Infrastructure Financing through Islamic

Finance in the Islamic Countries

102

4.2.5.2.

Islamic Financial Institutions

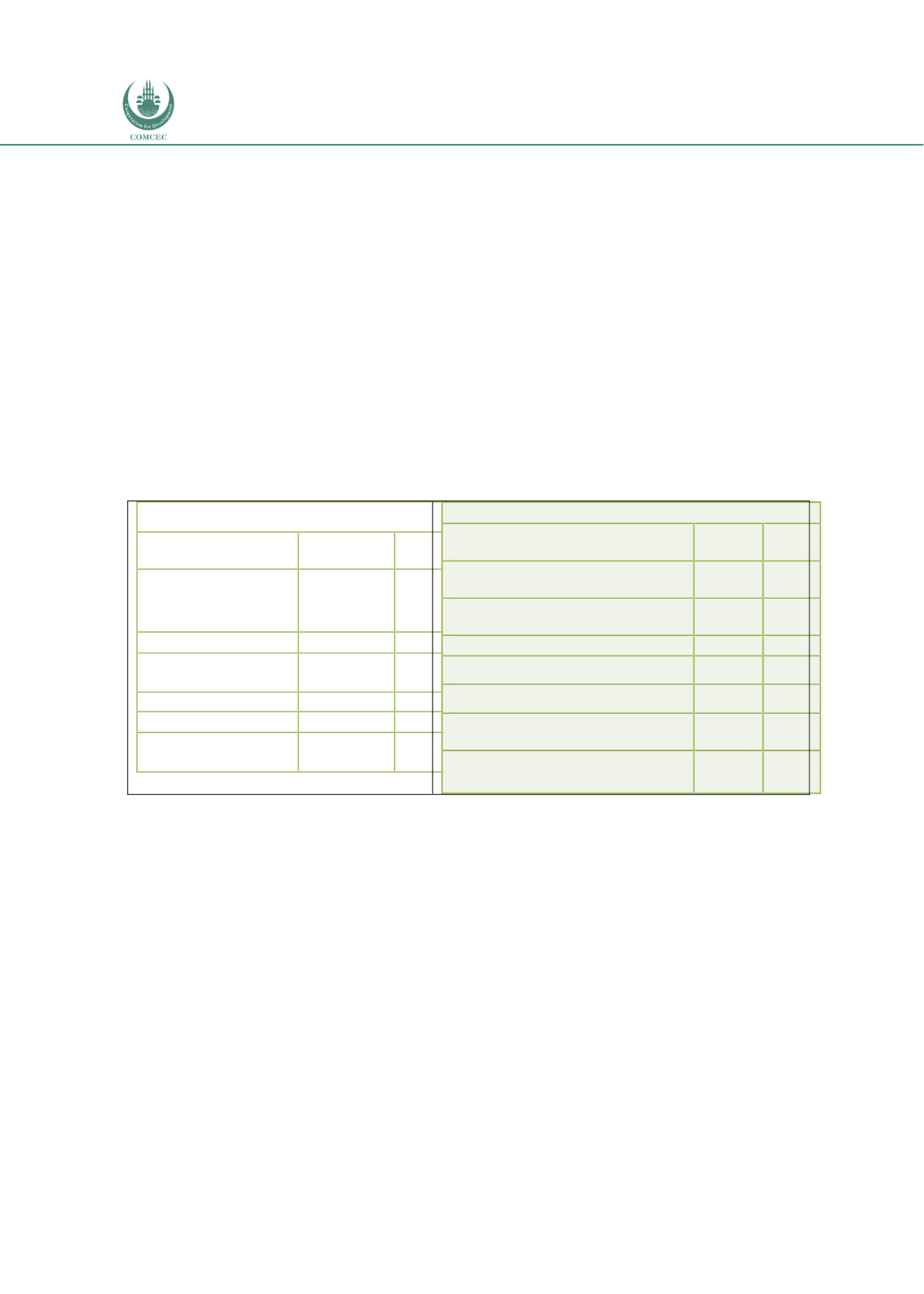

Financial institutions that provide Shariah-compliant financing for infrastructure projects and

entities include Islamic banks, takaful companies, and other institutional investors such as

pension funds. The asset composition and contribution of the Malaysian Islamic banking sector

in financing the infrastructure sector is shown in Table 4.2.3. The total assets of Islamic banks

in Malaysia in Q1 2018 were RM 665,288 billion (USD 172.265 billion). While the total

Shariah-compliant financing of Islamic banks was RM 490,841 billion, constituting 73.8% of

the total assets, only RM 29,112 billion (USD 7,538 billion) or 4.38% of this went to finance the

infrastructure sector. Within the infrastructure sector, transportation and storage secured the

highest financing of RM 11,78 billion (or 1.77% of the assets), followed by education with RM

8,965 billion (or 1.35% of assets). While the table showed that the sukuk holdings of Malaysian

Islamic banks were valued at RM 86,897 billion (or 13.1% of the total assets), information on

the proportion used for the infrastructure was not available.

Table 4.2. 3: Islamic Banks Assets Composition and Financing of Infrastructure Sector (Q1

2018)

Total Islamic Banking Assets

Asset Composition

RM (million)

% of

total

Total Shariah-compliant

financing (excluding

interbank financing)

490,841.3

73.8%

Sukūk holdings

86,897.6

13.1%

Other Sharī`ah-

compliant securities

80.4

0.0%

Interbank financing

63,964.8

9.6%

All other assets

23,504.8

3.5%

Total assets

665,288.9

100.0%

Infrastructure Financing by Islamic Banks

Financing going to infrastructure

RM

(million)

% of

total

Electricity, gas, steam and air-

conditioning supply

2,505.4

0.38%

Water supply; sewerage and

waste management

0.0

0.00%

Transportation and storage

11,780.2 1.77%

Information and communication 3,744.9

0.56%

Education

8,965.3

1.35%

Human health and social work

activities

2,116.7

0.32%

Total infrastructure

29,112.6

4.38%

Source: IFSB Prudential and Structural Islamic Financial Indicators (PSIFIs)

As discussed in Chapter 2, the small share of the investments in the infrastructure sector can

be attributed to various factors. Since assets are financed by liquid deposits that are short

term, there is limited scope for investing in assets that are long term and illiquid. Furthermore,

the BASEL III standards impose higher capital requirements for longer-term financing, which

also discourages investment in infrastructure projects. A better way to invest in infrastructure

would be to invest in sukuk issued by the infrastructure firms. The sukuk holdings of

Malaysian Islamic banks are 13.3% of the total assets, which is almost double that of

investments in the infrastructure sector. Since a part of sukuk is issued by the infrastructure

sector, Islamic banks contribute to the sector indirectly through capital markets.

Since IFSA distinguishes between deposit and investment accounts, one way in which Islamic

banks can increase the investments in the infrastructure sector is to use some of the funds

from the latter in projects. As indicated, the proceeds from the investment accounts are

collected in the Investment Account Platform (IAP) and are invested in different ventures and

projects. Though the focus of IAP investments has so far been on business ventures, one