Financial Outlook of the OIC Member Countries 2016

29

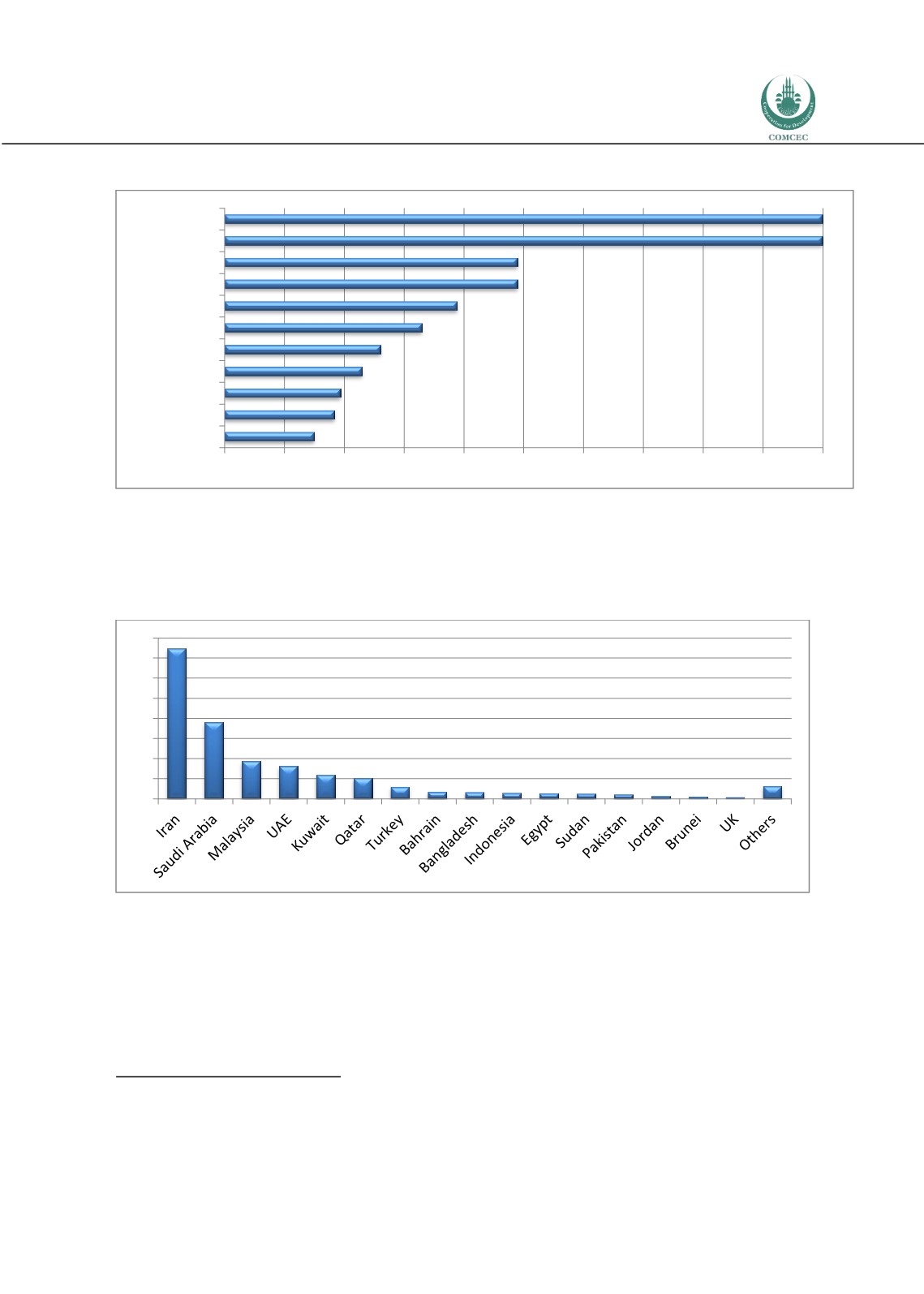

Figure 22: Islamic Banking Share in Total Banking Assets (%- 1H2015)

Source: IFSB, Islamic Financial Stability Report 2016

By jurisdiction, Iran is the largest domicile hub for participation banking assets. The 10 top

countries dominate the sector with 92.1 percent of the sector assets. The Compound Annual

Growth Rate between 2010 and 2014 was 16.1 percent (Ernst and Young, 2016).

Figure 23: Shares of Global Islamic Banking Assets as of 1H2015

Source: IFSB, Islamic Financial Stability Report 2016

Islamic Capital Market Sector

4.3

Islamic capital markets comprise three main sectors: Sukuk or Islamic Bond Market, Islamic

Equity Markets, and Islamic Fund Markets.

Sukuk/ Islamic Bond Market:

The global Sukuk issuances were 60.6 billion USD in 2015 with

a dramatic 43 percent fall according to 2014. IIFM (2016) identified the main reason behind

this drop as the Bank Negara Malaysia policy decision to discontinue issuance of short-term

investment Sukuk.

15

18,4

19,4

23

26,1

33

38,9

49

49

100

100

0

10

20

30

40

50

60

70

80

90 100

Djibouti

UAE

Bangladesh

Malaysia

Qatar

Yemen

Kuwait

Saudi Arabia

Brunei

Sudan

Iran

37,3

19

9,3 8,1

5,9 5,1 2,9

1,7 1,6 1,4 1,3 1,2

1

0,6 0,4 0,3

3,1

0

5

10

15

20

25

30

35

40