180

4.7.5

COUNTRY-SPECIFIC RECOMMENDATIONS

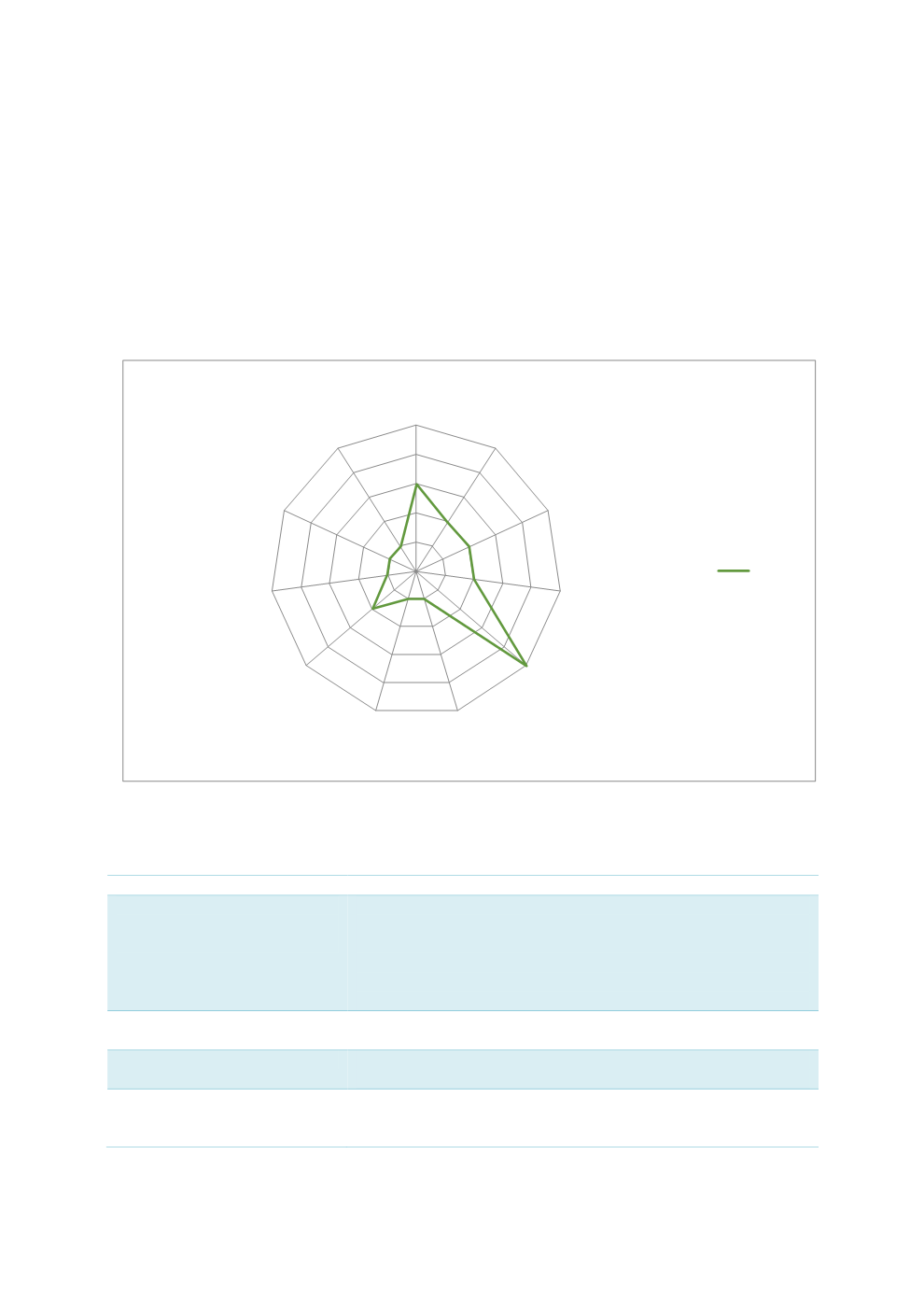

Nigeria shows a keen interest in developing its sukuk market. Nonetheless, it still faces a

number of challenges in the process, as reflected in Chart 4.61. Tables 4.37 and 4.38

summarise some of the proposals to facilitate the depth and breadth of Nigeria’s sukuk market

in terms of supply and demand. Table 4.39 provides some recommendations on improving the

country’s infrastructure.

Chart 4.61: Factors Influencing the Development of Nigeria’s Sukuk Market

0

1

2

3

4

5

Legal framework &

dispute resolution

Regulatory

framework

Shariah governance

framework

Tax incentives

Tax neutrality

Product innovation

Infrastructure

Diversification of

investor base

Diversification of

issuer

Cost

competitiveness

Benchmark yield

curve

Nigeria

Sources: RAM, ISRA

Table 4.37: Recommendations to Improve Supply (Sell Side) – Medium-Term Solutions

Issues and Challenges

Recommendations

Lack of short-term, non-

interest liquidity

instruments

Apart from its existing sovereign sukuk, the CBN plans to issue

sovereign sukuk to Islamic banks for their liquidity management.

The CBN will consider amending the Central Bank Act (CBA) and

Banks and Other Financial Institutions Act (BOFIA) to

accommodate the use of CBN assets to create non-interest

liquidity instruments.

Shortage of state sukuk

State governors should be encouraged to access the NICM

through sukuk issuance.

No corporate sukuk

GLCs must spearhead the issuance of corporate sukuk. This will

set a benchmark for private issuers.

No supranational sukuk

The SEC to engage the Islamic Development Bank (IDB), the

AFDB and other multilateral institutions to issue supranational

sukuk in Nigeria.