COMCEC Trade Outlook 2018

5

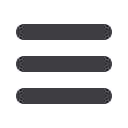

Table 1: Trade Volume and GDP, Annual % change

2015

2016

2017

Volume of world merchandise trade

2.5

1.8

4.7

Exports

Developed Economies

2.3

1.1

3.5

Developing Economies

2.4

2.3

5.7

North America

0.8

0.6

4.2

Europe

2.9

1.1

3.5

Asia

1.5

2.3

6.7

Imports

Developed Economies

4.3

2.0

3.1

Developing Economies

0.6

1.9

7.2

North America

5.4

0.1

4.0

Europe

3.7

3.1

2.5

Asia

4.0

3.5

9.6

World output (real GDP at market exchange rates,2005)

Developed Economies

2.3

1.6

2.3

Developing Economies

3.7

3.6

4.3

North America

2.7

1.5

2.4

Europe

2.3

1.9

2.6

Asia

4.2

4.1

4.5

Source: WTO

1.1. Recent Trends in World Merchandise Trade

There have been some emerging patterns shaping the

global trading environment recently. First trend is the

proliferation of non-tariff barriers. The Figure below

which is taken from UNCTAD (2017) provides data for

1995-2015 period and illustrates that while tariffs have

declined considerably in the 2000s, little progress was

achieved in terms of further declines in tariffs since the

global crisis. The number of non-tariff measures continue to rise especially in the aftermath of

the crisis. Slower pace of trade liberalization and increased protectionist measures are

considered among factors which constrain world trade.

According to WTO

6

, WTO members

introduced more trade-restrictive measures (tariff increases, stricter customs procedures,

imposition of taxes and export duties) in mid-October 2017 to mid-May 2018 period compared

to the previous review period.

6

https://www.wto.org/english/news_e/news18_e/trdev_25jul18_e.htm“Further rise in trade

restrictive measures

could pose a risk for

global trade