Financial Outlook of the OIC Member Countries 2017

37

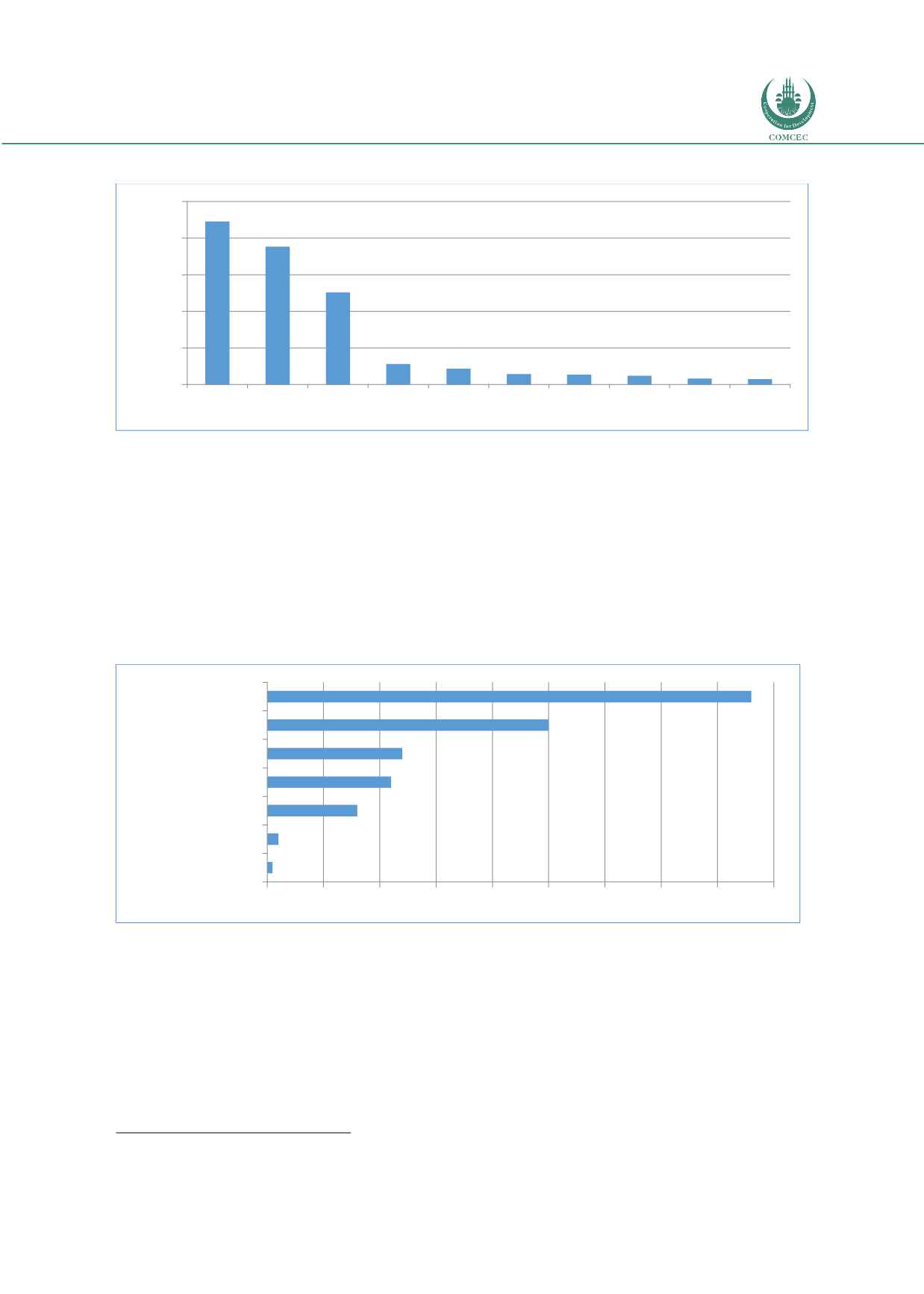

Figure 35: Top Countries in Islamic Funds AUM Outstanding (2015) (Million US$)

Source: Thomson Reuters

Despite the negative economic environment such as volatile global financial markets, decline

in commodity prices, there is an important effort from Southeast Asia to develop Islamic fund

market. Malaysian government has put a Shariah-compliant scheme in place for its retirement

savings fund (The Employees Provident Fund-EPF) which invests in Islamic finance assets,

particularly sukuk. In addition, Asian asset managers such as Malaysia’s RHB Group Asset

Management and Indonesia’s PT Mandiri Manajemen Investasi are also planning to launch new

Islamic funds in the near future.

39

Figure 36: Islamic Fund Assets by Asset Class

Source: IFSB

In terms of asset-class breakdown of the global Islamic funds, the share of equity-based funds

is 43% in 2016. Furthermore, the share of money market-based funds accounting for 25% and

commodity-based funds accounting for 12%. The other significant asset classes include fixed

income/ sukuk, mixed allocation and real estate (Figure 36).

39

ICD – Thomson Reuters Islamic Finance Development Report 2016, page 74

0

5.000

10.000

15.000

20.000

25.000

Saudi Arabia Malaysia

Iran

United

States

Luxembourg Kuwait

Pakistan South Africa Indonesia

UK

0

5

10 15 20 25 30 35 40 45

Alternative

Real Estate

Mixed Allocation

Fixed Income / Sukuk

Commodity

Money Market

Equity