Infrastructure Financing through Islamic

Finance in the Islamic Countries

105

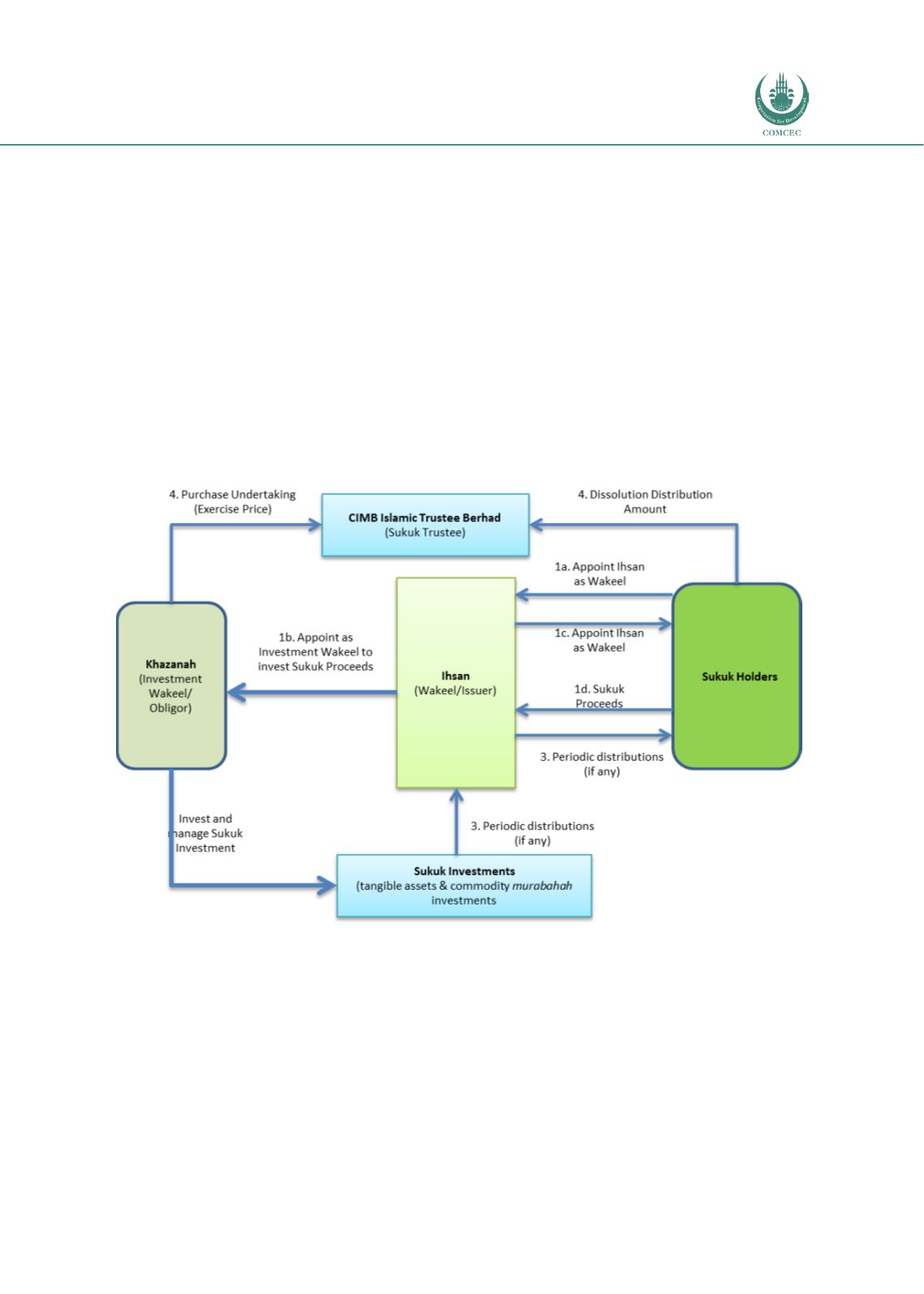

Case 1: Khazanah Sustainable and Responsible Investment Sukuk

Khazanah Nasional Berhad (Khazanah) issued an RM100 million Sustainable and Responsible

Investment Sukuk in 2015 to fund schools under the non-profit foundation Yayasan AMIR

Trust (YAT) School Programme. YAT was founded by Khazanah to improve the accessibility of

quality education in Malaysian government schools through a PPP arrangement with the

Ministry of Education. The first of its kind, the sukuk was issued via an independent SPV, Ihsan

Sukuk Berhad (Ihsan), which planned to raise a total of RM1 billion through its sukuk

programme. The first instalment of the seven-year tenor sukuk programme worth RM 100

million was issued in June 2015. The sukuk was rated AAA by RAM Ratings Services Berhad,

reflecting Khazanah’s credit rating and was fully subscribed with interests shown from

foundations, corporations, banks, pension funds and management companies. CIMB

Investment Bank Berhad (CIMB) was the lead manager and the sukuk was structured using the

wakalah bil istithmar

principle.

Chart 4.2. 12: Structure of Khazanah Sukuk Ihsan

Source: IIFM (2016: 55)

The sukuk was priced with a return guidance of 4.30% per annum. The Key Performance

Indicators (KPIs) that would be assessed over a five-year timeframe were identified to assess

the social impact. If the KPIs were fully met at maturity, the investors would forgo or

contribute up to 6.22% of the nominal value due under the sukuk. This would be considered

‘Pay-for-Success’ and reduce the effective yield to 3.5% as recognition of the social impact

produced by YAT, reflecting the social responsibility of the sukuk-holders. If the KPIs were not

met or met partially, investors would receive up to the nominal value of the sukuk as agreed

upon at issuance. The sukuk also had the option of converting the investment into a donation

at any point during the tenor of the instrument. By the end of 2016, the Trust Schools