Infrastructure Financing through Islamic

Finance in the Islamic Countries

110

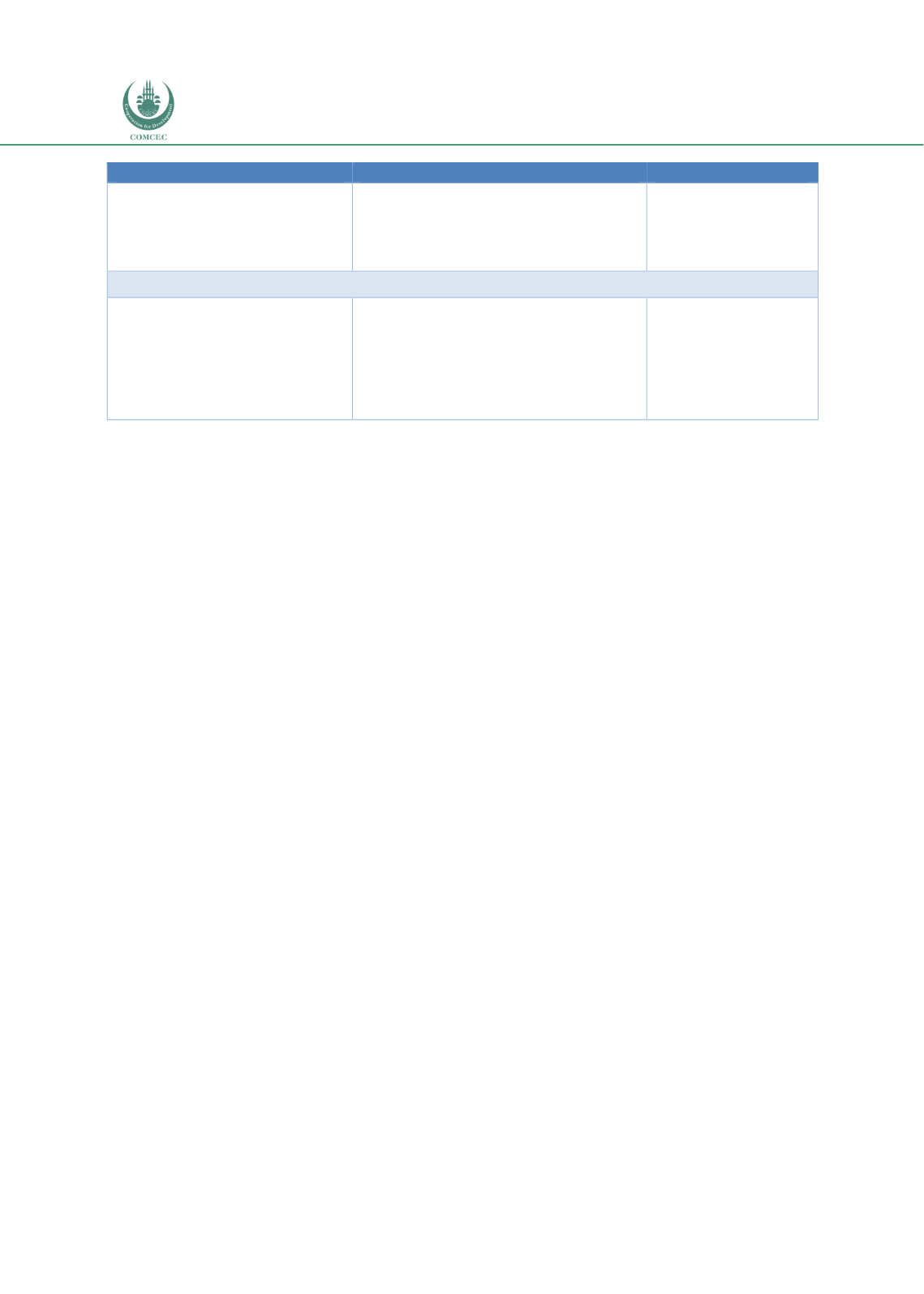

Issues

Recommendations

Implemented by

While Malaysia has developed the

sukuk market, infrastructure

projects are funded by issuing

both sukuk and bonds.

Issue more sukuk instead of bonds to

finance infrastructure projects since the

former has the potential to expand the

investor base by including both

conventional and Islamic investors.

Capital market

authority

Issuers (sovereign and

corporate)

Islamic Social Sector

The use of both waqf and zakat

institutions can be enhanced to

provide

social

infrastructure

services by coming up with

innovative solutions. Zakat and

waqf are managed at the state

level in Malaysia.

Increase the role of zakat and waqf by

taking initiatives and knowledge-sharing

programmes at the state level to develop

innovative models of using these

instruments to provide social

infrastructure services.

State level Religious

Councils