Risk Management in

Islamic Financial Instruments

118

5.8 EXTERNAL CONTROLS AND LEGAL SYSTEM

In addition to internal control mechanisms, IFIs must comply with the regulations of central

banks and other international organizations. The Basel Committee for Banking Supervision

(BCBS) publishes Basel capital adequacy requirements for banks that help them to keep the

adequate level of capital as a cushion against risk. However, IFIs have differing opinions on the

role of Basel regulation and the requirement of more or less capital, compared to conventional

counterparts. Banks are slowly moving towards an internal rating system that will decide the

capital adequacy of each bank. IFIs, with few exceptions, are yet to follow that lead.

A portion of IFIs are still of the opinion that the Basel committee capital regulation should not

be considered for IFIs. In order to minimize this problem, central banks of Islamic countries

have already introduced modified versions of the Basel capital requirement guidelines for the

Islamic banks of their regions. As the Basel guidelines are slowly moving towards an internal

rating based capital adequacy approach, all the IFIs have to invest to develop their internal

efficiency. In this respect, respondents believed that the capital requirements of IFIs should be

different in many cases. More than 50 percent of the respondents supported different levels of

capital requirements for IFIs.

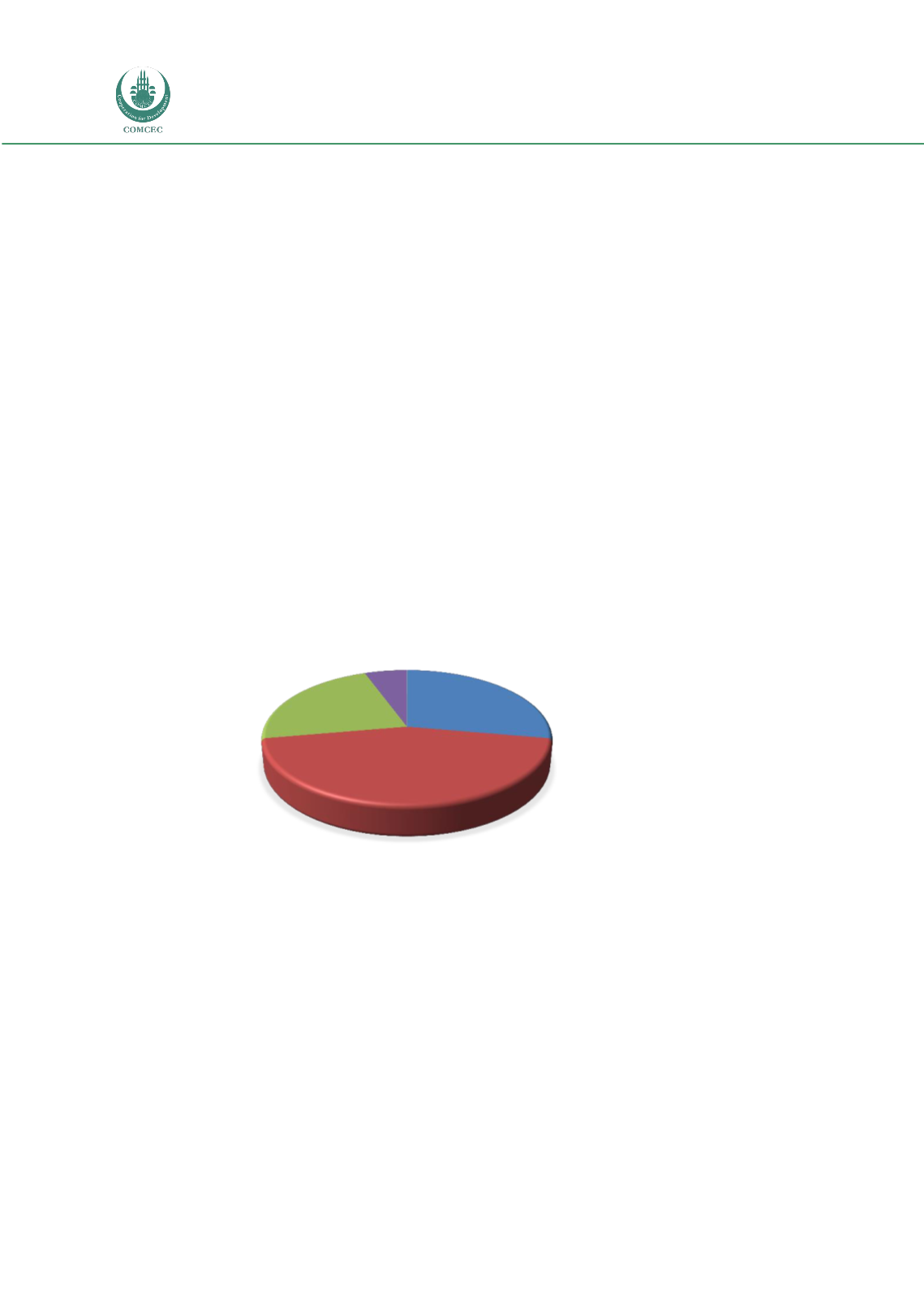

Figure 5.10: Capital Requirement of IFI and Conventional Banks

5.9 ARE IFIS HAPPY WITH EXISTING RM SYSTEM?

With the existing limitations, are the respondents happy with the risk management system of

their banks? Over half of the respondents were not happy with the existing system. The Islamic

financial system is growing very fast at over 15 percent rate every year. The industry will face

more challenges in the future and IFIs have to be ready with strong internal and external

systems to face those challenges. Figure 5.11 is an indication that bankers want to do more

with their risk management systems. They know about their limitations and would like to

bring positive changes to risk the management frameworks in their banks. The chart also

less

28%

Same

44%

More

22%

Others

6%