182

5.

POLICY RECOMMENDATIONS ON SUKUK MARKET DEVELOPMENT

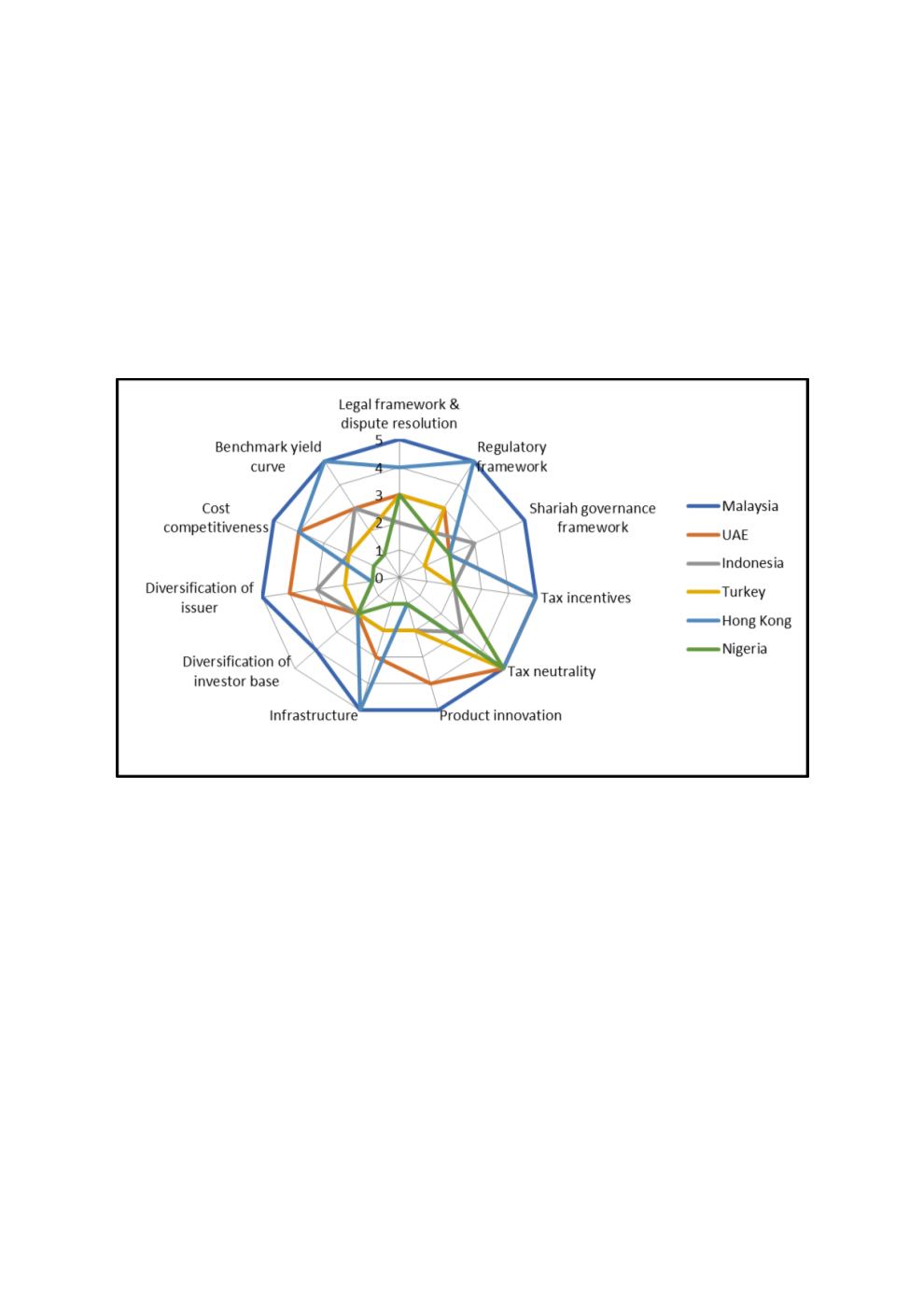

After concluding the benchmarking exercise on the respective development stages of each case

study based on 11 main criteria, we conclude that there is indeed no “one size fits all”

framework and roadmap to develop the sukuk markets in different OIC countries. Each market

has its own peculiarities, depending on the macroeconomic conditions that can be measured

through its stability level. Spider Chart 5.1 summarises the position of each country, with

Malaysia in the lead in all criteria, except diversification of investor base.

Chart 5.1: Key Building Blocks in Developing the Sukuk Markets in OIC Countries

Sources: RAM, ISRA

5.1

STRATEGIC FRAMEWORK AND ROAD MAP TO DEVELOP SUKUK

MARKETS

Learning from Malaysia as a jurisdiction that has made strides in its sukuk market, we can

conclude that a comprehensive framework―encompassing the building of both supply and

demand―and the development of a robust regulatory and market infrastructure are pertinent

towards achieving a state of maturity. Figure 5.1 can be used as a barometer to measure the

state of development of each OIC country, and as a guide to building a cohesive roadmap that

should be incorporated into a country’s capital market masterplan.