Financial Outlook of the OIC Member Countries 2017

34

Overall, despite challenging economic conditions, the majority of jurisdictions recorded

reasonable levels of growth in key Islamic banking statistics, with expansion of their

assets, financing and deposit portfolios at double-digit rates. The value of Islamic banking

assets globally is forecasted to amount to approximately USD 1.51 trillion in 2016.

38

3.4

CAPITAL MARKET SECTOR

Sukuk Market

The sukuk market continues to evolve in recent years and expand to new regions with the bulk

of issuances coming from sovereign and quasi-sovereign entities which is having a positive

impact on the development of Islamic finance industry and the market itself.

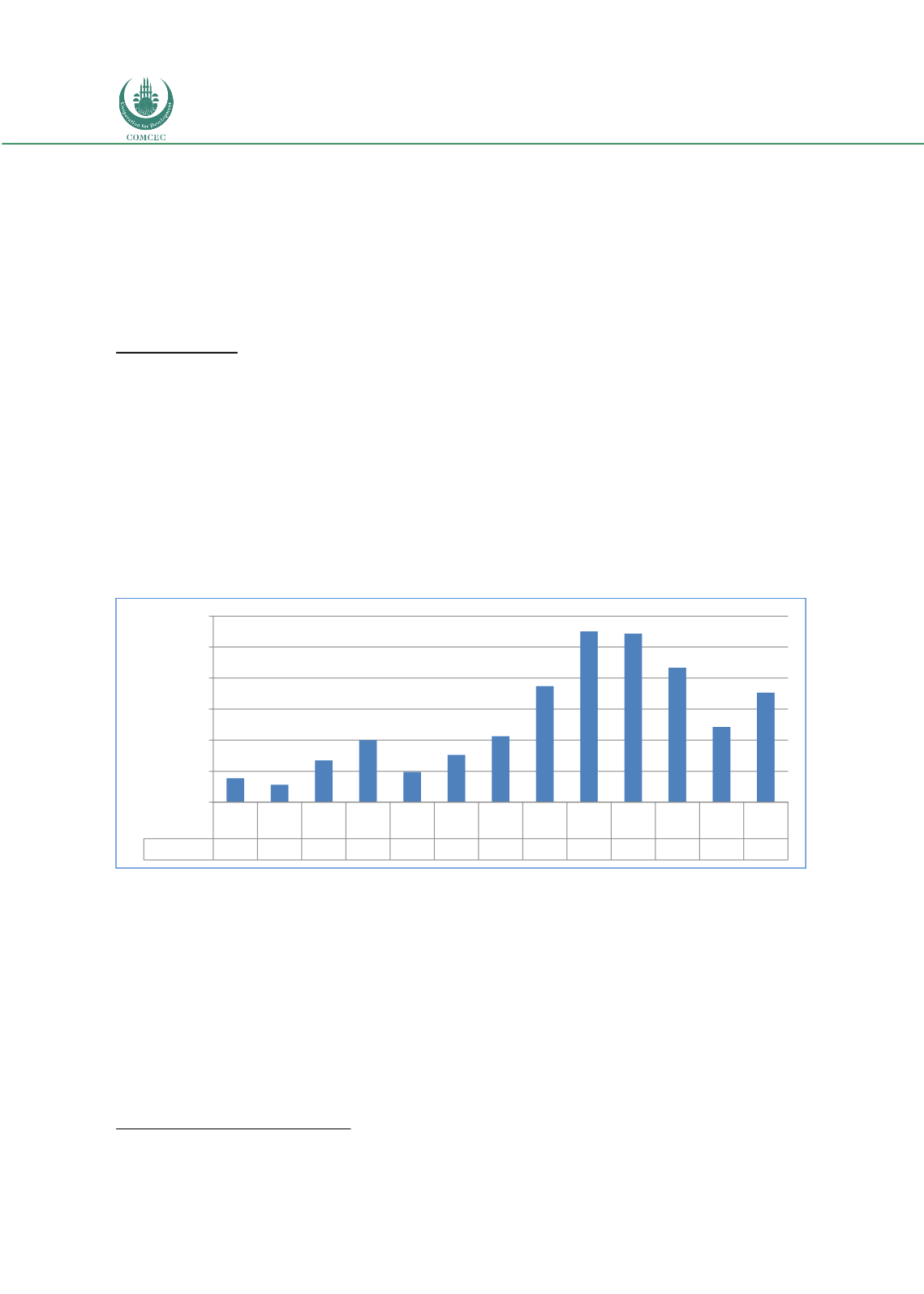

Total global issuances increased around 44% and amounted to USD 88.3 billion in 2016 which

was USD 60.7 billion in 2015 (Figure 30). The increase in volume during 2016 was due to

steady issuances from Asia, GCC, Africa and certain other jurisdictions while Malaysia continue

to dominate the Sukuk market and also Indonesia and Turkey increased sukuk issuances as

well.

Figure 30: Global Sukuk Issuances

Source: IIFM

Total international sukuk issuances stood at USD 31.56 billion in 2016 which was USD 20.9

billion in 2015 and total domestic sukuk issuances reached to USD 56.7 billion in 2016 from

USD 39.8 billion in 2015. In 2016 both international and domestic sukuk issuance increased

significantly.

In terms of issuer status sukuk issuances divided into four groups as sovereign, quasi-

sovereign, corporate and IFI issuers. The amount of sukuk varies according to issuer status and

whether issued at domestic or international sukuk market. In the international market quasi-

sovereign sukuk issuances constitute 51% of the total issuances. Nevertheless, in the domestic

38

IFSB Financial Stability Report 2017, page 13

2001-

2004

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Million USD 19,22 14,01 33,61 50,04 24,34 38,07 53,13 93,57 137,60 135,87 108,30 60,69 88,28

0

25

50

75

100

125

150