Improving Public Debt Management

In the OIC Member Countries

38

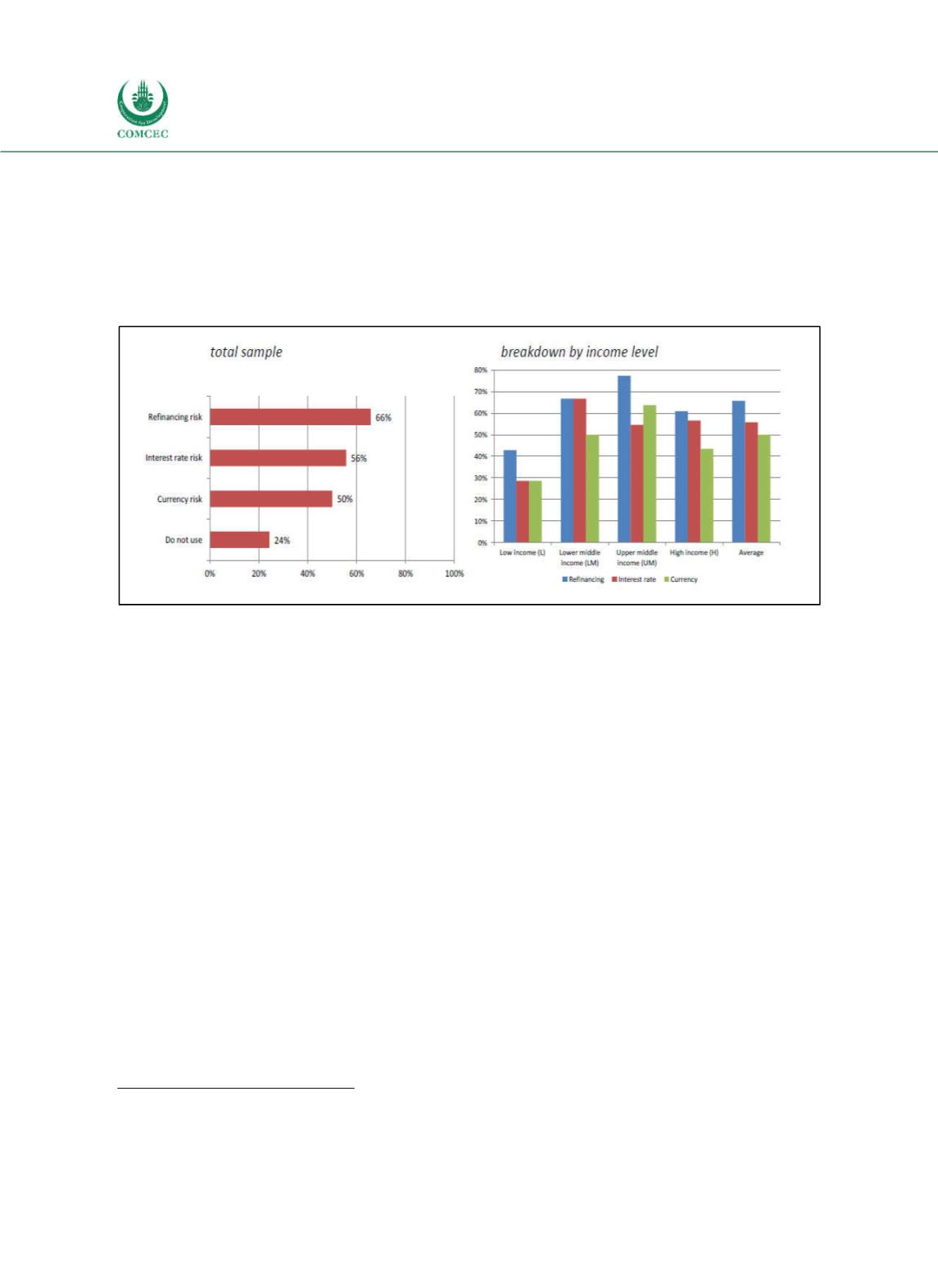

Indicators on refinancing risk are the most prevalent strategic target, followed by targets on

interestrate risk and exchange rate risk (see Figure 215). The support of debt management

by quantitative analysis, which reveals a certain sophistication of the DMO and its staff, is most

prevalent in highincome countries. Compared to the results of a similar survey, which was

carried out in 2007, the share of countries having a strategy has not increased. However, those

countries having a strategy increasingly base it on target values.

Figure 2-15: Use of Strategic Targets by Type of Risk Worldwide

Source: Cabral (2015, p. 13).

2.4

Survey Results

After the review of public debt levels and their structure as well as the illustration of global

practice in the institutional design of public debt management, the analysis is complemented

by qualitative results on the present stage of public debt management around the world. A

survey was conducted among international economic experts about debt management

practices in their home countries and their assessment of risks encountered in public debt

management.

The survey was executed as part of the World Economic Survey (WES) of the Ifo Institute.

4

The

survey was launched in 1981 as Economic Survey International (ESI) and renamed in 2002.

This quarterly survey aims at providing a timely picture about the economic conditions – the

current situation and expectations about future developments – around the world. WES polls

more than 1000 experts in more than 100 advanced, emerging and developing countries.

Experts provide an assessment about the economic situation in the country where they are

considered to be insiders. Panel members are normally located in the country on which they

report. The selection of experts is based on their professional competence in economic matters

and their ability to evaluate economic developments. The largest group of experts works for

research institutes, universities or think thanks (30%). 16% are based at financial institutions,

14% work for firms and 13% are representatives of associations or chambers of industry or

trade. The remaining 25% are made up of employees of ministries, central banks, embassies,

4

F

or more detailed information about the survey and the latest results, please refer to the homepage of WES at

https://www.cesifogroup.de/ifoHome/facts/SurveyResults/WorldEconomicSurvey.html. The survey design is

illustrated at https://www.cesifogroup.de/ifoHome/facts/SurveyResults/WorldEconomic Survey/WESDesign.html.