Financial Outlook of the OIC Member Countries 2016

23

reserves, retained earnings and as such considerable as capital. In 2014, the level of this

measure decreased compared to the level at the previous year whereas the level increased

during this period in the world (Figure 20).

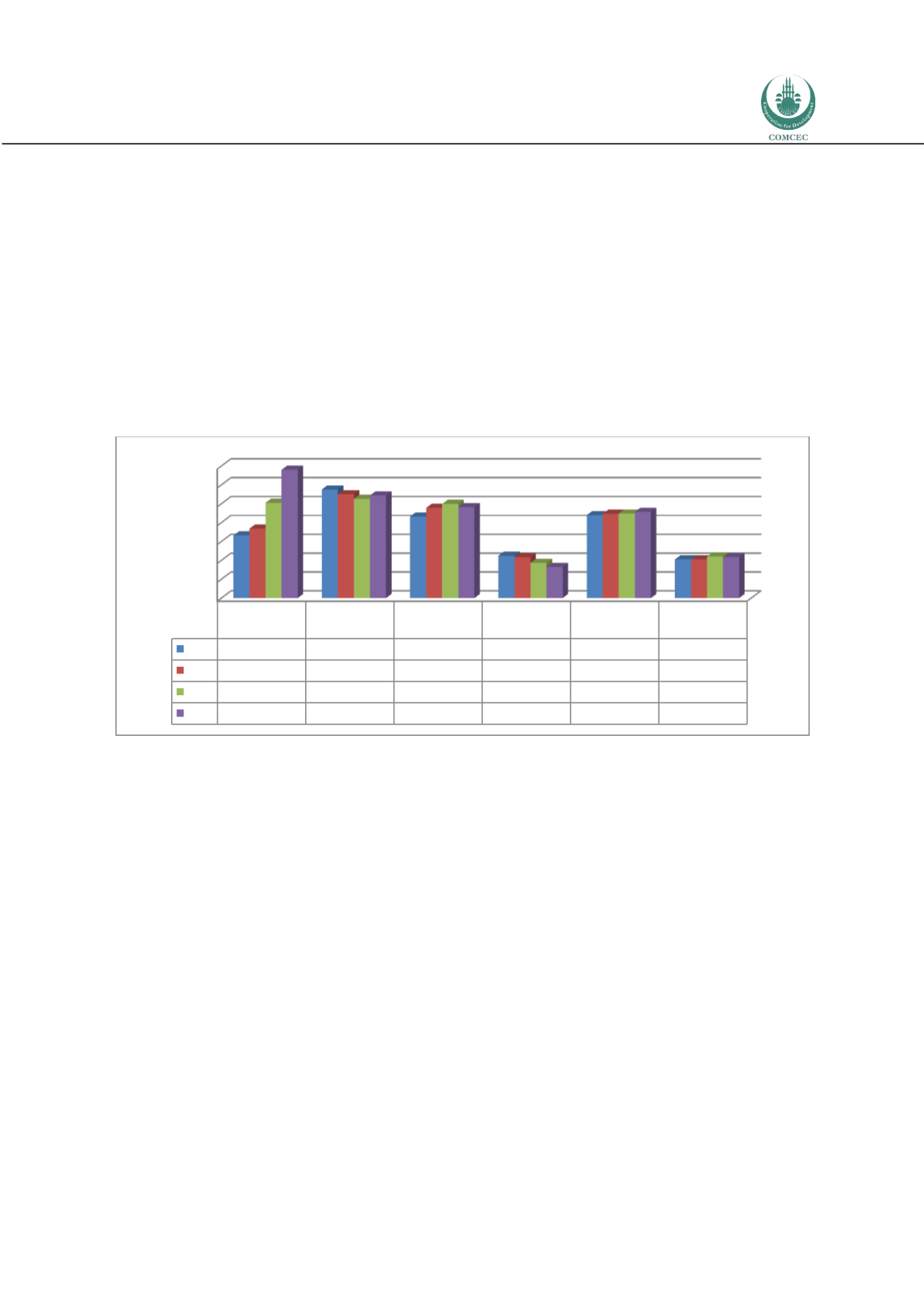

Measure of bank nonperforming loans to gross loans (%) shows how successful a bank to pick

projects or extend credits. However, in countries where macroeconomic stability is a big issue,

this measure quickly reaches higher levels without bankruptcy calls of banks. Hence, this

measure is inversely related to macroeconomic stability and the unused capacity of banks to

buffer further shocks. Banks nonperforming loans to gross loans peaked to 13.6 per cent in

2014 from 6.6 per cent in 2011 for OIC-LIG. World average of this measure is about 4 per cent.

The figures are 10.9, 9.6 and 3.3 per cent for OIC-LMIG, OIC-UMIG and OIC-HIGH respectively

in 2014.

Figure 21: Bank nonperforming loans to gross loans (%)

Source: COMCEC Coordination Office staff estimations by using Global Financial Development Database, World

Bank (2016b)

0

2

4

6

8

10

12

14

OIC-LIG

Average

OIC-LMIG

Average

OIC-UMIG

Average

OIC-HIGH

Average

OIC Average

World

2011

6,63

11,51

8,65

4,50

8,79

4,10

2012

7,37

11,02

9,56

4,33

8,93

4,10

2013

10,10

10,53

9,98

3,74

8,96

4,40

2014

13,60

10,88

9,64

3,30

9,13

4,35