Improving Public Debt Management

In the OIC Member Countries

16

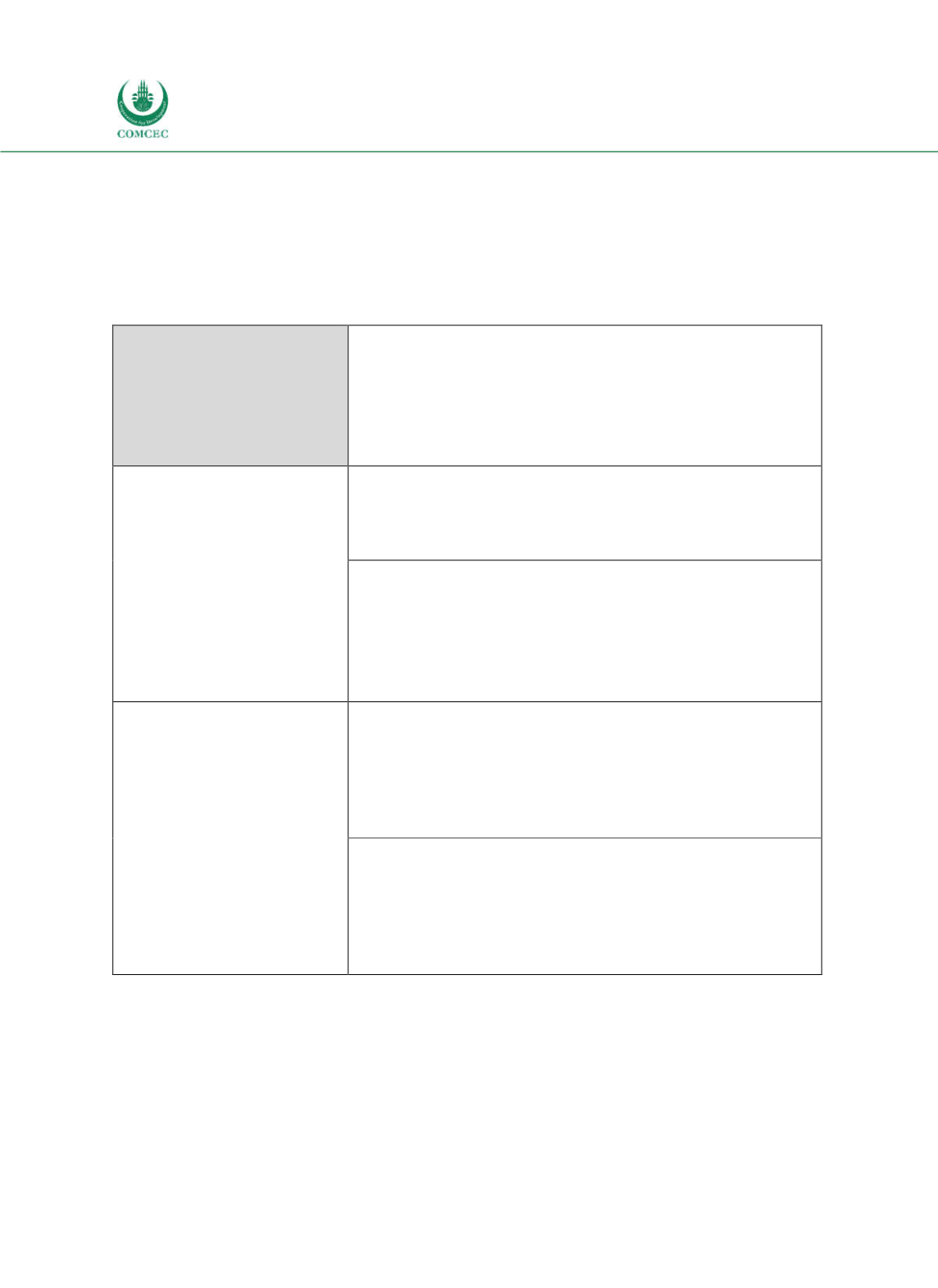

implementation of public debt management, fiscal policy and monetary policy are

interdependent and involve tradeoffs (see Table 13). However, it is advised that public debt

management should be pursued independently (Togo 2007). Nevertheless, fiscal policy

makers, monetary policy makers and debt managers should coordinate their actions, e.g. by

establishing an internal public debt committee, and agree on common objectives such as

targets or ceilings on the deficit and on the stock of public debt (Allen et al. 2013).

Table 1-3: Interdependencies of Public Debt Management, Fiscal Policy and Monetary Policy

Source: Togo (2007)

Debt management transactions shall be formally separated from monetary policy operations if

the central bank conducts debt management transactions as an agent of the central

government. It is recommended that the central bank provides information to the government

and markets, clearly stating whether it performs transactions under the objective of monetary

policy or debt management on behalf of the government. A steady exchange of information

between the debt management entity and the central bank on current and future debt

transactions and on central government cash flows is advisable, especially if those transactions

are important for monetary policy. Moreover, a formal limitation concerning public funding

Public Debt Management

Objective: raising the required amount of government funding

at the lowest possible cost, consistent with a prudent degree of

risk

Target: debt structuring

Instruments: operations on the capital markets

Fiscal Policy

Objective: achieving the least

distorting budgetary policy

that stabilizes output,

improves the resource

allocation and manages

distributive effects

Target: primary budget

balance

Instruments: government

spending, taxes

Debt management actions are likely to influence the

government’s debt service costs,

and can thus force

governments to reduce expenditures to decrease debt levels and

meet their debt obligations.

Fiscal policy measures (in particular spending and taxation) are

likely to influence the risk premium of government debt which

affects debt managers’ ability to issuing debt instruments and

build a sound debt portfolio.

Monetary Policy

Objective: achieving price

stability while possibly

stabilizing or increasing

output

Targets: inflation, interest

rates, monetary aggregates,

exchange rate

Instruments: open market

operations, regulatory tools.

The debt structure, including maturity, floating interest rates or

currency denomination, are likely to restrain the central bank’s

policy options, e.g. in increasing interest rates or devaluating the

domestic currency, given that these measures may potentially

trigger a debt crisis.

Exchange rate and interest rate policies are likely to restrict the

issuance of foreign currency debt and floating rate debt. A loose

monetary policy may increase the inflation expectations of

investors, and hence require debt managers to issue shortterm

debt, or debt that is indexed to inflation rates.