Infrastructure Financing through Islamic

Finance in the Islamic Countries

111

4.3.

Nigeria

4.3.1.

Nigerian Financial Sector and Islamic Finance: An Overview

The financial sector of Nigeria is shaped by the Financial System Strategy 2020 (FSS2020)

initiated in 2007. The aim of the strategy was to develop a robust and integrated financial

system that is safe and fast-growing in emerging markets and which can be a catalyst for

economic growth in order to make the Nigerian economy as one of the 20

th

largest economies

in the world by 2020.

59

Different regulatory bodies including Central Bank of Nigeria (CBN),

Securities and Exchange Commission (SEC), National Insurance Commission of Nigeria

(NICON) and stakeholders such as Nigerian Deposit Insurance Corporation (NDIC), Nigerian

Stock Exchange (NSE) were expected to implement the strategy.

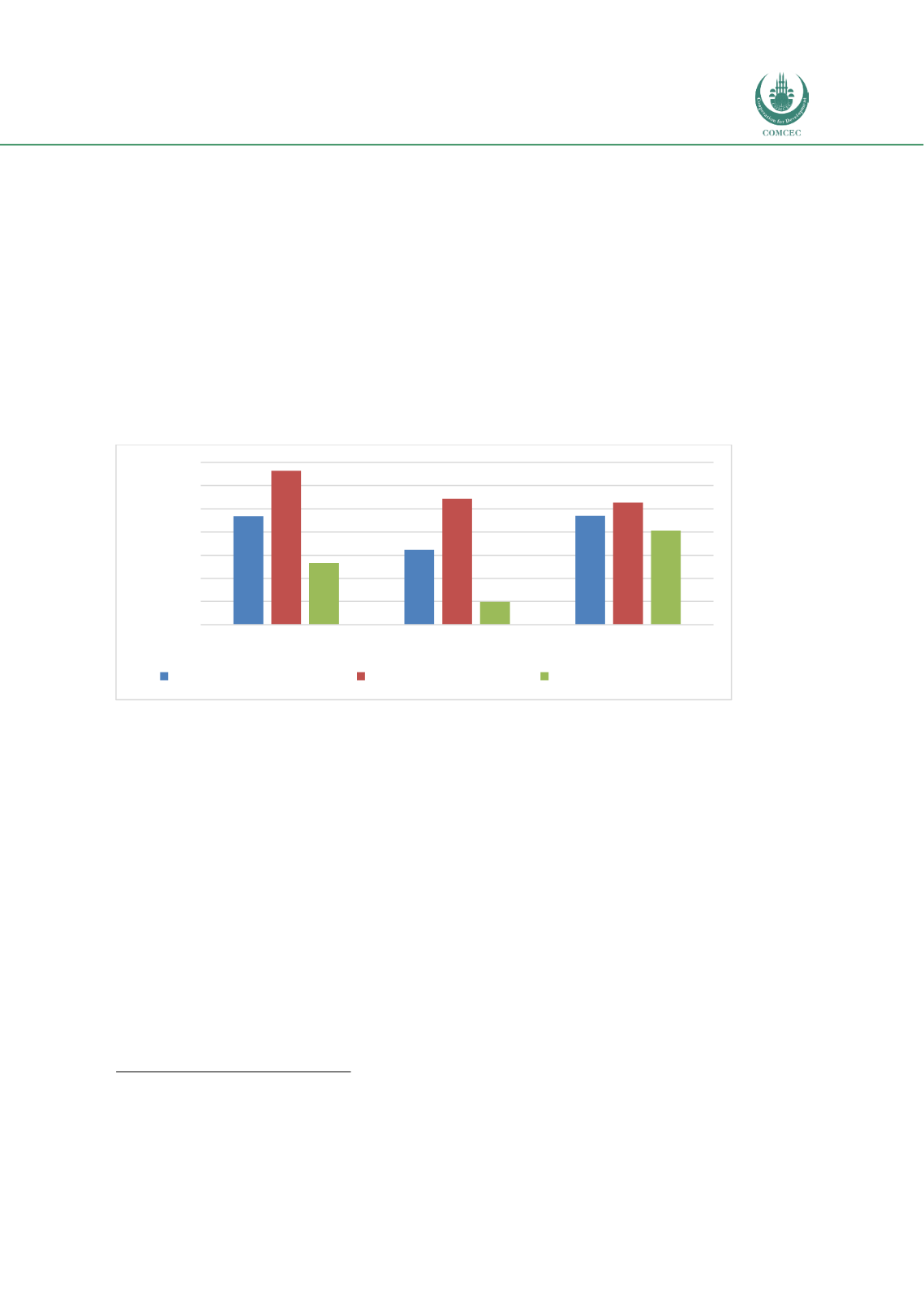

Chart 4.3. 1: Relative Financial Sector Development in Nigeria (2016) (0-1 Highest)

Source: IMF Financial Sector Development Database

Chart 4.3.1 shows the status of the Nigerian financial system compared to OIC countries and

the African region. While the overall development of the Nigerian financial sector (0.24)

appears to be similar to the average of the OIC countries (0.23), it is better than the average for

the African countries (0.16). However, while the index for the financial markets for Nigeria

(0.20) is better than that of the OIC (0.13) and Africa (0.05), the index for the financial

institutions in the country (0.24) lag behind the average of the OIC countries (0.33).

4.3.1.1. Islamic Finance Industry Overview

The Nigerian Islamic finance industry comprises Islamic banking, Islamic capital market and

Takaful. Currently, the Islamic banking industry consists of a fully-fledged Islamic bank, Jaiz

bank Islamic banking window; Sterling bank non-interest banking window; and two Islamic

microfinance banks, Tijara and I-care non-interest microfinance banks. Stanbic IBTC non-

interest banking window had previously sought and obtained the Central Bank’s approval to

discontinue operations in December 2017, mainly due to persistent losses incurred by the

Window since its inception in January 2011. The performance of the Islamic banking sector

59

See

https://www.fss2020.gov.ng/financial-markets/and

https://www.cbn.gov.ng/fss/mon/Nigeria's%20Financial%20System%20Strategy%202020%20Plan%20-

%20OUR%20DREAM_Prof.%20Soludo.pdf

0.23

0.16

0.24

0.33

0.27

0.26

0.13

0.05

0.20

0.00

0.05

0.10

0.15

0.20

0.25

0.30

0.35

OIC Average

Africa

Nigeria

Index Value (0-1 Highest)

Financial Development Index Financial Institutions Index Financial Markets Index