Financial Outlook of the OIC Member Countries 2016

7

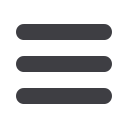

Panel B. Countries with 10 Lowest Concentration Values

Note: Comoros and Guinea Bissau are excluded due to unavailable data. Somalia has no bank coverage in

Bankscope database. Brunei Darussalam and Chad have only one bank data which makes HHI as 10,000 for these

countries and therefore not included in the figure.

Source: COMCEC Coordination Office staff estimations from Bankscope database

Box 1. Herfindahl Hirschmann Index

Main operation of banks is to give loans to individuals and private sector. In order to see in

what degree the banking system execute its main operation, Net Loans over Total Assets could

be used. Figure 3 shows the simple and weighted average of net loans over total assets ratio

among banks in a given country. Simple average takes the average of the ratios in all the banks

in a given country. Weighted average use total assets market share of banks to weight the

banks’ ratios. Another way to find out the weighted average is to estimate total loans and total

assets in a given country by summing up loans and assets of individual banks in a given

country and divide total loans to total assets. The highest ratio belongs to Tunisia with 74 per

cent in weighted average.

Information given by simple and weighted average can be interpreted as follows. In the case of

Malaysia, weighted average is higher than simple average. This means that banks with higher

assets have higher Net Loans over Total Assets. Hence, big banks give loans in higher share in

their assets. In the case of Azerbaijan, the opposite is true. Simple average is higher than

0

200

400

600

800

1.000

∑

The Herfindahl-Hirschmann Index (HHI) is widely used to measure concentration among industries and markets. In

the case of banks, the competition degree in assets, loans and deposits can be measured by the values of HHI.

Rhoades (1993) explains how to measure and interpret HHI. The market share of all banks in a country is identified

as percentage points. Squares of the shares are summed up to calculate HHI. The formula below summarizes this

explanation where n is the number of banks and MS is the market share in percentage points:

As an example, suppose there are 5 banks in a country with the following market shares: 10, 10, 20, 30, 30 per cent.

Then HHI is calculated as follows:

HHI is interpreted as the lower the better in terms of competition. Although there are critics on the use of HHI

(Matsumoto, Merlone and Szidarovsky, 2012), HHI is widely used as one of the measure for quantifying competition

or in other words concentration (Al-Muharrami, Matthews and Khabari, 2006).