Risk Management in

Islamic Financial Instruments

115

related matters. Similarly, to deal with other financial matters, Malaysia has established the

IFSB. Malaysian Islamic banks also have to follow local standards. As countries slowly move

towards a combined Islamic financial reporting system, the job of bankers is expected to be

more complex in terms of balancing the culture and depth of

Shari’ah

practices in accordance

with their own banking system.

Figure 5.5 illustrates the use of various accounting reporting systems. As countries are slowly

adopting the International Financial Reporting System, one third of the banks have moved to a

market specific accounting reporting system. These localized reporting standards are either

modified versions of AAOIFI or are completely new, being driven by a mixture two or more

systems. For instance, many Malaysian banks follow the Malaysian Accounting Standard Board

(MASB) regulations. The Bank Negara Malaysia, Securities Commission,

Shari’ah

Advisory

Council and the Islamic Financial Services Board (IFSB) also have contributed in the

development of the Islamic Financial Reporting System for IFIs in Malaysia. However, almost a

half of the sample banks are still using AAOIFI accounting reporting standards. Since the

sample in this study is biased towards MENA, the dominance of AAOIFI is expected.

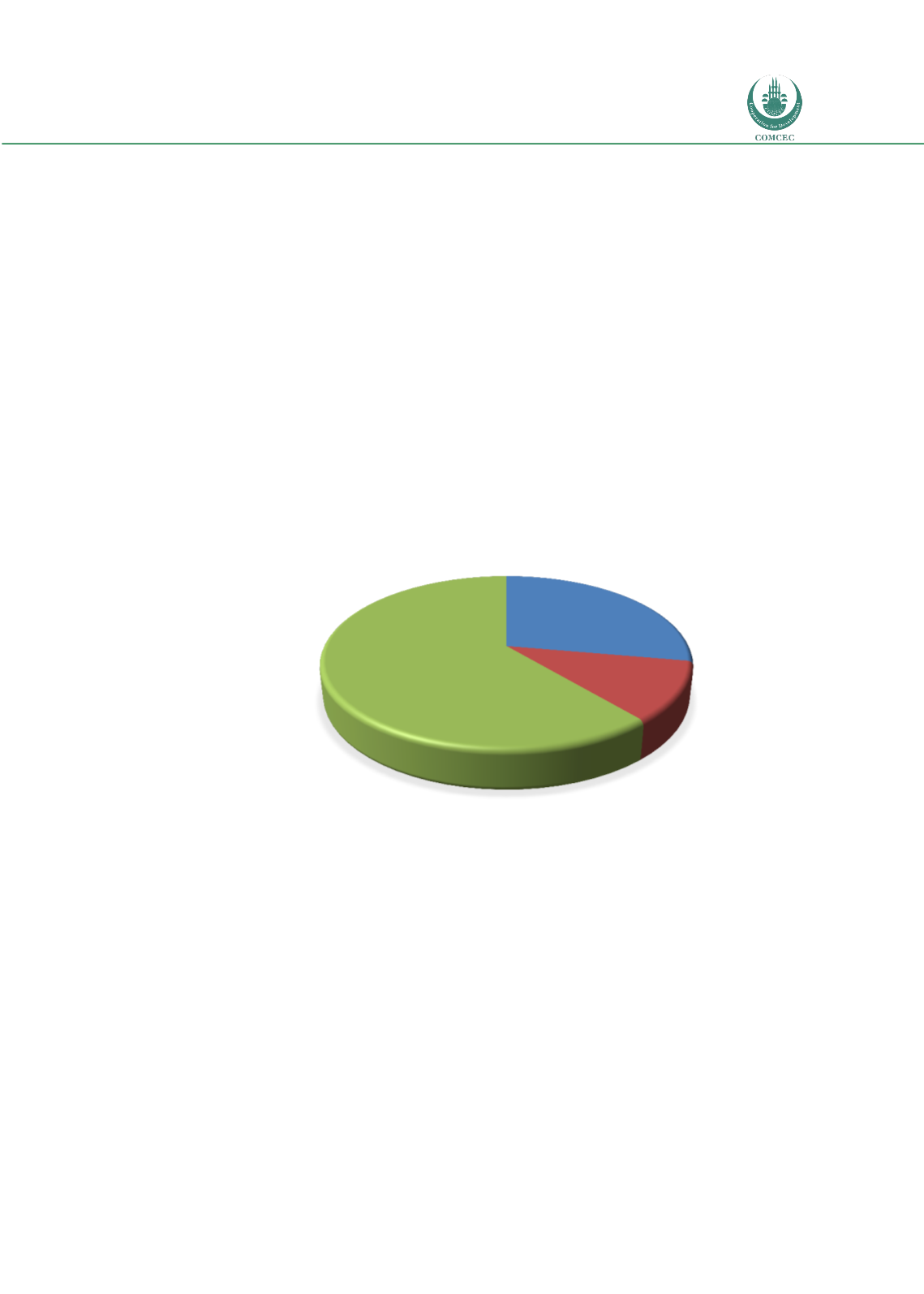

Figure 5.6: Assessment of Profit-and-Loss Situation

Banks periodically monitor their profit and loss scenario, and whether these are affected by

any major events. As monitoring is expensive, it is suggested that IFIs have frequent

computerized monitoring of their profit and loss scenario. End of day processing of the profit

and loss scenario may help bankers better prepare for adverse situations. Figure 5.6 explains

how frequently the IFIs appraise their profit and loss situations. Some highly technology-based

IFIs do it daily through a report called the ‘end of day processing report (EDP)’. However, it is

highly challenging for the remaining IFIs to maintain a daily report. The cost of monitoring is

an important aspect, which is expected to rise with a more frequent monitoring exercise. IFIs

have to devise an optimal plan to balance the cost and benefits of frequent monitoring.

Internationally, conventional banks monitor large loans very frequently, but lengthen the

monitoring of smaller loans to a monthly or quarterly basis.

Daily

28%

Weekly

11%

Monthly

61%