Infrastructure Financing through Islamic

Finance in the Islamic Countries

59

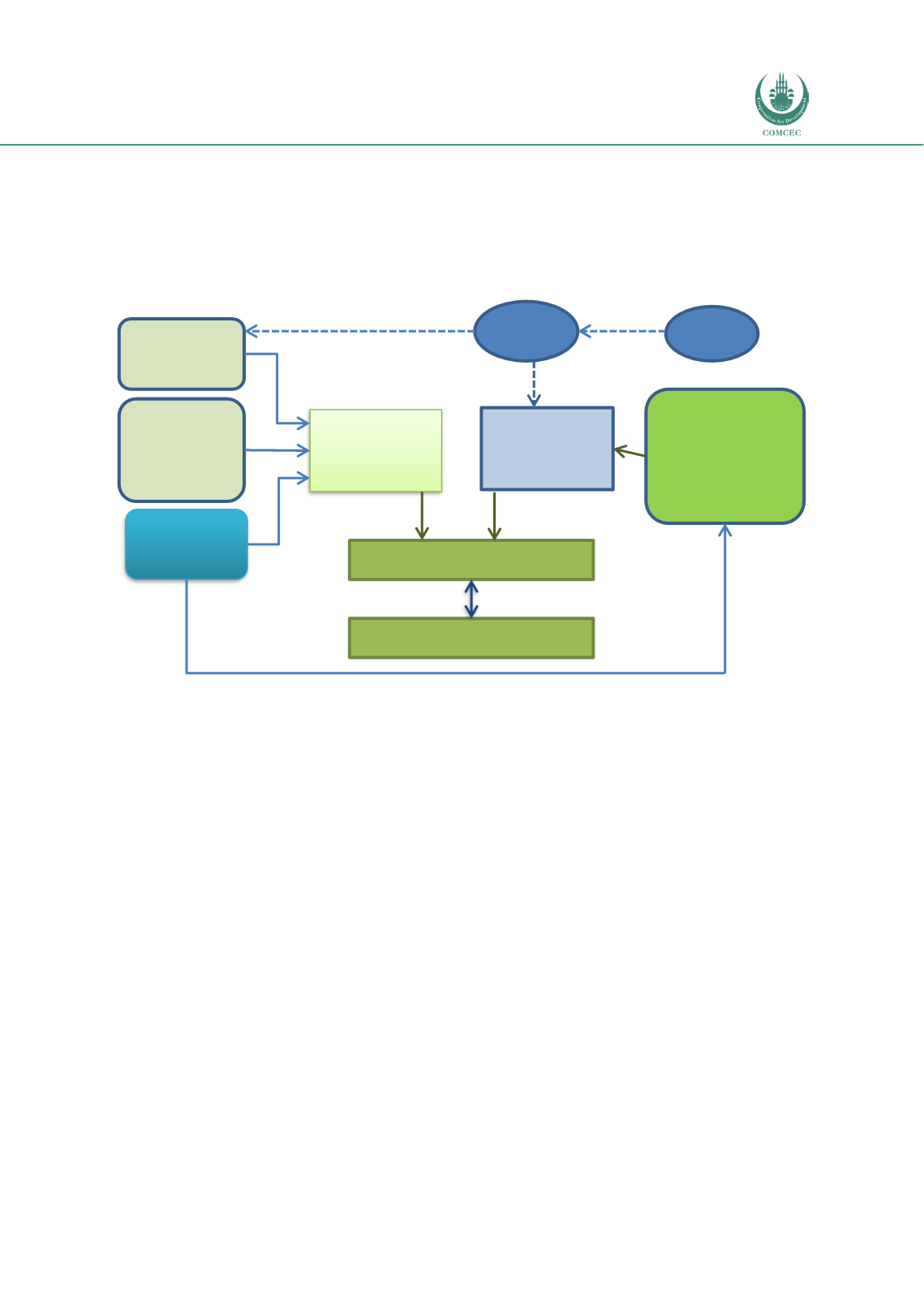

The takaful components came in the form of guarantees for USD 427 million provided by MIGA

to all investors (USD 5 million to DP World and $422 million to the financiers) against risks of

breach of contract, restrictions on currency transfers, expropriation, and civil disturbance and

war. Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC) in turn

provided reinsurance for USD50 million to MIGA.

Chart 3.12: Doraleh Container Terminal Financing Structure

Source: World Bank et. al. (2017) and MIGA (2008)

3.6.

Islamic Capital Markets/

Sukuk

and Infrastructure Financing

Instead of getting direct financing from financial institutions, another option for raising funds

for infrastructure is to use the capital markets by issuing sukuk. AAOIFI identifies various

types of

sukuk

that can be classified broadly as being based on assets, debt, equity, and

services. Asset based

sukuk

include certificates issued against an asset (

ijarah

sukuk

)

or the

usufructs of an asset (

sukuk manfah

). While

ijarah

sukuk

are issued against an existing tangible

asset, leased asset, and/or promise of leasing an asset in the future,

manfah

sukuk

are issued

by owners of the usufruct of existing or future assets. Investors in these

sukuk

become owners

of the assets in the former and usufructs in the latter. Debt-based

sukuks

arise from sale

transactions that create debt. Funds raised by

murabahah sukuk

are used to purchase assets or

goods that are then sold at a mark-up to the obligor. Similarly,

istisna sukuk

are used to raise

funds that are used in the construction of real estate. The investors become the owners of the

real estate upon completion and lease it to the obligor against periodic rental payments.

Equity-based

sukuks

can take the form of mudarabah or musharakah whereby partnership is

formed between the investors and the obligor. Investors of

mudarabah sukuk

participate in a

project by contributing funds and then appointing the Project Company as a manager. The

profit of the project is shared by the investors and obligor at an agreed upon ratio.

Musharakah

sukuk

is similar to mudarabah sukuk with the difference that investors have a say in the

management of the project. Under the agency-based

sukuks

such as

wakala

, the investors

DP World

Djibouti FZCO

Government

of Djibouti

Islamic Financiers

•

Dubai Islamic

Bank

•

Standard

Chartered

BankWestLB AG

Port

Autonome

International

de Djibouti

Financiers

Investment agent

Doraleh

Container

Terminal S.A.

(Project

Company)

DCT Musharakah JV

Doraleh Container Terminal Project

Owns

Concession

Owns

Owns

Contributes

MIGA

ICIEC

Equity

Guarantee

Musharakah

financing

Guarantee

Reinsurance

Direct Agreement