Financial Outlook of the OIC Member Countries 2017

38

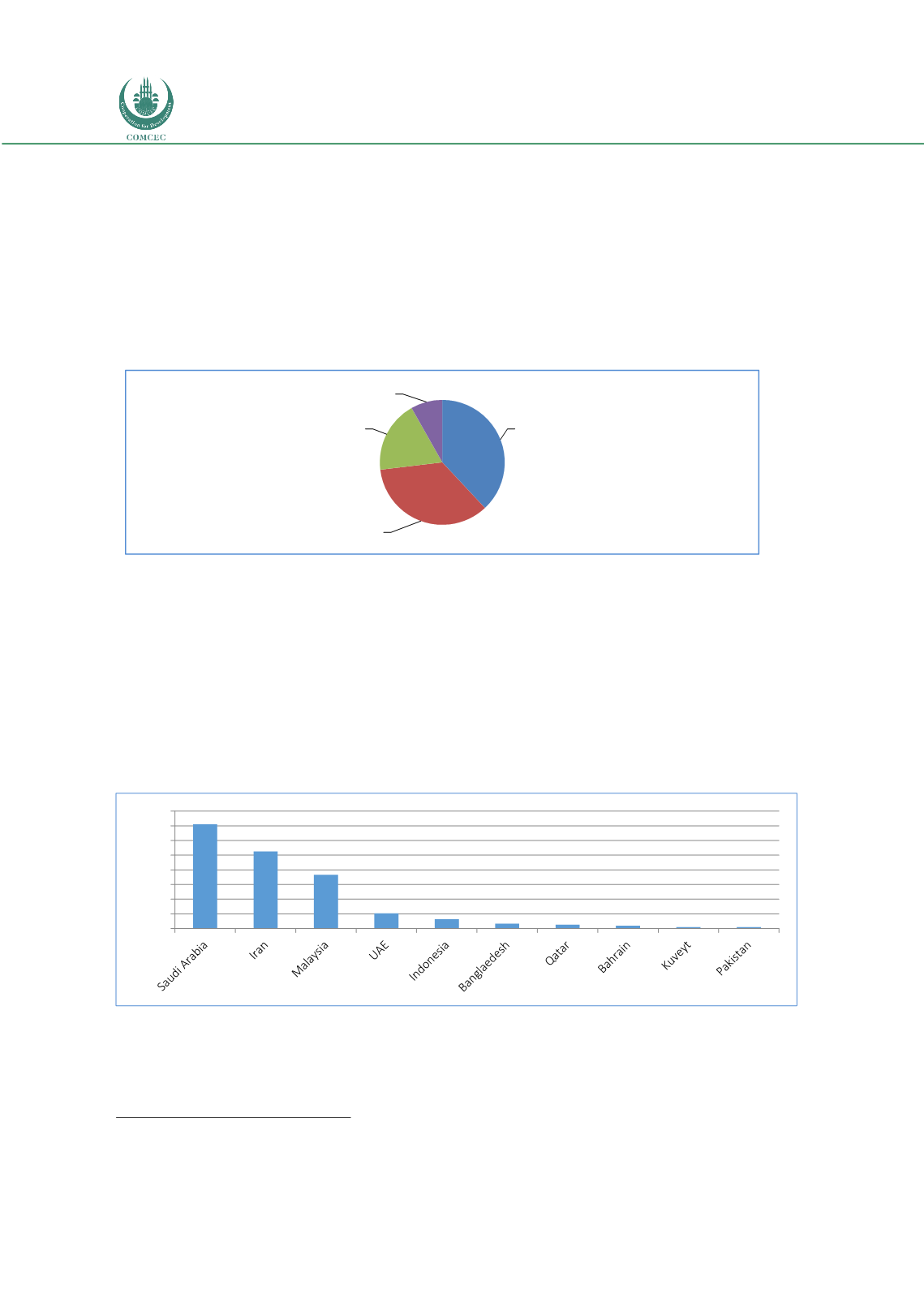

Composite; 116

General; 107

Family; 57

ReTakaful; 25

3.5 TAKAFUL

Although takaful has a small volume and it is rather an underdeveloped segment of Islamic

finance, its popularity has increased recent years and becoming an important component of

Islamic financial industry. This small, yet growing, industry is served by 305 takaful providers

including 25 re-takaful companies.

40

With 116 companies, composite takaful dominates the

global takaful industry. In addition to the composite takaful, 107 general and 57 family takaful

companies are operating in the industry (Figure 37).

Fig

ure 37: Number of Takaful Operators and Windows Globally (2015)

Source: IFSB

With a series of challenging global economic conditions in the past decade, the global takaful

sector has witnessed an average annual growth of 16% during the period of 2008–2015.

41

Global takaful assets reached to USD 38 billion in 2015 and were mainly driven by the top 3

countries: Saudi Arabia, Iran and Malaysia. These three countries hold 85% of total takaful

assets. Saudi Arabia is the biggest takaful market as its insurance market is based fully on a

cooperative insurance model. Besides Saudi Arabia, Iran and Malaysia are the prominent

players in takaful industry that Iranian takaful sector stands at USD 10.5 billion and Malaysian

is USD 7.3 billion (Figure 38).

Figure 38: Top Countries in Takaful Assets (2015) (USD MN)

Source: Thomson Reuters

The insurance penetration in most OIC countries is rather low and takaful industry is growing

by the support of the Islamic finance industry. In this context, there is an important market

potential for market shareholders.

40

IFSB Stability Report 2017

41

IFSB Stability Report 2017

0

2.000

4.000

6.000

8.000

10.000

12.000

14.000

16.000