Improving Public Debt Management

In the OIC Member Countries

64

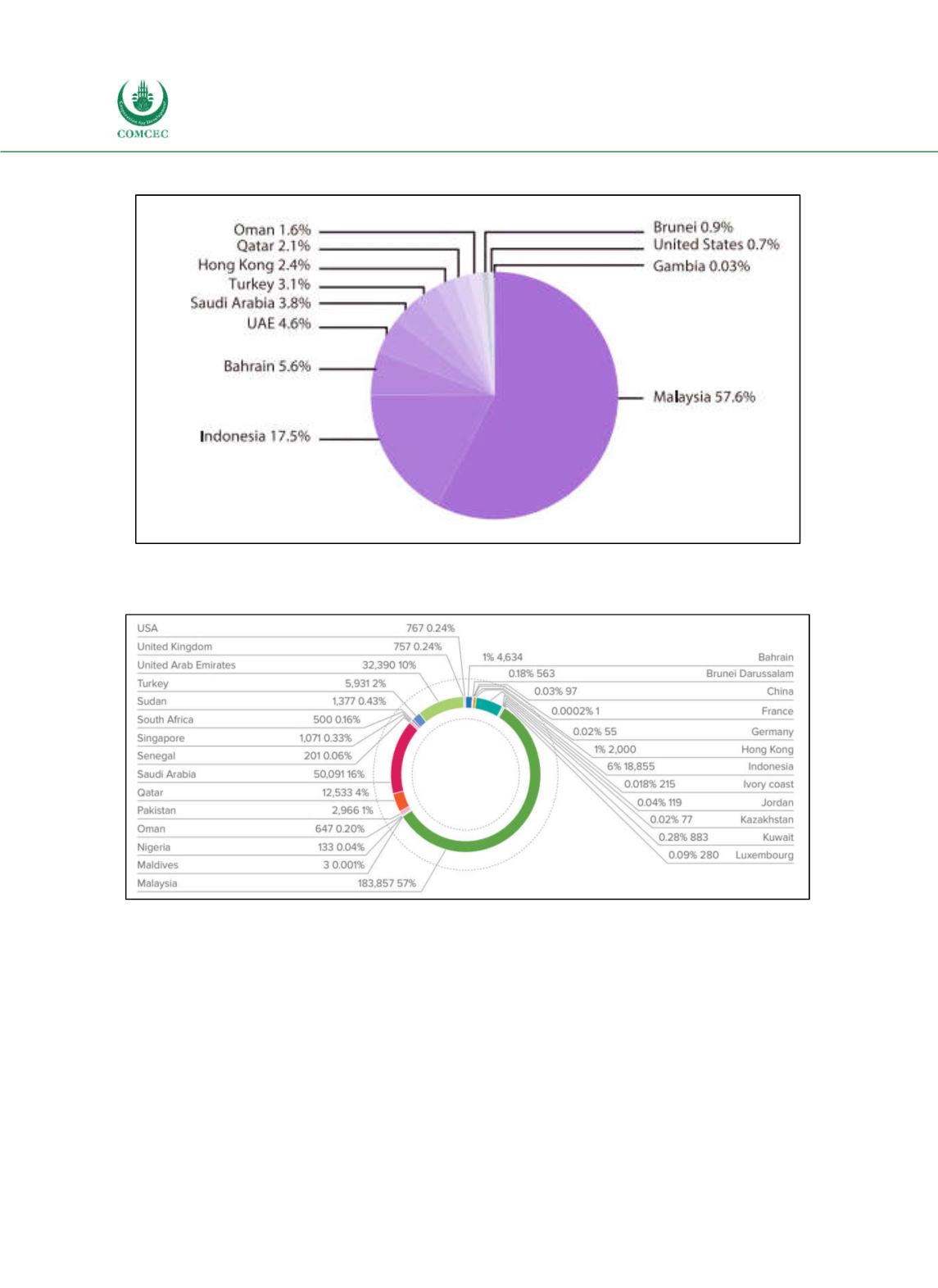

Figure 3-19: Sovereign Sukuk Issuance by Country (11M2015)

Source: IFSB (2016, p. 16).

Figure 3-20: Sukuk Outstanding by Country (2015)

Source: IIFM (2016, p. 43).

Many countries are planning on issuing sovereign

sukuk

to signal their willingness to

participate in the global Islamic financial sector. New

sukuk

markets in Africa and East Asia

present promising opportunities for Islamic finance to access key emerging economies. For

example, Côte d’Ivoire and Nigeria are planning to follow Senegal’s example and issue

sovereign

sukuk

. Even China, Singapore, Hong Kong and Japan are increasingly interested in

Islamic finance (Reuters 2015).

Sovereign

sukuk

are likely to gain popularity in OIC and in nonOIC countries given that

various growth drivers for the

sukuk

market exist (IFSB 2013). An important factor is growing

preference for sharia compliant finance products, especially by Islamic state funds. Moreover,

the issuance of

sukuk

bonds serves market development purposes by diversifying domestic