COMCEC Trade Outlook 2017

8

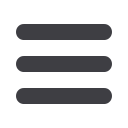

Table A: Intra and Extra Trade in Selected Preferential Trade Agreements - 2016

World (billion dollars)

Intra-PTA share in total

(%)

Extra-PTA share in total

(%)

Export

Import

Export

Import

Export

Import

ASEAN (Association of South-East Asian Nations)

1,138

1,077

24.0

22.6

76.0

77.4

CEMAC (Economic and Monetary Community of Central

Africa)

18

19

2.9

3.9

97.1

96.1

Commonwealth of Independent States (CIS)

419

316

16.5

21.0

83.5

79.0

Common Market for Eastern and Southern Africa

(COMESA)

69

146

9.9

5.6

90.1

94.4

EAC (East African Community)

14

32

21.7

7.1

78.3

92.9

Economic Co-operation Organization (ECO)

300

359

10.5

7.7

89.5

92.3

Economic Community of West African States (ECOWAS)

73

87

11.7

10.0

88.3

90.0

European Free Trade Association (EFTA)

398

347

0.5

0.6

99.5

99.4

European Union (28)

5,358

5,220

63.7

59.7

36.3

40.3

Gulf Cooperation Council (GCC)

579

451

10.5

9.7

89.5

90.3

Southern Common Market (ME RCOSUR)

283

224

14.0

15.2

86.0

84.8

North American Free Trade Agreement (NAFTA)

2,216

3,040

50.2

33.2

49.8

66.8

SAARC (South Asian Association for Regional

Cooperation)

327

487

7.0

5.4

93.0

94.6

WAEMU (West African Economic and Monetary Union)

24

28

13.5

8.1

86.5

91.9

Source: UNCTADSTAT

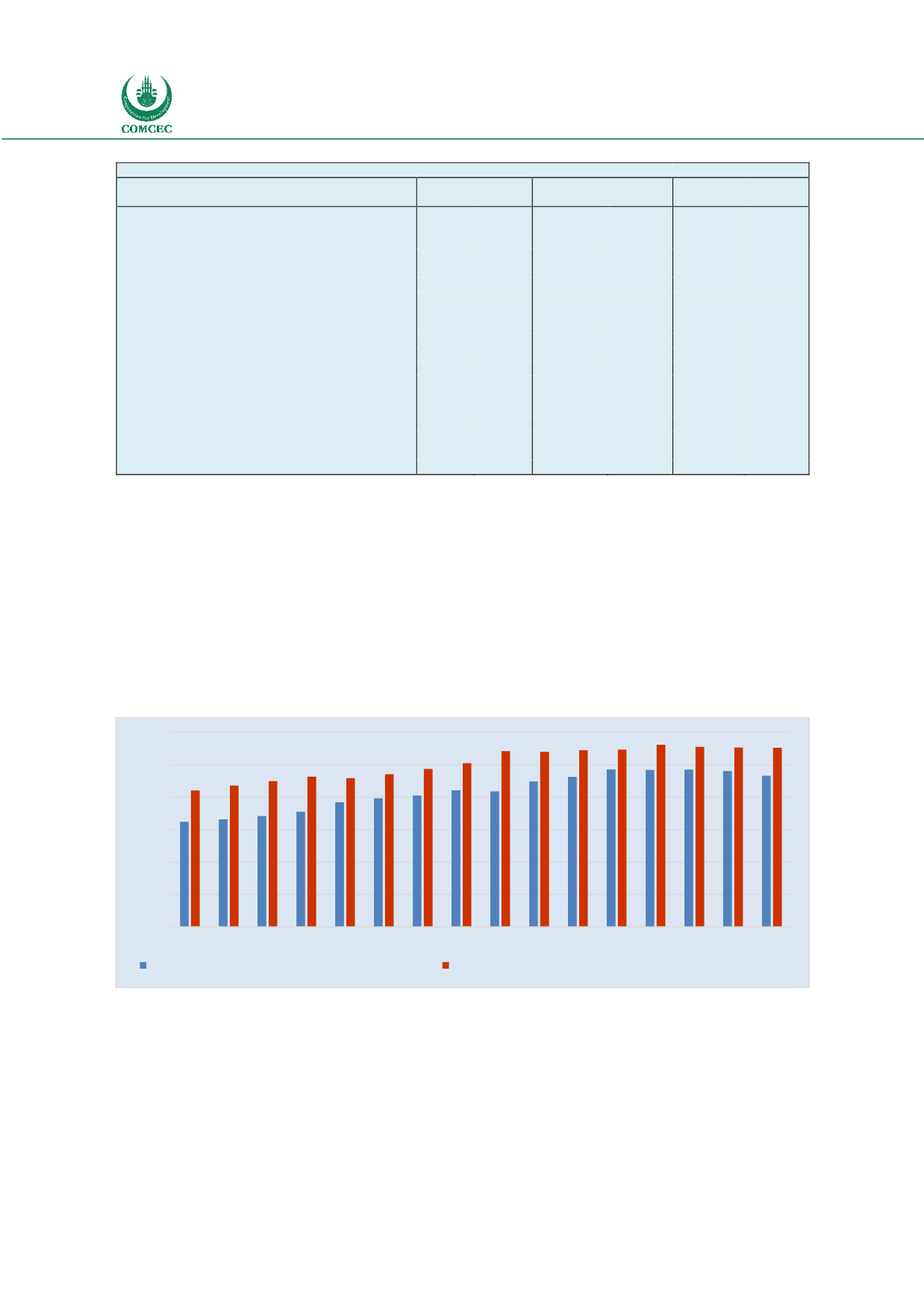

The rising share of developing economies in world trade was the third dominant pattern in the

world trade. The share of developing countries in global exports increased from 32.7 percent in

2001 to 46.5 percent in 2016. The rising share of developing countries in world trade was driven

by the rapid growth in South-South trade (trade between the developing countries) and

especially by the exports of Brazil, Russia, India and China. The high growth of Developing

countries trade is considered as a major driver of the global trade growth in the past decade and

a major factor contributing to recovery from the global crisis. However, since 2013 growth in

developing countries share in world exports has slowed down.

Figure 6: Evolution of the Share of Developing Countries in World Exports

Source: ITC Trademap

Increasing participation to the global value chains (GVCs) in particular of the developing

countries was a key factor driving the dramatic increase in developing countries trade and in

turn the world trade in the period prior to the global crisis. However, a recent trend has been

the slowing pace of global value chains, which have negative impacts on world trade growth.

The shift to domestic production of intermediate inputs by China, Japan and US firms

contributed to the slowdown in GVCs.

0

10

20

30

40

50

60

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

per cent

Developing countries exports as % of world exports

South-South exports as % of total Developing Countries Exports