Infrastructure Financing through Islamic

Finance in the Islamic Countries

109

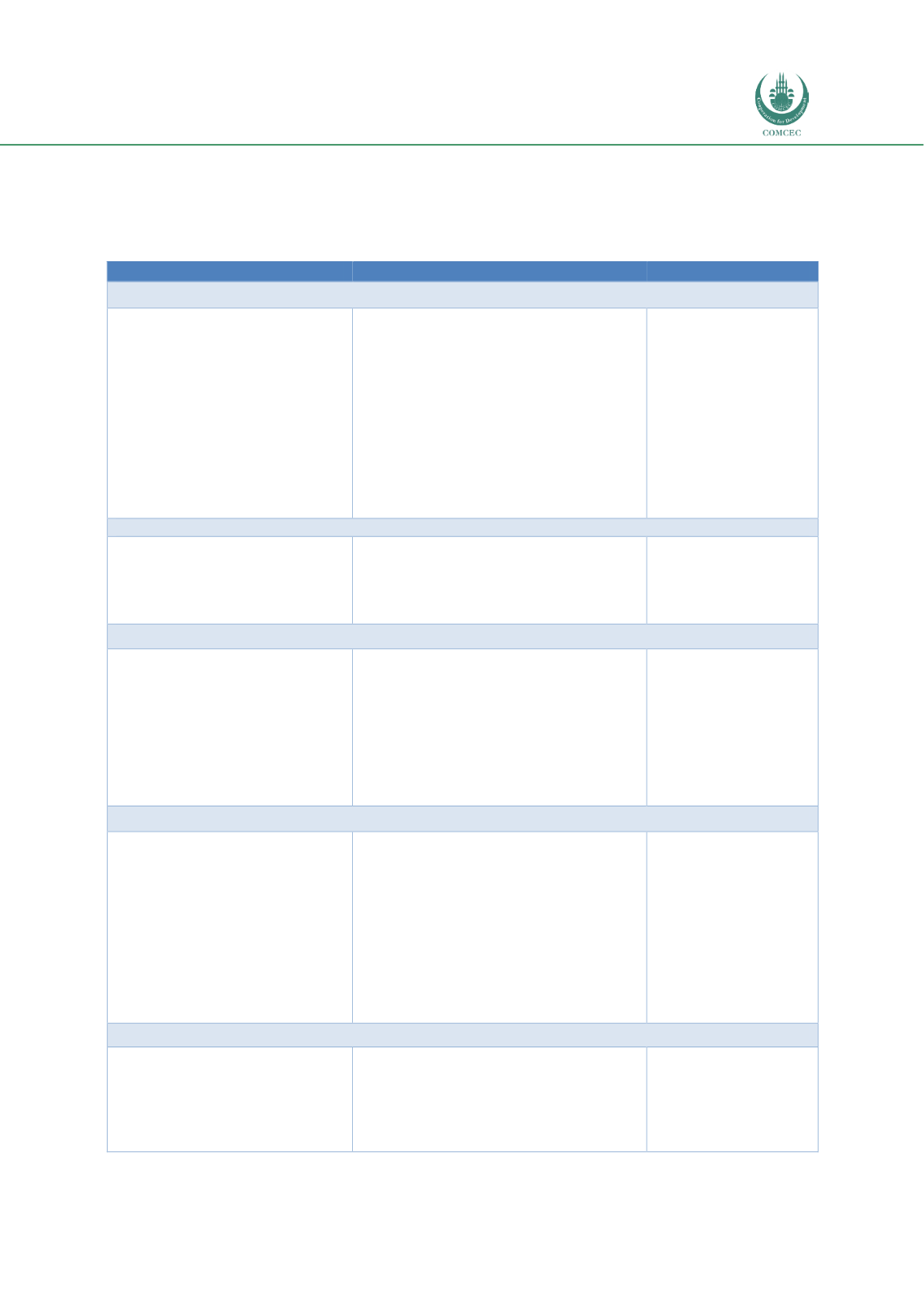

Based on the results of the case study, the issues arising and recommendations are suggested

in Table 4.2.4 to further enhance the role of Islamic finance in infrastructure development in

Malaysia.

Table 4.2. 4: Issues and Policy Recommendations: Malaysia

Issues

Recommendations

Implemented by

Infrastructure Related Strategies and Policies

PPP projects and contracts are

novel and complex.

Although Danajamin in Malaysia

provides guarantees for corporate

sukuk, there is a need to expand

the guarantee to other project-

specific risks to encourage private

sector participation in

infrastructure investments.

Develop Shariah-compliant contract

templates for different types of PPP

projects that help stakeholders to

structure contracts.

Providing Shariah-compliant guarantees

of the implementation of PPP contracts

and making takaful cover political risks

and partial credit risks.

PPP Unit under the

Prime Minister’s

Office.

Danajamin

Relevant public bodies

Private sector

insurance/takaful

companies

Legal and Regulatory Regimes

The relatively higher capital

requirements for long-term

investments inhibit Islamic banks

from investing in the

infrastructure sector.

Balance financial stability objectives with

lowering the capital requirements for

investments in long-term projects to

encourage the greater involvement of

Islamic banks in infrastructure financing.

Banking regulatory

authority (BNM)

Government and Public Bodies

Dana Infra was established to

raise funds for infrastructure

projects. Its facilitative role can be

further expanded.

The scope of Dana Infra can be further

expanded by creating a fund to encourage

the pooling of resources from different

institutional and retail investors in

infrastructure projects.

Dana Infra can also provide advice on the

issuance of sukuk and develop templates

for issuing sukuk for infrastructure

projects

Dana Infra or a new

GLIC

Islamic Financial Institutions

The direct investments in the

infrastructure sector by Islamic

banks in Malaysia are small.

The contribution of the Islamic

nonbank financial institutions in

Malaysia in the infrastructure

sector is relatively small due to

their small size.

Increase the share of investments in

infrastructure projects by Islamic banks

by expanding the size of investment

accounts which can be used for longer

term investments.

Create incentives to increase the share of

the takaful sector in the overall insurance

industry and share of Shariah-compliant

components in the pension funds and

sovereign wealth funds.

Islamic banks

Regulatory authorities

Islamic nonbank

financial institutions

Islamic Capital Markets

Islamic funds and platforms for

infrastructure investments can

potentially increase the share of

Islamic finance in developing

infrastructure projects.

Develop Islamic funds and platforms for

infrastructure investments.

Relevant market

players such as

Islamic investment

banks