Infrastructure Financing through Islamic

Finance in the Islamic Countries

64

Challenges and Prospects

Given the issues related to illiquid assets and capital requirements related to direct long-term

investments by financial institutions, a better way to raise funds for investment projects is to

use the capital markets. Since debt-based sukuk cannot be sold, it would be desirable to issue

asset-based and equity-based project sukuk. Issuing these kinds of sukuk not only reflects the

risk-sharing features of Islamic finance but will also enhance the liquidity features of the

securities that will attract investments from Islamic financial institutions in infrastructure

projects. However, the data shows that the Islamic capital markets are relatively small and

underdeveloped in many OIC countries relative to the Islamic banking sector. To increase the

role of Islamic finance in infrastructure investments would, therefore, require developing the

Islamic capital markets.

3.7.

Islamic Nonbank Financial Institutions

The nonbank financial institutions (NBFIs) such as

takaful

(Islamic insurance), pension funds,

investment banks, sovereign wealth funds, etc. form another potential source of funds for

infrastructure investments. However, the size of other Islamic financial institutions (OIFIs) and

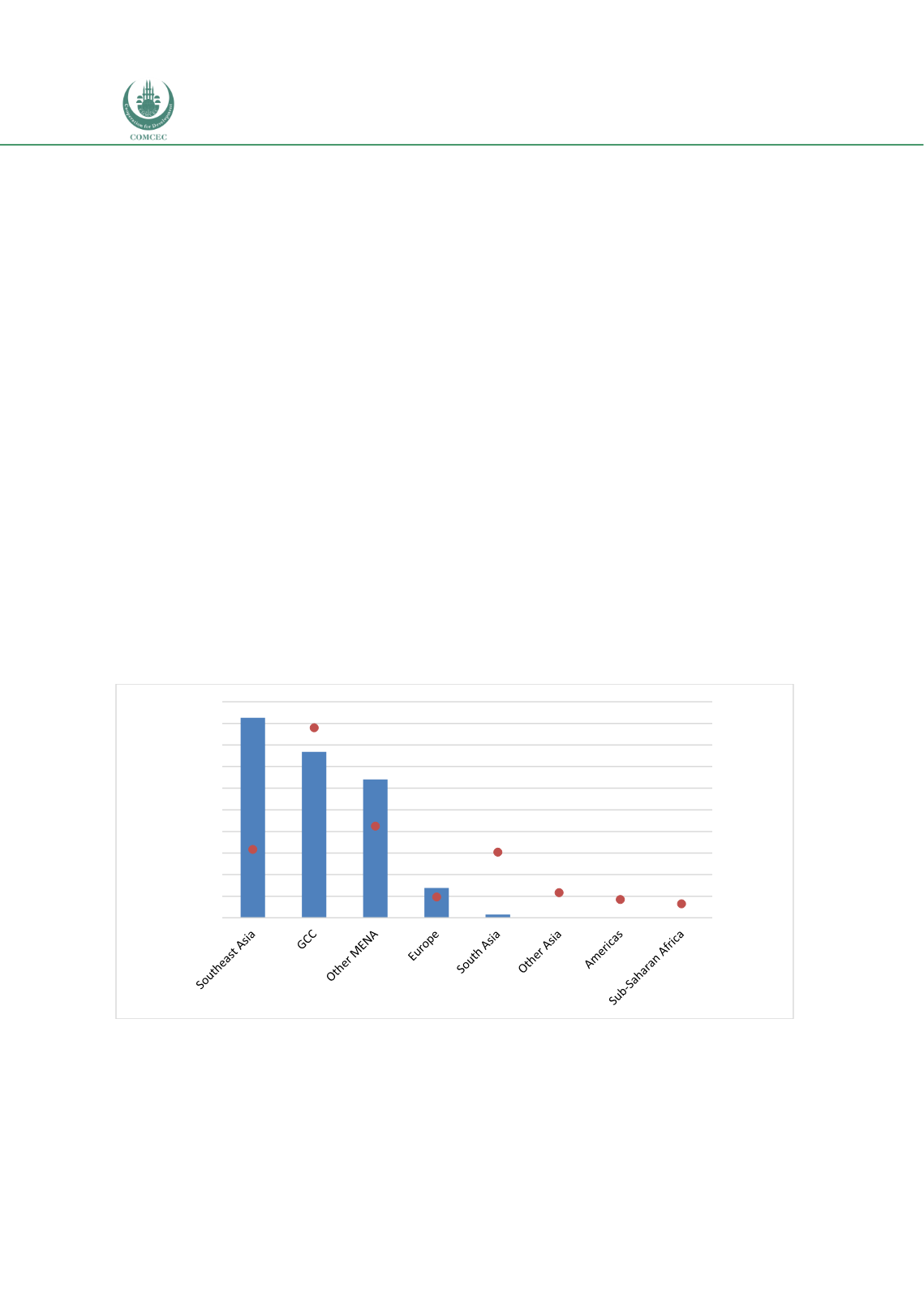

the takaful sector is relatively small. Charts 3.17 and 3.18 show the relative sizes of these

sectors in different regions. Of the total of 571 OIFIs in the world, 220 OIFIs are located in the

GCC with assets worth USD 38.419 billion and 79 OIFIs in Southeast Asia have assets valued at

USD 46.319 billion. The numbers indicate that the assets of an average size OIFI in Southeast

Asia (USD 586.3 million) is larger than one in the GCC with an average size of USD 172.6

million.

Chart 3.17: Distribution of OIFIs and Assets (USD million)

Source: ICD & TR (2017)

The distribution of the takaful operators and their assets is shown in Chart 3.18. Most of the

total global 339 takaful companies are located in the GCC with 94 takaful companies having

assets worth USD 18.902 billion. While the Southeast Asia region has 88 takaful operators,

their assets are valued at USD 10.491 billion which is lower than that of the Other MENA

region which has 75 operators with assets of USD 11.591 billion.

46,319

38,419

32,034

6,879

705

42

14

1

79

220

106

24

76

29

21

16

0

50

100

150

200

250

-

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

45,000

50,000

No. of OIFIs

USD (million)