Financial Outlook of the OIC Member Countries 2016

28

international level, Malaysia is the worldwide pioneer in Islamic financial services industry.

Although UK, USA and Sri Lanka have worse score in 2016 according to 2015, it is quite

remarkable that 3 non-OIC countries, find place in the top 20 countries.

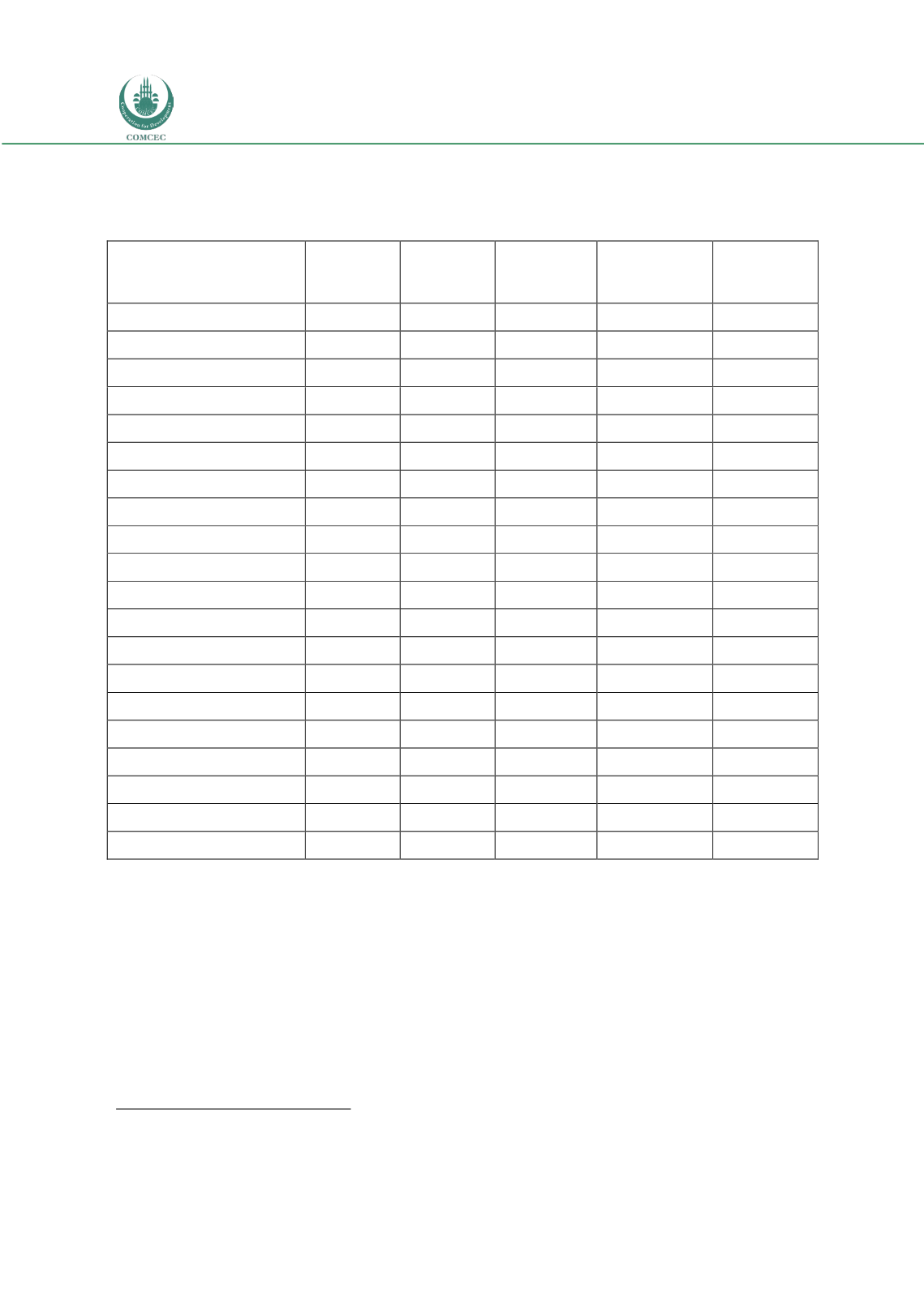

Table 7: Adjusted IFCI Scores of top 20 Countries

Countries

IFCI Rank

2016

IFCI Rank

2015

IFCI Rank

2011

Changes

according to

2015

Changes

according to

2011

Malaysia

1

2

2

1

1

Iran

2

1

1

-1

-1

Saudi Arabia

3

3

3

0

0

United Arab Emirates

4

4

7

0

3

Kuwait

5

5

5

0

0

Indonesia

6

7

4

1

-2

Qatar

7

8

13

1

6

Bahrain

8

6

8

-2

0

Pakistan

9

10

6

1

-3

Bangladesh

10

11

9

1

-1

Sudan

11

9

10

-2

-1

Egypt

12

13

12

1

0

Turkey

13

12

14

-1

1

Jordan

14

15

19

1

5

United Kingdom

15

14

15

-1

0

Oman

16

19

--

3

--

Brunei Darussalam

17

17

19

0

2

United States of America

18

16

14

-2

-4

Sri Lanka

19

18

22

-1

3

Lebanon

20

21

18

1

-2

Soruce: GIFR 2016

Participation Banking Sector

4.2

As the largest segment of the global Islamic finance industry, the total asset of the sector is

estimated as- approximately- 1.6 trillion USD in 2015 (GIFR, 2016). The participation banking

sector has achieved systemic importance

4

in 11 out of 57 member countries (IFSB, 2016).

4

Islamic Financial Stability Report 2016

considers the Islamic financial sector as being systemically important when the

total Islamic banking assets in a country comprise more than 15% of its total domestic banking sector assets.