Financial Outlook of the OIC Member Countries 2017

35

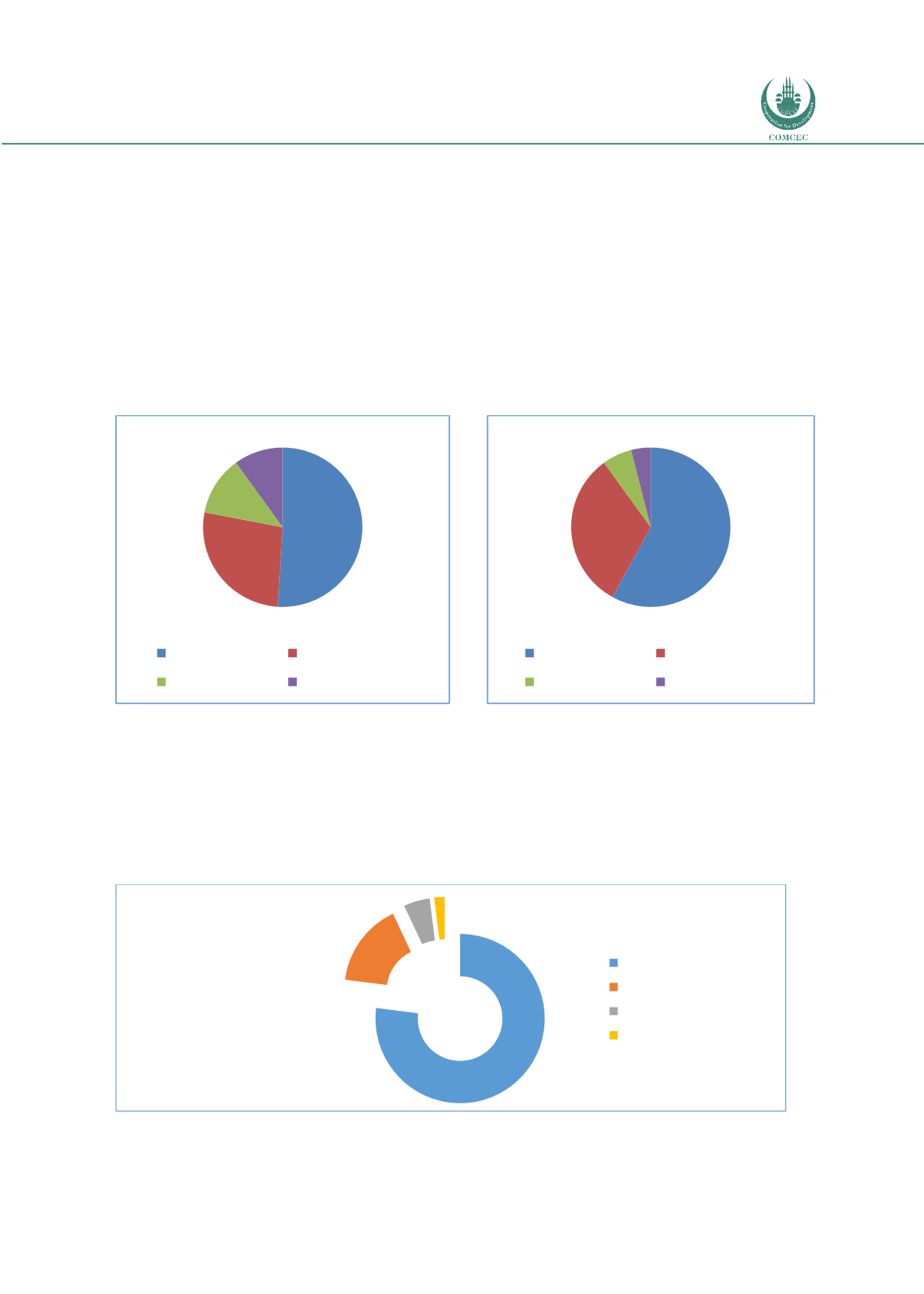

market sovereign sukuk issuances accounted 58% of the issuances. The issuances by IFIs

remain stagnant in comparison with the other issuer types (Figures 31 and 32).

The sukuk industry still continues to depend heavily on government issuances to drive the

market. According to the sukuk report published by the International Islamic Financial Market

(IIFM) due to the tighter economic and geo-political conditions in different parts of the world

the growth in sukuk market is expected to be driven by sovereign and quasi-sovereign issuers.

In order to deepen the sukuk market, there is a need for corporate entities to become more

active in issuing sukuk taking lead from jurisdictions like Malaysia.

Figure 31: International Sukuk Issuances

(2016)

Figure 32:Domestic Sukuk Issuances (2016)

Source: IIFM

Source: IIFM

In international and domestic sukuk markets sukuk financing structures varies based on

market needs and trends. In the international Sukuk markets, Sukuk Al Ijarah has historically

been the more popular structure for issuance. Since 2010 share of Sukuk Al Ijarah started to

decline and its place was taken by Sukuk Al Wakalah. In 2016 Sukuk Al Wakalah share rose to

77% amounting to USD24.2 billion of the total international issuances (Figure 33).

Figure 33: Sukuk Structures in International Sukuk Issuances (2016)

Source: IIFM

51%

27%

12%

10%

Quasi-Sovereign Sovereign

IFI's

Corporate

58%

32%

6% 4%

Sovereign

Corporate

Quasi-Sovereign IFI's

77%

16%

5% 2%

Sukuk Al Wakalah

Sukuk Al Ijarah

Sukuk Al Mudharabah

Sukuk Al Murabahah