Infrastructure Financing through Islamic

Finance in the Islamic Countries

58

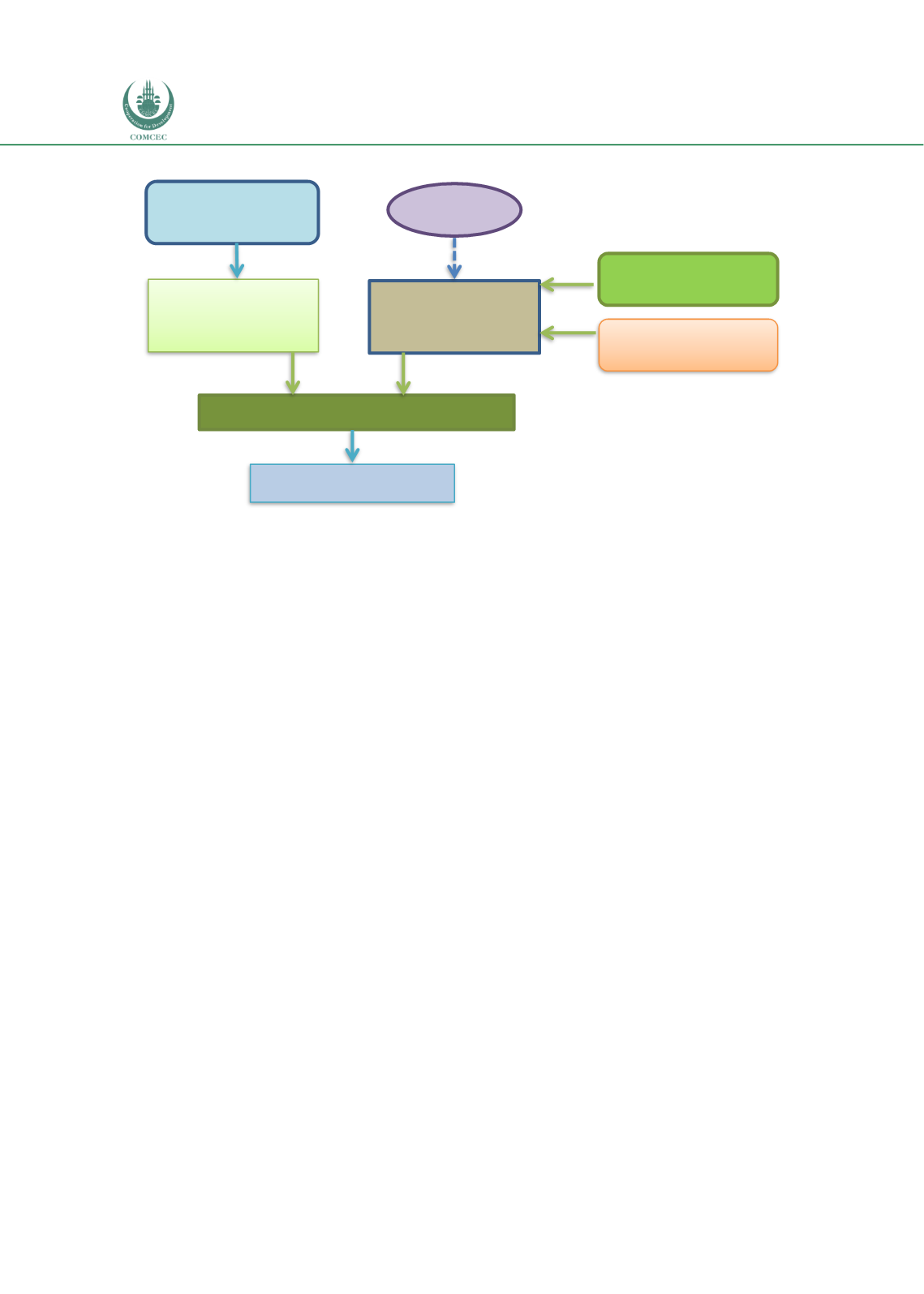

Chart 3.11: Master Wind Energy Limited Financing Structure

Source: Adapted from Ahmed (2017)

The uncertainty in revenue stream was mitigated with the Upfront Tariff Regime announced

by the GoP in 2013 whereby the Feed in Tariff along with permitted indexations and

escalations was applicable throughout the 20 years concession period. The arrangement was

also backed by guarantees provided by the GoP under the Concession Agreements. However,

the project assets were insured and in case of total loss, the insurance claims would be

distributed among the financiers and project sponsors according to their shares of

musharakah

assets. The structure of the financing is shown in Chart 3.11.

Case Study: Doraleh Container Terminal Project

Djibouti’s Doraleh container terminal project was one of the first, large PPP infrastructure

projects that was wholly financed by Islamic syndication. Initiated in 2007, DP World of the

United Arab Emirates (UAE) and Port Autonome International of Djibouti were the key

sponsors of the project. They established the Doraleh Container Terminal S.A. (DCT) as a

Project Company to develop and operate the port under a 30-year concession agreement. DP

World provided the initial USD 5 million equity in the project and then the Project Company

raised USD 422 million through Islamic syndication. Dubai Islamic Bank, Standard Chartered

Bank and WestLB AG provided the funds in the syndicate through an investment agent, which

acted as the Funding Company.

The Islamic project financing used in the project was complex and included four contracts of

musharakah, istisna, ijarah

and

takaful

. Under

musharakah,

a partnership (DCT Musharakah

JV) was formed by the Project Company (DCT) and the financiers (Funding Company) to

procure the assets of the project. The DCT Musharakah JV then appointed DCT as their agent to

construct the terminal using the

istisna

contract. The payments for the construction were made

from the

musharakah

to DCT as multiple drawdowns. The financier’s co-ownership interests in

the project were leased to DCT under an

ijarah

agreement. Since the contract was for a long

period of time, the rental payments had both fixed and floating components. The ijarah

contract included advance rental payments during the construction period and regular rental

payments payable to the financiers after the completion of the terminal.

Islamic Financiers

AEDB

Investment Pool

Project Company

(MWEL)

Musharakah

Project Assets

USD 100 million

GoP

Guarantee

Concession

OPIC

USD 32 million