Financial Outlook of the OIC Member Countries 2017

32

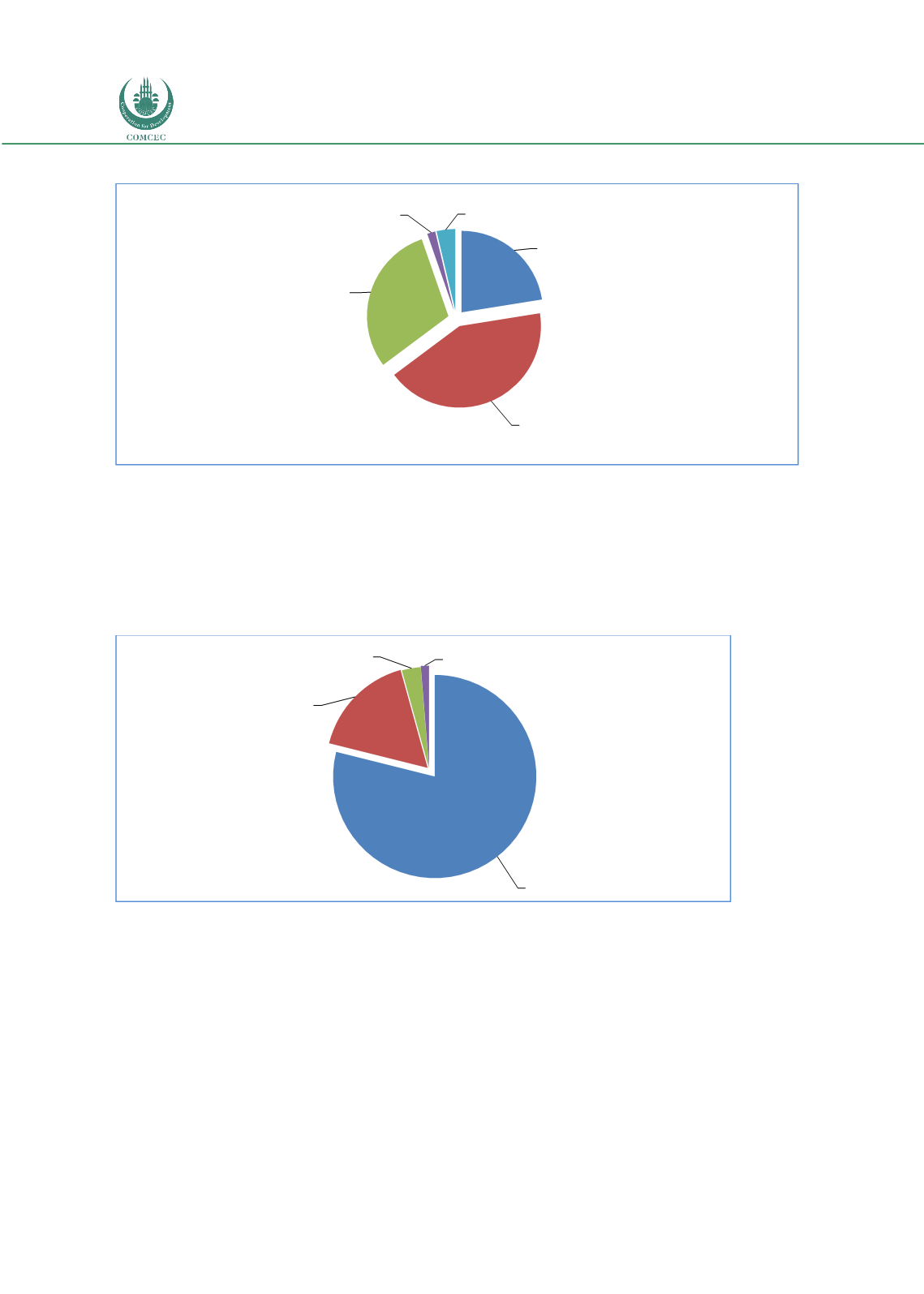

Figure 26: Breakdown of IFSI by Region

Source: IFSB

The Islamic Finance industry consists of three main segments as banking, capital markets and

takaful. Islamic banking sector is the dominant component of the Islamic finance industry. As

of the first half of 2016, global Islamic banking assets are representing 78.9% of the industry’s

total assets. Also Sukuk market represents 16.8%, Islamic funds represents 3.0% and Takaful

market represents 1.3% of the Islamic finance industry.

Figure 27: Breakdown of IFSI by Islamic Finance Segments

Source: IFSB

Considering the breakdown of total global Islamic finance assets, Islamic banking will likely be

the main driver of growth. Regional and global events that have taken place over the past year

have clearly impacted the financial sector, including Islamic finance. Because of the various

factors affecting the global economic environment, growth rates of the Islamic financial

industry segments remain depressed in 2016.

Asia; 22,5

GCC; 42,3

Mena (ex-GCC);

29,9

Africa (ex-North

Africa); 1,6

Others; 3,7

Islamic

Banking; 79%

Sukuk; 17%

Islamic Funds;

3%

Takaful; 1%