Financial Outlook of the OIC Member Countries 2017

31

3.2 ISLAMIC FINANCE OUTLOOK

Islamic finance growing rapidly over the past decade and its banking segment has become

systemically important. Islamic finance is inherently less prone to crisis because its risk-

sharing feature reduces leverage and encourages better risk management on the part of both

financial institutions and their customers.

Islamic finance is projected to continue to expand against a shifting global economic landscape

led by new challenges emerging from a changing political environment, new monetary policy

directions from the US, sluggish recovery in oil prices, unresolved geopolitical conflicts and a

general uncertainty in economic outlook for 2017.

36

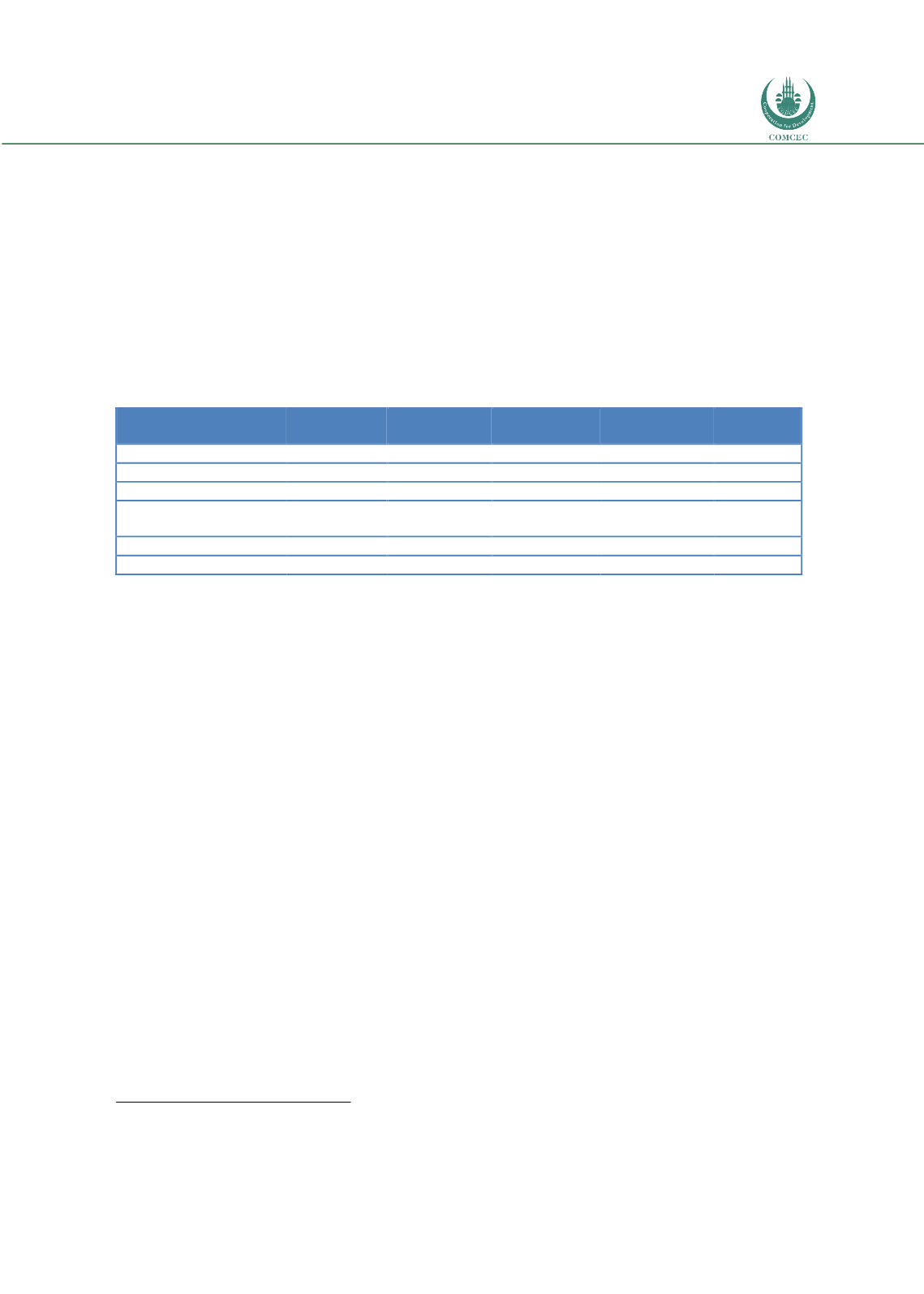

Table 3: Breakdown of IFSI by Sector and by Region, US$ Billion

37

Islamic

Banking

Outstanding

Sukuk

Islamic

Funds Assets

Takaful

Contributions

Total

Asia

218.6

182.7

19.8

4.4

425.5

GCC

650.8

115.2

23.4

11.7

801.1

Mena (ex-GCC)

540.5

16.6

0.2

8.4

565.7

Africa (ex-North

Africa)

26.6

1.9

1.5

0.6

30.6

Others

56.9

2.1

11.2

N/A

70.2

Total

1,493.4

318.5

56.1

25.1

1,893.1

Source: IFSB

According to the IFSI Stability Report 2017, the asset size of the Islamic finance sector has

grown steadily in 2016. The industry’s total worth is estimated at USD 1.89 trillion in 2016

(see Table 3) which is USD 1.88 trillion in IFSI Stability Report 2016 and USD 1.87 trillion in

IFSI Stability Report 2015. The slowdown largely stemmed from an adjustment in the value of

global Islamic banking assets in US Dollar terms on the back of exchange rate depreciations in

key Islamic banking markets (e.g. Iran, Malaysia, Turkey and Indonesia).

Islamic finance has grown rapidly in recent years, but remains concentrated in a few

jurisdictions. Given the regional distribution of the Islamic finance sector, it is seen that the

Gulf Cooperation Council (GCC) has the largest share of the Islamic financial assets in 2016.

The region covers 42.3% of the global IFSI. The market share of Asia is 22.5%, MENA region

except GCC countries has 29.9% and Africa except North Africa countries has 1,6% of the

global IFI market share (see Figure 26).

36

IFSB 2017 Report

37

Data for Sukuk outstanding and Islamic funds is for full-year 2016; data for Islamic banking is for the six months ended

June 2016 (1H2016); data for takaful is as at end-2015