Improving Public Debt Management

In the OIC Member Countries

40

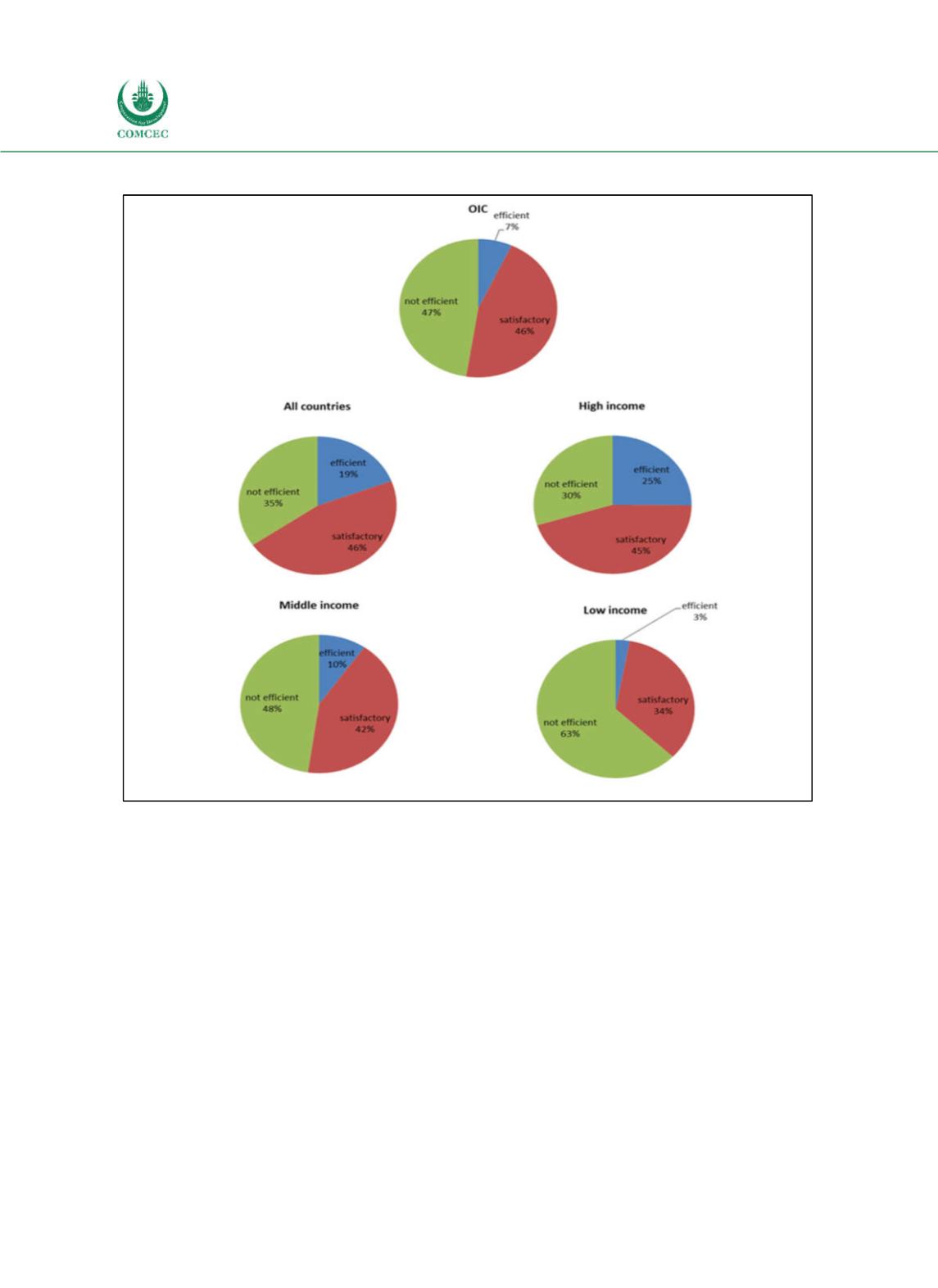

Figure 2-16: Assessment of Public Debt Management

Source: Ifo World Economic Survey (WES) IV/2016.

As described in previous sections, the most important risks faced by public debt management

are foreign currency risk, interest rate risk and refinancing risk. The task of public debt

management consists in controlling those risks and in evaluating their effect on borrowing

costs to determine a costrisk portfolio that accounts for a country’s preferences. WES experts

were asked to assess the importance of these different kinds of risks in their country as “most

important”, “important” or “not so important”. In the entire sample, refinancing risk is

considered to be the most important risk, followed by foreign currency risk and interest rate

risk. However, this result is driven by highincome countries. In middleand lowincome

countries, foreign currency risk is ranked as most important.

Figure 217 compares the importance of risks in the different country groups. For high income

countries foreign currency risk is least important while interest rate risk and refinancing risk

receive almost equal attention of being less than important. This reflects the fact that highincome countries usually have access to financial resources denominated in their own

currency. In middleand lowincome countries interest rate risk receives the lowest rank in

importance. In these countries foreign currency risk is most important. OIC countries are