Financial Outlook of the OIC Member Countries 2016

27

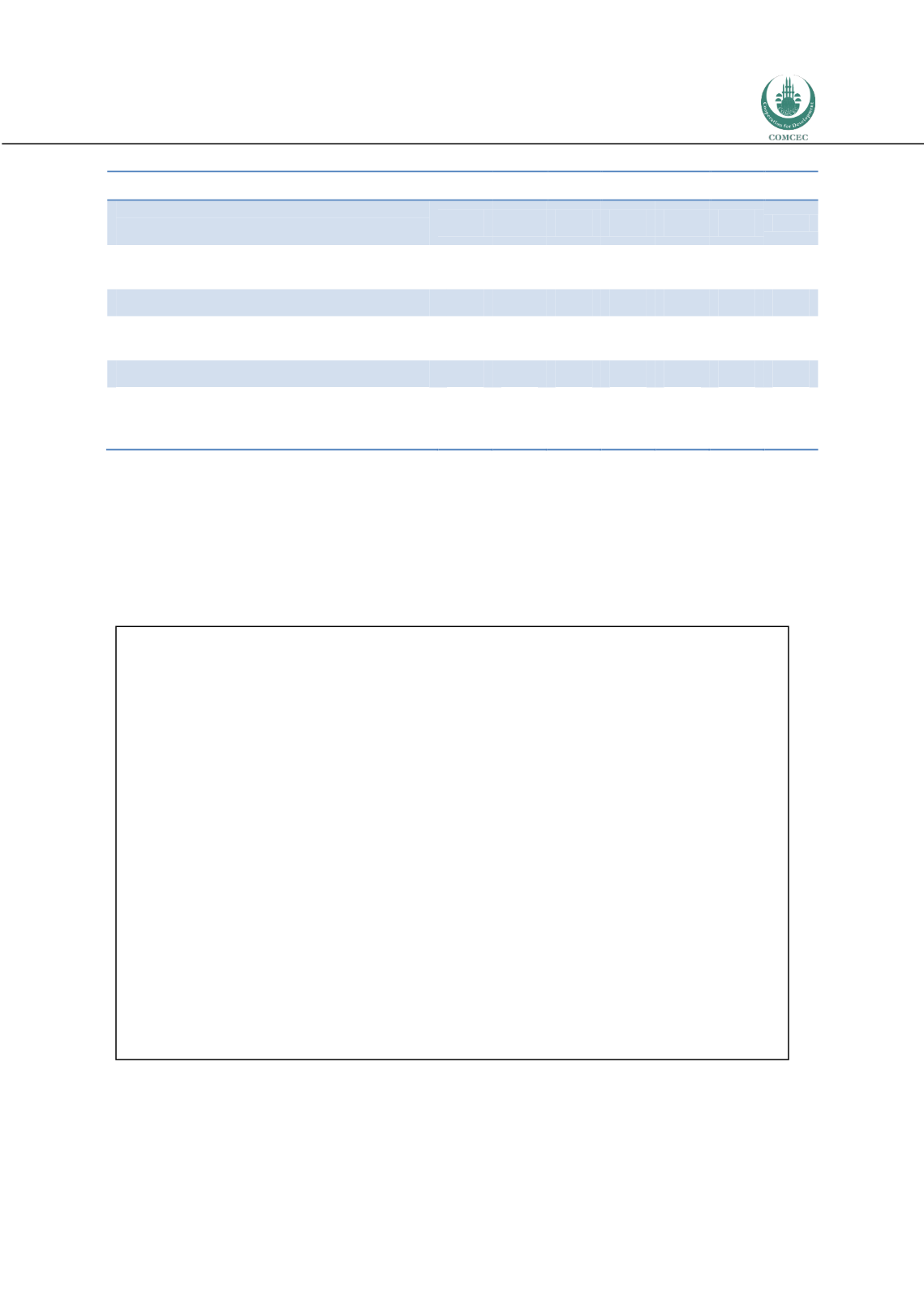

Table 6: Potential and Actual Size of the Islamic Financial Services Industry

2009

2010

2011

2012 2013

2014 2015

Potential size of the global Islamic financial

services industry (US$ trillion)

4.0

4.4

4.8

5.3

5.9

6.5

7.1

Actual size of the global Islamic financial

services industry (US$ trillion)

1.036 1.139 1.357 1.631 1.813 1.981 2.143

Size gap (US$ trillion)

2.964 3.261 3.483 3.693 4.043

4.47

4.953

Growth in actual size of the global Islamic

financial services industry (%)

26

9.9

19.1

20.2

12.3

9.3

7.3

Average growth rate between 2009-2015 (%)

15

Catch-up period - based on 10% growth in

potential size and 15% growth in actual size

(years)

27

Soruce: GIFR 2016

While some global finance centers are trying to be centers of excellence for Islamic finance, the

Islamic Financial Assets mostly concentrated in the OIC countries. Iran, Malaysia and Saudi

Arabia are the three leading players in the global Islamic financial services industry and only

the UK could rank among the list of top 20 countries in terms of Islamic finance assets (GIFR,

2016).

Box 3. Islamic Finance Country Index- IFCI

As indicated by Islamic Finance Country Index 2016- GIFR 2016 (Box 3), a composite index

utilized for ranking different countries with respect to the state of Islamic financial services

industry and their leadership role in the industry on a national level and benchmarked on

IFCI is based on a multivariate analysis. For construction of the index, data was collected on a number of variables,

including macroeconomic indicators of the countries included. The data was then tested to see if it contained any

meaningful information to draw conclusions from. After consideration of different multivariate methods, it was

decided to use factor analysis to identify the factors that may influence Islamic Banking and Finance (IBF) in the

countries included in the sample.

It must be clarified that IFCI is a positive measure of the state of affairs of IBF and its potential in a country, without

taking a normative view on what should be the important factors determining size and growth of the industry, and

their relative importance (i.e., weights).

The general model used for the construction of IFCI is as follows:

where

Cj = Country j included in the index

Wi = Weight attached to a given variable/factor i

Xi = A given variable/factor i included in the index

The countries are ranked according to the above formula every year, using the annual data.

Source: Global Islamic Finance Report 2016