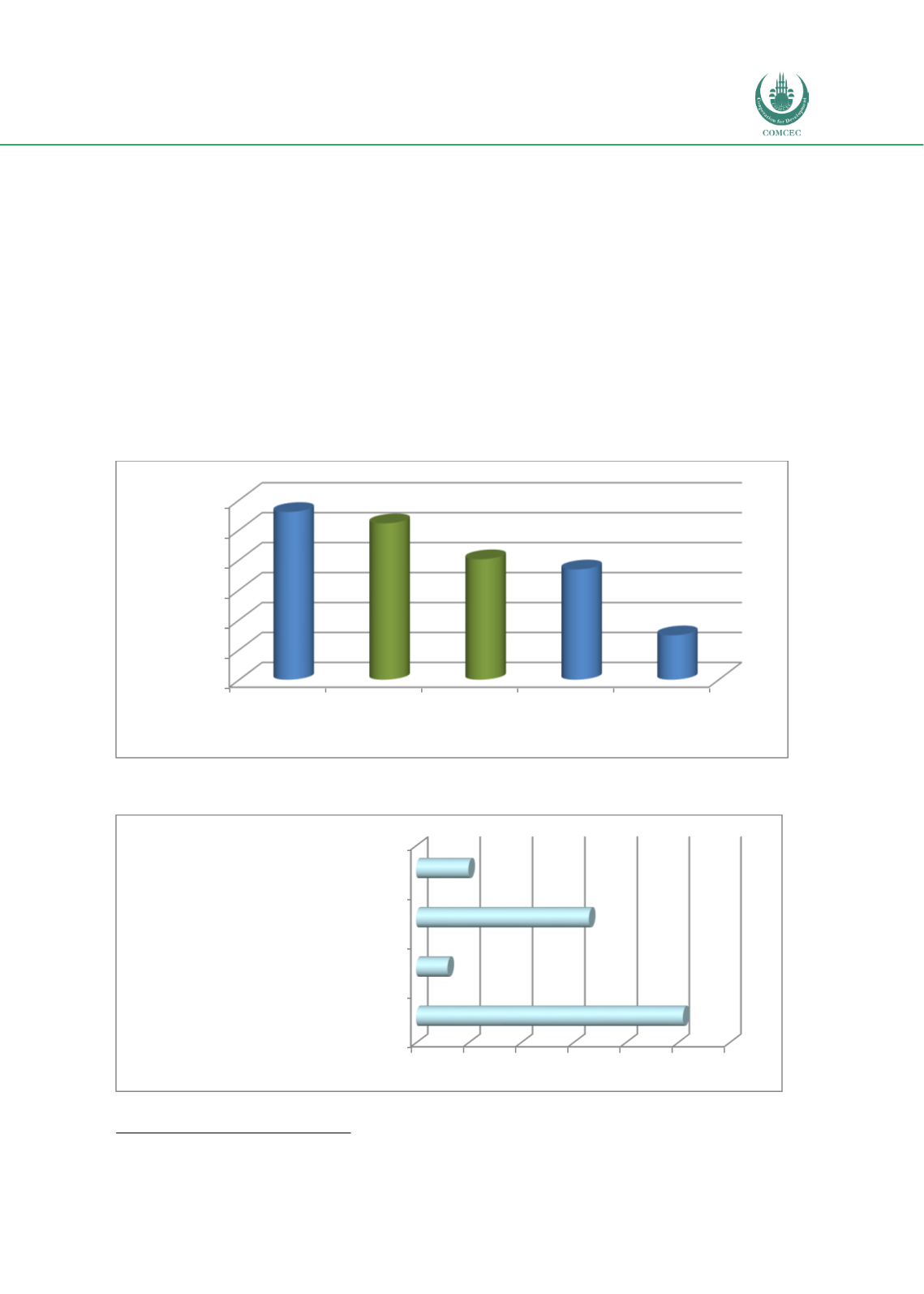

Given the size of the capital markets in general and sukuk sector in particular, they play an

important role in financing the infrastructure sector in Malaysia. The key players in the

infrastructure sector are GLCs that receive their equity capital from the government and other

GLICs and then raise funds from capital markets, a large part of which are sukuk. Ahmad

(2017) reports that 61% of the world’s infrastructure sukuk was issued out of Malaysia during

the period 2012 to 3Q2015. Chart 4.2.9 shows that more than 46% of the sukuk issued in

Malaysia was by infrastructure-related entities (transport, storage, communications, energy,

gas and water).

Chart 4.2. 9: Corporate Sukuk Issuer Profile in Malaysia (end of June 2015) (%)

Source: IIFM (2016: 125)

Chart 4.2. 10: Investor Profile of Corporate Sukuk in Malaysia (%)

Source: COMCEC (2018: 90)

57

https://iaplatform.com/investment/execution/completedProjlisting#!0%

5%

10%

15%

20%

25%

30%

Banking and

Financial Services

Transport,

Storage &

Communications

Energy, Gas and

Water

Industrial

Others

28.00%

26.10%

20.10%

18.40%

7.40%

% of total

0% 10% 20% 30% 40% 50% 60%

Domestic commercial, Islamic & investment banks

Foreign commercial & Islamic banks

Insrance Companies

Employees Provident Fund

51%

6%

33%

10%