Improving Public Debt Management

In the OIC Member Countries

15

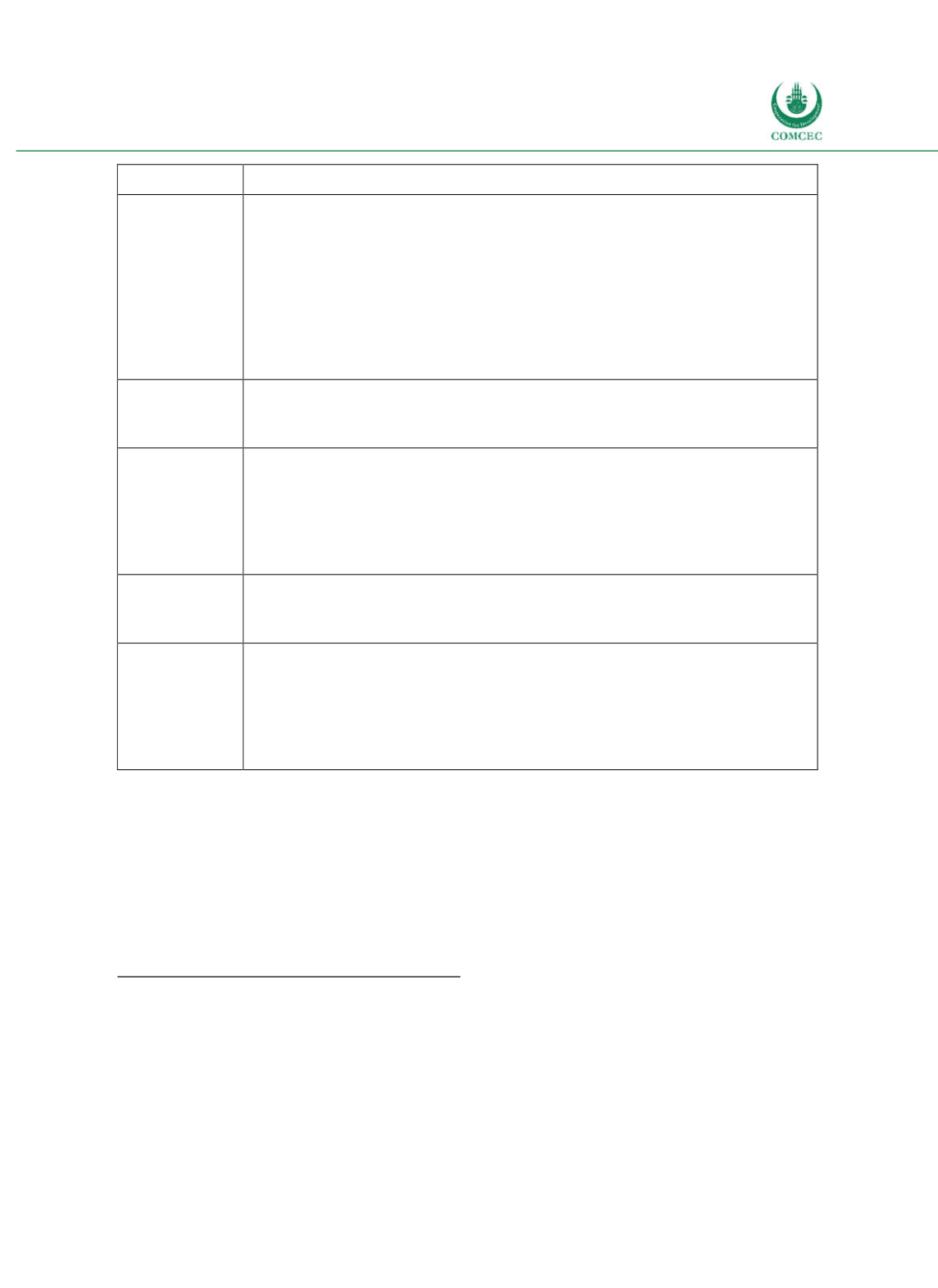

Risk

Description

Exchange rate

risk

Refers to the risk of increases in the value of debt arising from changes in

exchange rates. Debt denominated in or indexed to foreign currencies may add

volatility to debt servicing costs as measured in domestic currency due to

exchange rate movements.

Measures of exchange rate risk include the share of foreign currency to

domestic currency debt, the currency composition of foreign currency debt,

and the share of shortterm external debt to international reserves.

Liquidity risk Refers to the risk that the volume of liquid assets, especially cash, diminishes

quickly as a result of unanticipated cashflow obligations and/or possible

difficulties in raising funds through shortterm borrowing.

Credit risk

The risk of nonperformance by borrowers on loans or other financial assets,

or by a counterparty on financial contracts. This risk is particularly relevant in

cases where debt management includes the management of liquid assets. It

may also be relevant with regard to the acceptance of bids in auctions of

securities issued by the government and credit guarantees, and with respect to

derivative contracts entered into by the debt manager.

Settlement risk Refers to the risk that counterparty does not deliver a security as agreed in a

contract, after the country (other counterparty) has already made the payment

according to the agreement.

Operational

risk

Refers to a range of different types of risks, including but not limited to

transaction errors in the various stages of executing and recording

transactions; inadequacies or failures in internal controls, or in systems and

services; reputation risk; legal risk; security breaches; or natural disasters that

affect the debt manager’s ability to pursue activities required to meet debt

management objectives.

Sources: IMF (2014, pp. 12-13), World Bank (2015)

Debt reporting and evaluation

To ensure a transparent disclosure of the debt portfolio, it is recommended that a statistic

bulletin is published regularly, including information on domestic and external public debt

stocks and ratios (by creditor, residency classification, instruments, currency, interest rate

basis and original and residual maturity), debt flows (especially principal and interest

payments) and loan guarantees decomposed by type of loan and clarifying the amount that has

already been amortized.

(2) Coordination with Macroeconomic Policies

Public debt management interacts with fiscal and monetary policy. Fiscal policy involves the

usage of public spending, taxes and other sources of revenue which determine the primary

budget balance and influence economic outcomes. Objectives pursued by fiscal policy include

stabilizing the economy, improving resource allocation and providing public goods and

services and influencing the income distribution. Monetary policy primarily aims at achieving

price stability. By doing so, it inevitably affects both interest rates and exchange rates while

possibly trying to stabilize output. Instruments available to monetary policy include open

market operations and regulatory tools, e.g. reserve requirements. The objectives and the