Infrastructure Financing through Islamic

Finance in the Islamic Countries

65

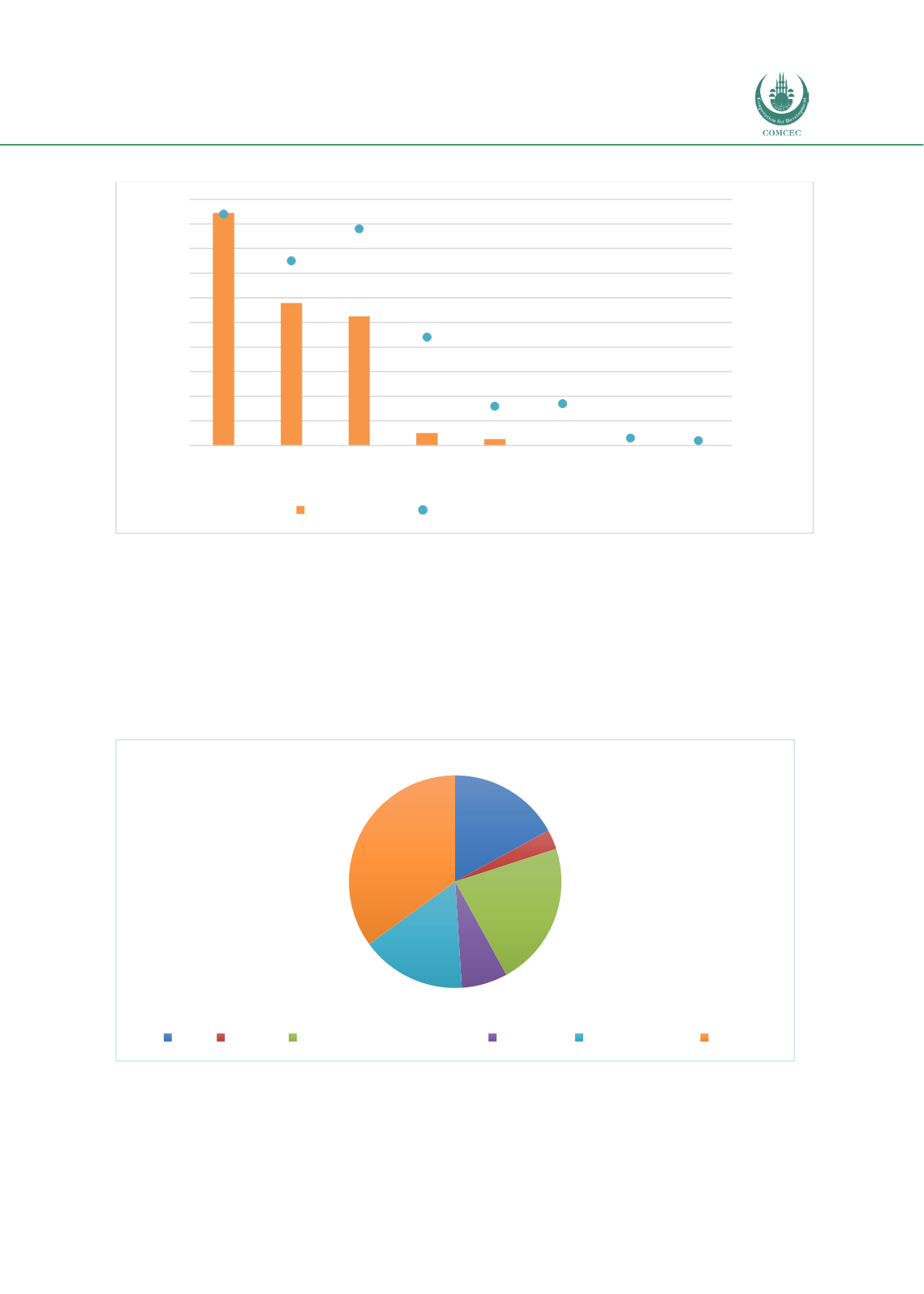

Chart 3.18: Distribution of Takaful Operators and Assets (USD billion)

Source: ICD & TR (2017)

In order to have an understanding of the contribution of the takaful sector in infrastructure

investments, Chart 3.19 shows the distribution of their investments in the GCC region.

Although a significant part of the investments is in the other category, more than one-fifth

(22%) of the investments of takaful operators are in government bonds and sukuk. A

significant amount of assets (17%) are held as cash and 16% are invested in funds. Although

some of the investments in sukuk can possibly be related to infrastructure, there is no clear

indication of the takaful sector’s investments in these projects.

Chart 3.19: Distribution of Investments by Takaful Operators in GCC (%)

Source: Global Advisors World Takaful Report 2016

18.902 11.591 10.491 1.02

0.521 0.008 0.003

94

75

88

44

16

17

3

2

0

10

20

30

40

50

60

70

80

90

100

0

2

4

6

8

10

12

14

16

18

20

GCC Other MENA Southeast

Asia

South Asia Europe Sub-Saharan

Africa

Americas Other Asia

No. of takaful operators

USD (billion)

Takaful Assets

No. of Takaful Operators/Windows

17%

3%

22%

7%

16%

35%

Cash Equities Government and other sukuk Properties Funds/Unit Trust

Others