Infrastructure Financing through Islamic

Finance in the Islamic Countries

106

Programme has been implemented at 83 schools in 10 states, providing better outcomes for

over 65,000 Malaysians students.

In 2017, Khazanah issued the second tranche of the RM100 million sukuk that also had a retail

component that gave opportunities to individuals to participate in the scheme. As in the case of

the first issue, the sukuk had features of the step-down of returns upon achieving KPIs and the

option to donate the principal to the Trust School Programme.

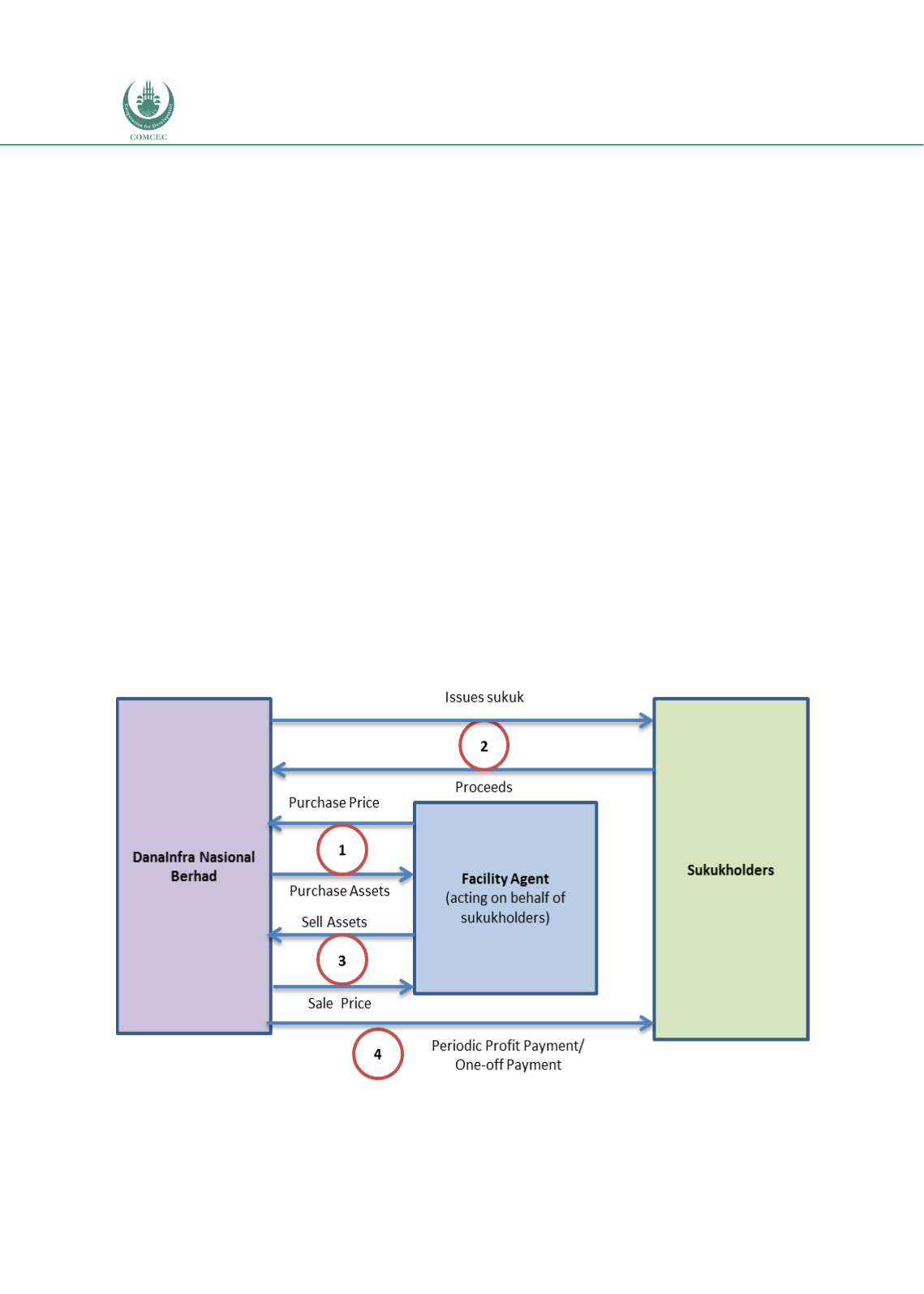

Case 2: DanaInfra Retail Sukuk

DanaInfra Nasional Berhad (DanaInfra), a company owned by the Ministry of Finance of

Malaysia, was established in 2011 to undertake the funding of infrastructure projects assigned

by the Government of Malaysia. The first infrastructure project initiated by DanaInfra was the

USD 6.2 billion Klang Valley Mass Rapid Transit (MRT) Project. DanaInfra raised a total of

RM2.5 billion (USD 789.14 million) by selling different series of

sukuk

to partly cover the total

cost of the project.

The

series of retail sukuk included RM300 million (issued February 2013

with a 10 year maturity), RM 100 million (issued October 2013 with a 15 year maturity), and

RM 100 million (issued July 2014 with 7 year maturity) paying a profit rate of 4.0%, 4.58% and

4.23% respectively. The sukuk was structured using a commodity murabahah contract and

coupon payments were made semi-annually. Priced at MYR 100, the minimum subscription

amount of the retail sukuk was MYR 1000. Investors could buy the

sukuk

by using different

modes such as internet banking or through automated teller machines (ATMs) of participating

banks and financial institutions (Star 2014 and DNB 2014). Guaranteed by the Government of

Malaysia, the DanaInfra Retail Sukuk was listed and traded on Bursa Malaysia.

Chart 4.2. 13: Structure of DanaInfra Retail Sukuk

Source: Haneef (2016)