Financial Outlook of the OIC Member Countries 2017

36

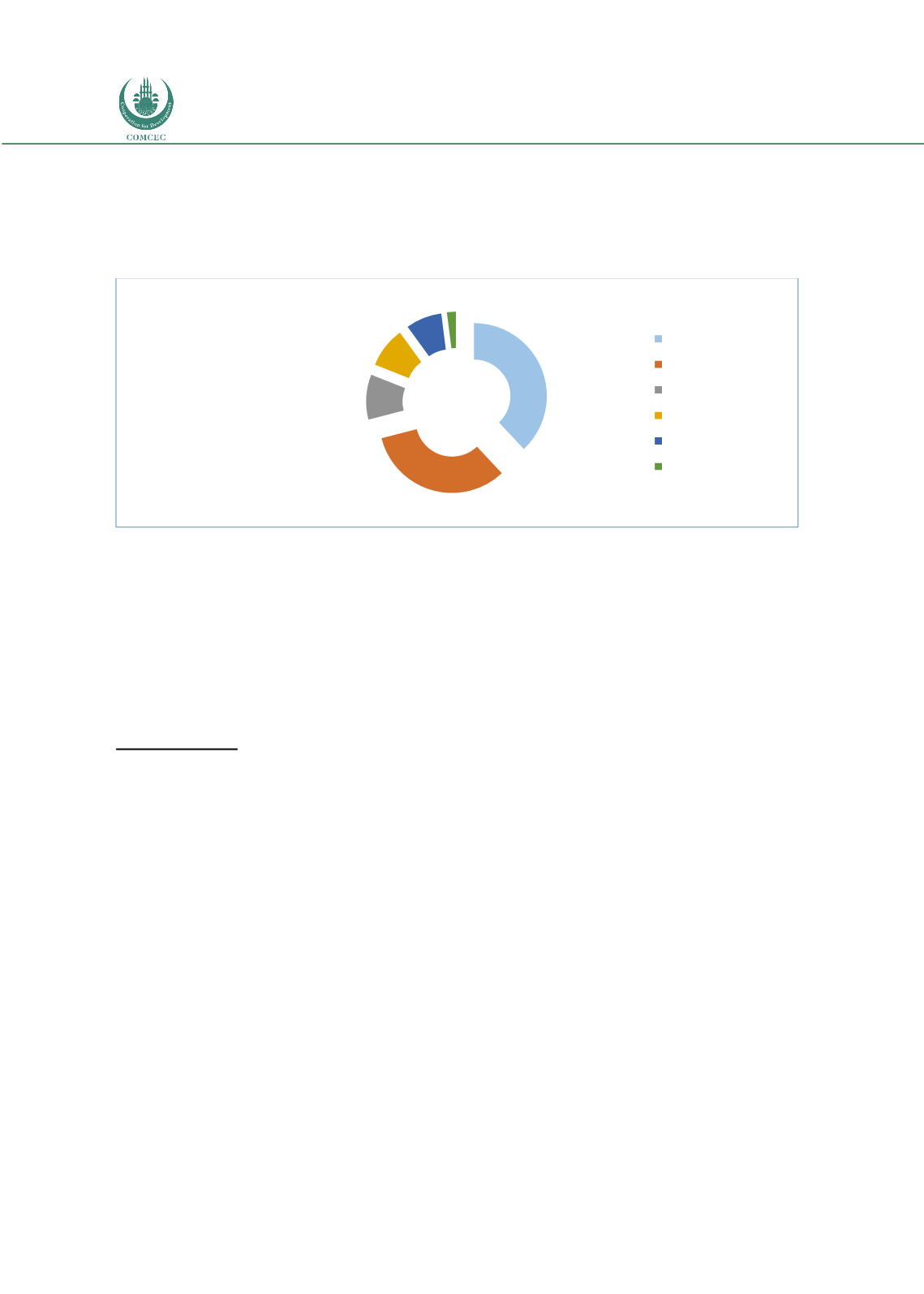

In domestic sukuk markets, Sukuk Al Murabahah has been the most popular sukuk structure

for years. In 2016, USD 21.7 billion or 38% of total domestic issuances were based on the

Sukuk Al Murabahah structure. Sukuk Al Ijarah and Sukuk Al Wakalah are still important for

the market and they constitute 43% of the total domestic sukuk issuances (Figure 34).

Figure 34: Sukuk Structures in Domestic Sukuk Issuances (2016)

Source: IIFM

The sukuk market experienced moderate improvements year by year in both issuances volume

in the primary market and sukuk outstanding in the secondary market. Secondary market

returns performances of sukuk instruments depends on the global economic conditions

because the sukuk market operating alongside the bond market in the financial world. Based

on a potential increase in public spendings after the US Presidential election results in

November 2016, demand by investors for USD instruments also USD sukuk triggered.

Islamic Funds

Islamic funds are investment vehicles which take the form of equal participating shares/units,

representing the shareholders’/unitholders’ share of the assets and entitlement to profits or

losses. There are many types of Islamic funds such as Islamic index funds, Shariah private

equity funds, Sukuk funds, Islamic equity funds etc.

Saudi Arabia and Malaysia are the leaders in Islamic funds market. In 2015 Saudi Arabia,

Malaysia and Iran make up 81% of total global Islamic funds market. Apart from these

countries, the position of non-OIC member states (United States, Luxemburg and UK) among

the top ten countries is notable (Figure 35)

38%

33%

10%

9%

8% 2%

Sukuk Al Murabahah

Sukuk Al Ijarah

Sukuk Al Wakalah

Sukuk Al Musharakah

Sukuk Al Mudharabah

Sukuk Al Salam