10

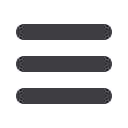

prices have been on an increasing trend since August 2017 due to the revival of global economic

activity, OPEC agreement to cut oil production and geopolitical instability in the Middle East.

10

OPEC and non-OPEC oil exporters including Azerbaijan, Kazakhstan and Russian Federation

agreed to curb oil production from January 2017 to March 2018 to 1.8 million barrels per day.

11

They had further agreed to extend these cuts until the end of 2018. Thus, oil prices which

averaged to 52.8 dollars per barrel in 2017 recovered strongly to 73 dollars per barrel in May

2018 which was the highest price since December 2014. However, oil prices are still well below

their peak levels of 118 dollars achieved in March 2012.

Figure 9: Monthly Oil Prices (nominal)

Source: World Bank Commodity Prices database Note: Average of Brent, Dubai and WTI.

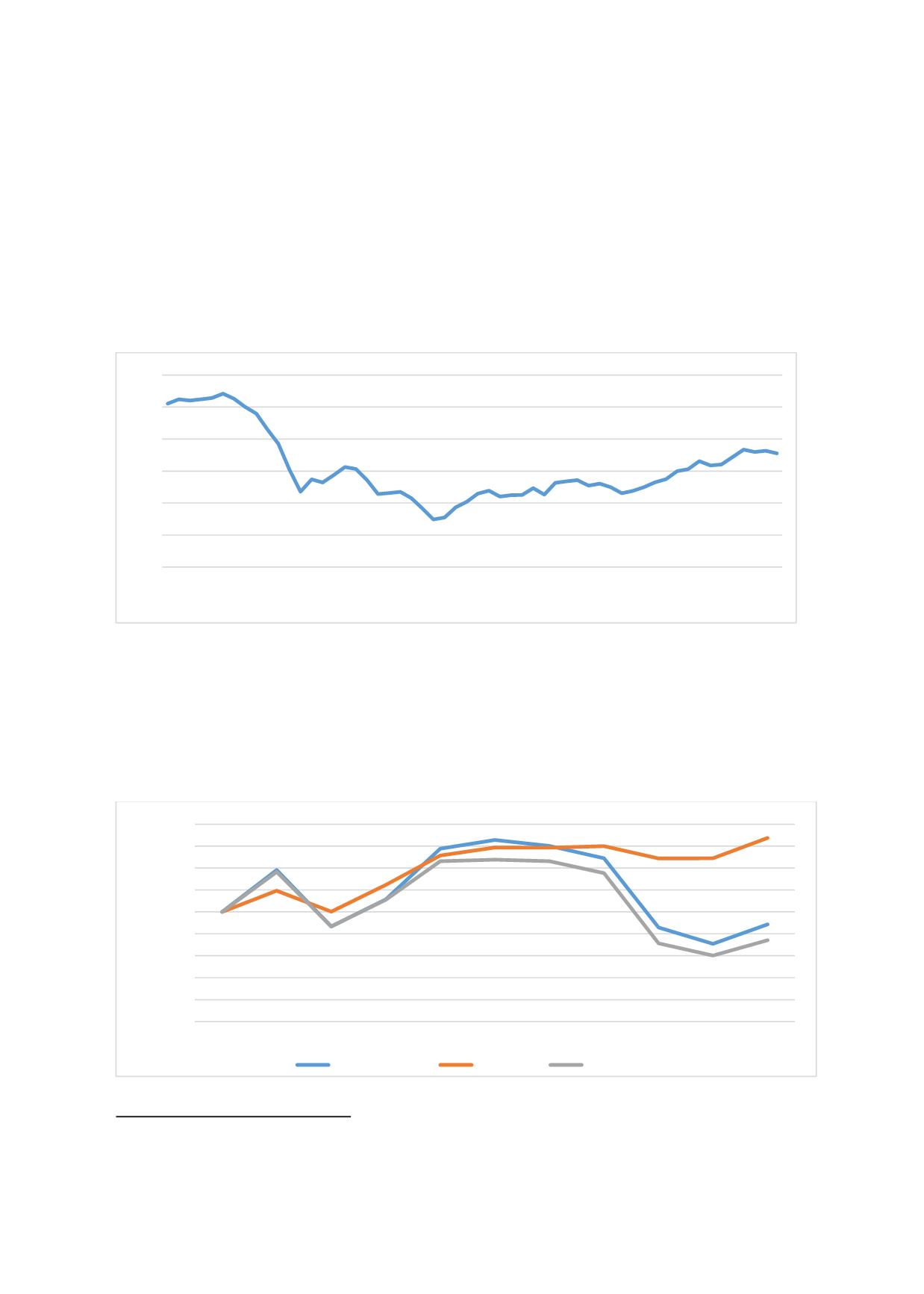

Figure 10 shows the evolution of total OIC fuels and non-fuels exports versus oil price

developments. Fuels exports are highly volatile depending on the oil price movements. As a

result, OIC fuels exports contracted severely in 2015 following the oil price collapse but bounced

back in 2017 as oil prices increased. However it should be noted that OIC fuels exports in 2017

are almost half of their levels in 2012. Meantime, OIC non fuels exports increased in 2017 as the

global activity increases.

Figure 10: Evolution of OIC Fuels and Non-Fuels Exports versus Oil Prices

Source: UNCTAD STAT database

10

IMF WEO Update January 2018

11

UN World Economic Situation and Prospects, 2018

102

108

86

61

55

63

47

30

48

54

46

55

66 69 71

0

20

40

60

80

100

120

2014M1

2014M3

2014M5

2014M7

2014M9

2014M11

2015M1

2015M3

2015M5

2015M7

2015M9

2015M11

2016M1

2016M3

2016M5

2016M7

2016M9

2016M11

2017M1

2017M3

2017M5

2017M7

2017M9

2017M11

2018M01

2018M03

2018M05

2018M07

USD per barrel

0

20

40

60

80

100

120

140

160

180

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

2007: 100 Index

Fuels (SITC 3)

Non Fuel

Oil Prices