Infrastructure Financing through Islamic

Finance in the Islamic Countries

112

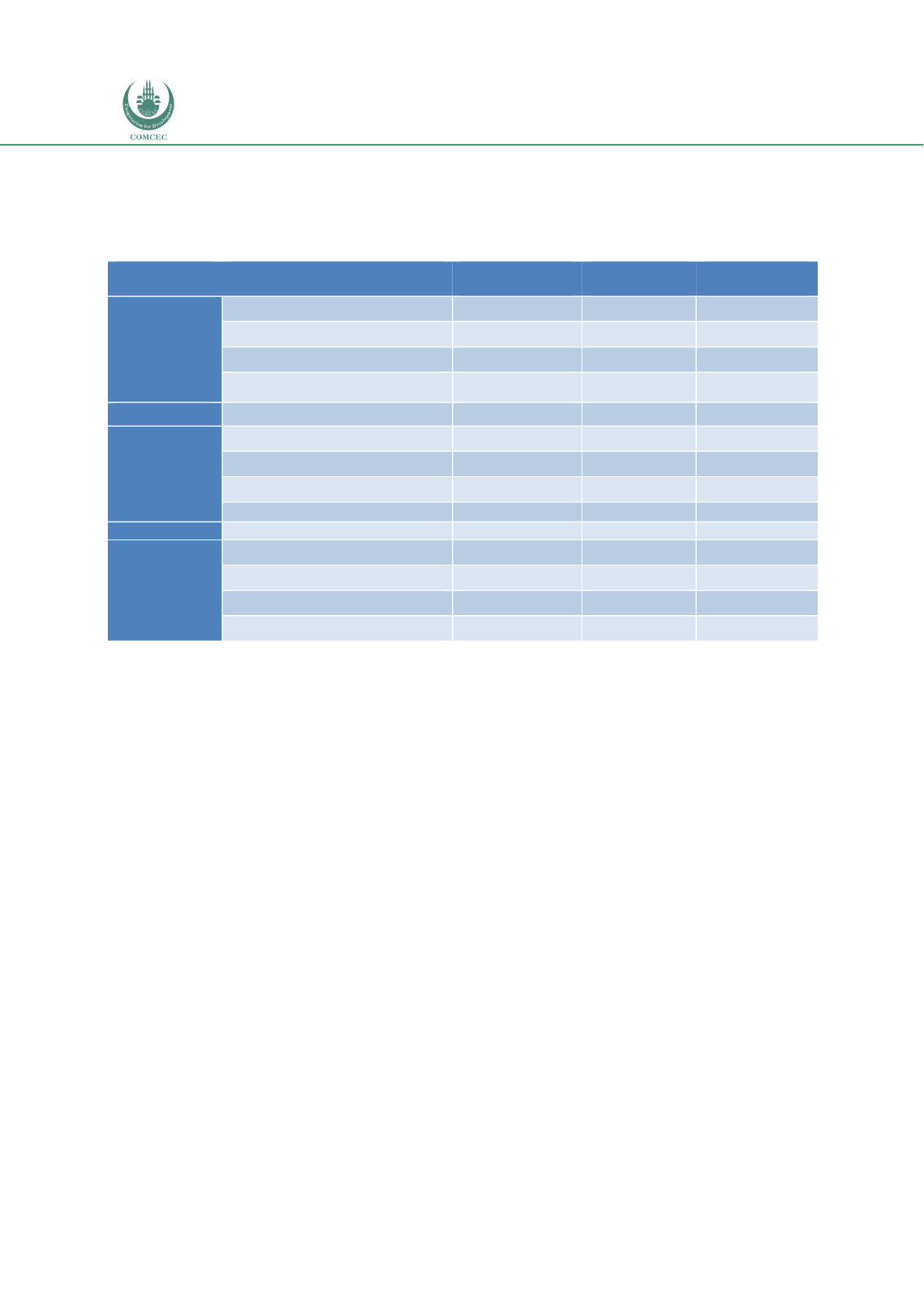

vis-à-vis the entire industry in terms of deposit mobilization, credit/financing and asset base

over a 3-year period are presented in Table 4.3.1 below:

Table 4.3. 1: Performance indicators of Conventional and Islamic banks

(USD million; Exchange rate: USD1 = N305.8)

Total Deposits

DEC. 2015 (USD

Million)

DEC. 2016

(USD Million)

DEC. 2017 (USD

Million)

Conventional banks

57,104.18

60,626.10

63,364.78

Non-Interest banks

129.90

164.43

222.74

INDUSTRY

57,234.08

60,790.54

63,587.53

% Non-interest banks/Industry

0.23

0.27

0.35

Total Credits

Conventional banks

43,586.57

53,165.88

52,035.78

Non-Interest banks

83.06

115.62

122.67

INDUSTRY

43,669.62

53,281.50

52,158.45

% Non-interest banks/Industry

0.19

0.22

0.24

Total Assets

Conventional banks

88,169.55

98,597.43

106,416.45

Non-Interest banks

177.59

229.81

297.60

INDUSTRY

88,347.14

98,827.25

106,714.05

% Non-interest banks/Industry

0.20

0.23

0.28

Source: Central Bank Nigeria (CBN) Financial Analysis (FinA) System

Table 4.3.1 shows that Islamic banks contributed only 0.23%, 0.27% and 0.35% of the entire

deposits in the industry in 2015, 2016 and 2017 respectively. Similarly, Islamic banks

contributed only 0.19%, 0.22% and 0.24% of the total credit/financing in the industry over the

same period respectively while the contribution by Islamic banks was only 0.20%, 0.23% and

0.28% of the total assets in the industry in 2015, 2016 and 2017 respectively. Overall, even

though the performance of Islamic banks relative to the entire industry was dismal on all the

three indicators, it portrayed a steady, marginal growth over the period.

The Islamic capital market in Nigeria comprises of Islamic mutual funds and Sukuk. There are

two types of Islamic funds in the market: closed and open-ended mutual funds. The open-

ended mutual funds are the Lotus Capital Halal Fund and the Stanbic IBTC Imaan fund while

the closed fund is the Lotus Halal Exchange Traded Fund (ETF). The net asset value (NAV) of

the Islamic funds vis-à-vis the total funds in the industry for the period 2015-2017 is

presented Table 4.3.2. Even though the NAV of the Islamic fund consistently rose over the

period, its composition in the industry fluctuated as it was 1% in 2015 before increasing to

1.26% in 2016 and then declining to 0.76% in 2017. This fluctuation is explained by the

fluctuating conventional mutual funds over the period.