Financial Outlook of the OIC Member Countries 2017

33

3.3 ISLAMIC BANKING

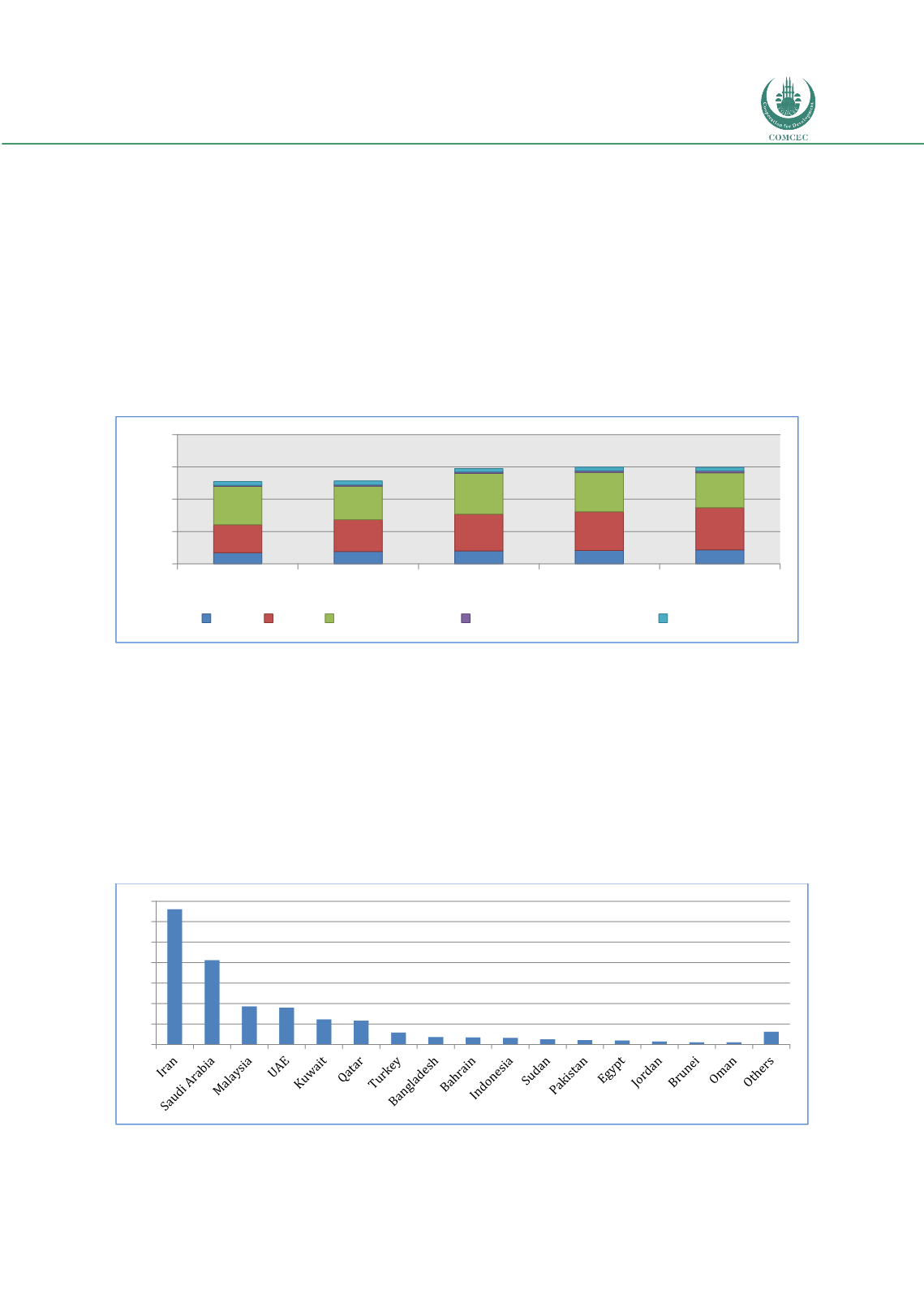

Islamic banking sector which has the largest market share of the Islamic finance industry has

grown significantly since the first known experiment started in the Egyptian village of Mit

Ghamr in 1963. Islamic banking assets valued at USD 1.49 trillion in 2016 and it represents

approximately 79% of the industry’s total assets.

Between 2012-2016, the banking assets increased steadily as shown in the figure below.

However, in 2016 and 2015 the US Dollar values of Islamic banking assets in several countries

were affected by exchange rate fluctuations. Especially national currencies of Iran, Malaysia,

Nigeria and Turkey depreciated by more than 10% against the US Dollar in 2015, with an

average decline of 19.2% against the US Dollar.

Figure 28: Islamic Banking Assets (2012 1H-2016 1H)

Source: IFSB

In terms of global shares, Iran has the largest market share with accounting for 33% of the

global Islamic banking industry in the first half of 2016. Iran is followed by Saudi Arabia and

Malaysia with the market shares of 20.6% and 9.3% respectively. Among the Muslim countries,

the market share of GCC countries have the highest share compared to others. In first half of

2016, the top 10 Islamic banking jurisdictions in terms of asset size account for 91.8% of the

global Islamic banking industry. According to this concentration ratio, the stability of the

Islamic financial system as well as the further development and sustainable growth of the

industry is highly dependent on the soundness and resilience of Islamic banking operations in

these particular countries.

Figure 29: Shares of Global Islamic Banking Assets (1H2016) (%)

Source: IFSB

0

500

1000

1500

2000

2012

2013

2014

2015

2016

Asia GCC Mena (ex-GCC)

Africa (ex-North Africa)

Others

0

5

10

15

20

25

30

35