Improving Public Debt Management

In the OIC Member Countries

63

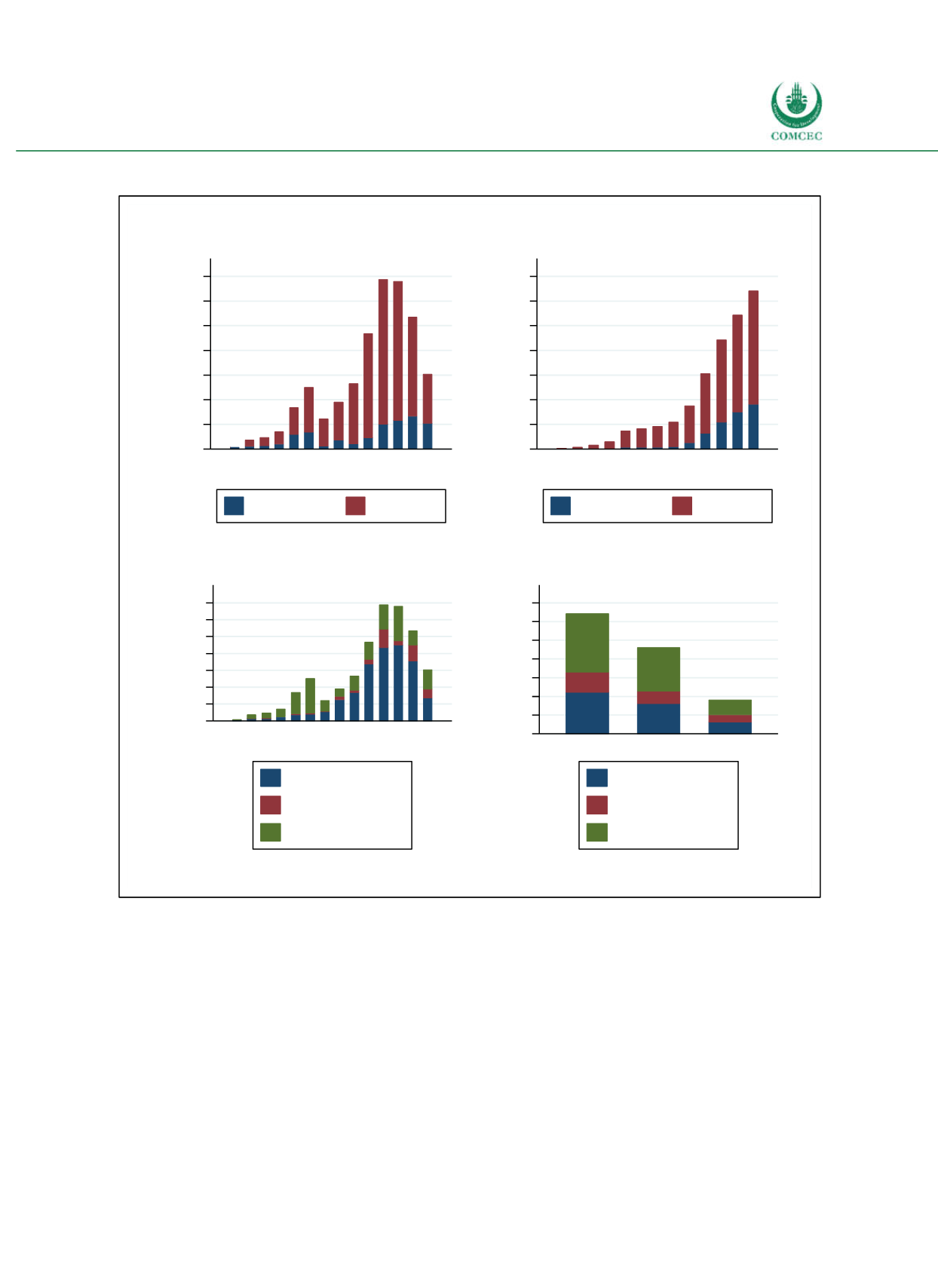

Figure 3-18: Global

Sukuk

Issuances and Outstanding

Source: IIFM (2016), illustration by the Ifo Institute.

Figure 319 shows sovereign issuances by jurisdiction in 2015. Malaysia accounts for 57.6% of

the sovereign

sukuk

volume, followed by Indonesia (17.5%), Bahrain (5.6%), the United Arab

Emirates (4.6%), Saudi Arabia (3.8%) and Turkey (3.1%). These countries also account for the

largest shares of total outstanding

sukuk

(see Figure 320).

0

20

40

60

80

100

120

140

Billion U.S. dollars

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

Global Sukuk Issuance

International

Domestic

0

50

100

150

200

250

300

350

Billion U.S. dollars

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

Global Sukuk Outstanding

International

Domestic

0

20

40

60

80

100

120

140

Billion U.S. dollars

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

Issuance by Issuer

Sovereign

Quasi-Sovereign

Corporate

0

50

100

150

200

250

300

350

Billion U.S. dollars

Total

Domestic International

Outstanding by Issuer

Sovereign

Quasi-Sovereign

Coporate