Infrastructure Financing through Islamic

Finance in the Islamic Countries

104

Chart 4.2.10 shows the investor profile of corporate sukuk in Malaysia. The majority (51%) of

sukuk investors belong to the category of “commercial, Islamic and investment banks” while

the insurance sector is the second largest holder of corporate sukuk (33%). The Employees

Provident Fund holds around 10% of the sukuk and the remaining 6% is held by foreign

commercial and Islamic banks. Although the data represents investors for all corporate sukuk,

information from Chart 4.11 implies that around 46% of these are linked to the infrastructure

sector.

The information from these charts and Table 4.3 reveals two interesting aspects of the

Shariah-compliant financing of the infrastructure sector. First, while Islamic banks have the

option of providing direct financing to infrastructure projects, the data shows that they do it in

relatively small amounts and instead prefer to invest in the sector by investing in sukuk

instruments. Second, issuing sukuk can tap into funds from both Islamic and non-Islamic

institutions. However, this is not the case with conventional bonds since it limits the

investments to conventional sources only. Thus, providing Shariah-compliant products to

finance infrastructure projects can attract a larger investment base

4.2.5.4. International Sources

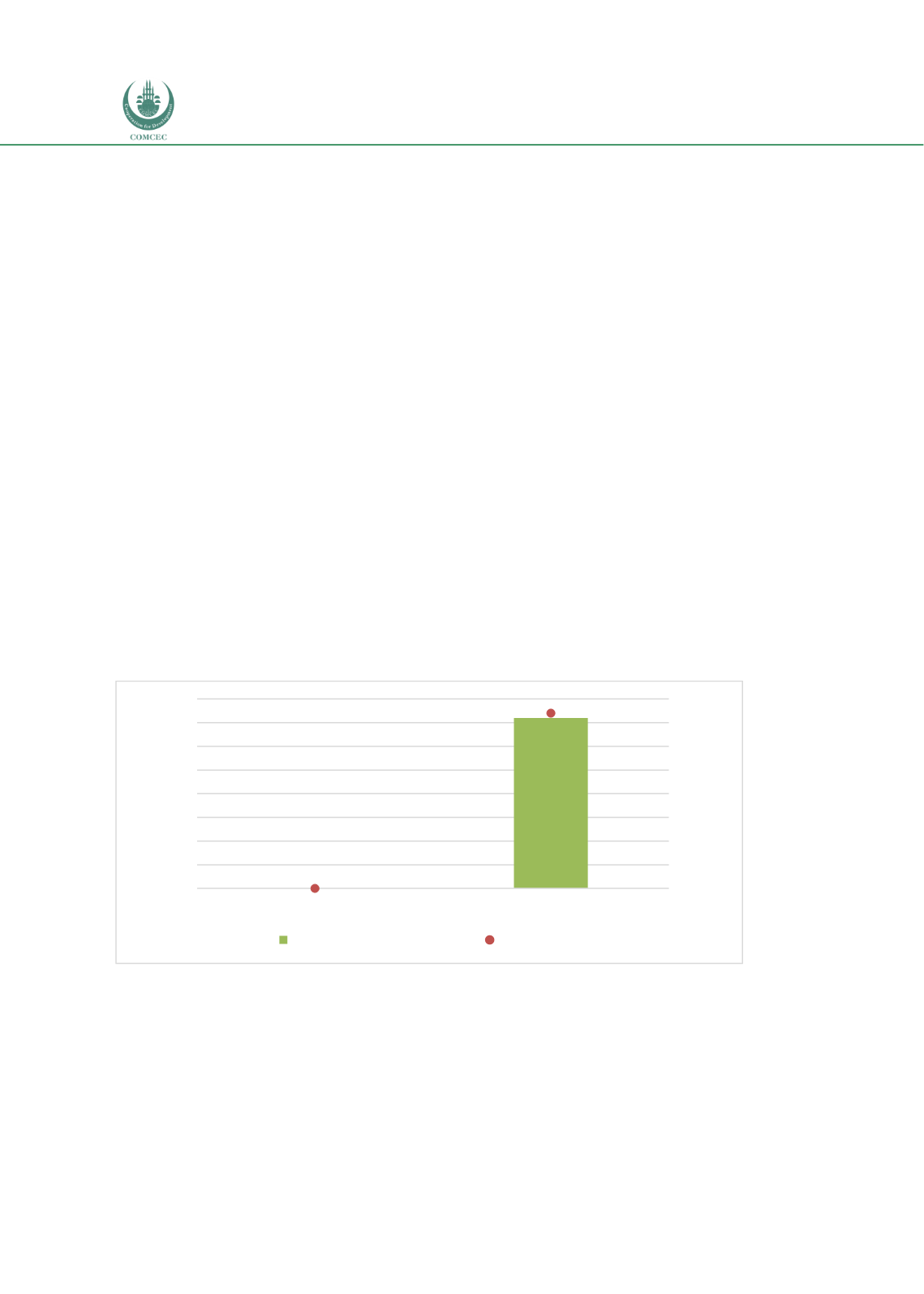

Chart 4.2.11 shows the Islamic financing for infrastructure projects that Malaysia received

from IDB. While 37 projects worth USD 719.8 million were financed during 1976-2016,

Malaysia has not used IDB funds since 2016. The latter figure reflects the strategic decision

Malaysia made after the Asian financial crisis, to not depend on external funds and to instead

focus on raising funds domestically.

Chart 4.2. 11: Number of Projects and Financing from IDB: Malaysia

Source:

https://isdbdata.github.io/monograph2017.html4.2.5.5. Case Studies

In this final subsection, three case studies on sukuk issuances in Malaysia for infrastructure

projects from different sectors is presented. While the first two of these were issued by GLCs to

fund transport and education, the last one is a private sector initiative to finance green energy.

0.0

719.8

0

37

0

5

10

15

20

25

30

35

40

0

100

200

300

400

500

600

700

800

Total Project Financing 2016+

Total Project Financing (1976-2016)

No. of Projects

USD (Million)

Total Financing (US$ Million)

No. of Projects