Infrastructure Financing through Islamic

Finance in the Islamic Countries

63

Case Study: Neelum Jhelum Sukuk, Pakistan

17

The government-owned public utility agency of Pakistan Water and Power Development

Authority (WAPDA), responsible for power and water production and distribution in the

country, planned to raise funds for the construction of a 969MW Neelum Jhelum Hydropower

project and decided to issue a sukuk to partially finance costs. Accordingly, it established the

Neelum Jhelum Hydropower Company (Private) Limited (NJHPC) as a Project Company that

issued sukuk certificates worth PKR100 billion making it the largest fund mobilization for a

public sector entity. Pak Brunei Investment Company Limited (PBICL) acted as the investment

agent for the investors composed of a consortium of 16 banks led by the National Bank of

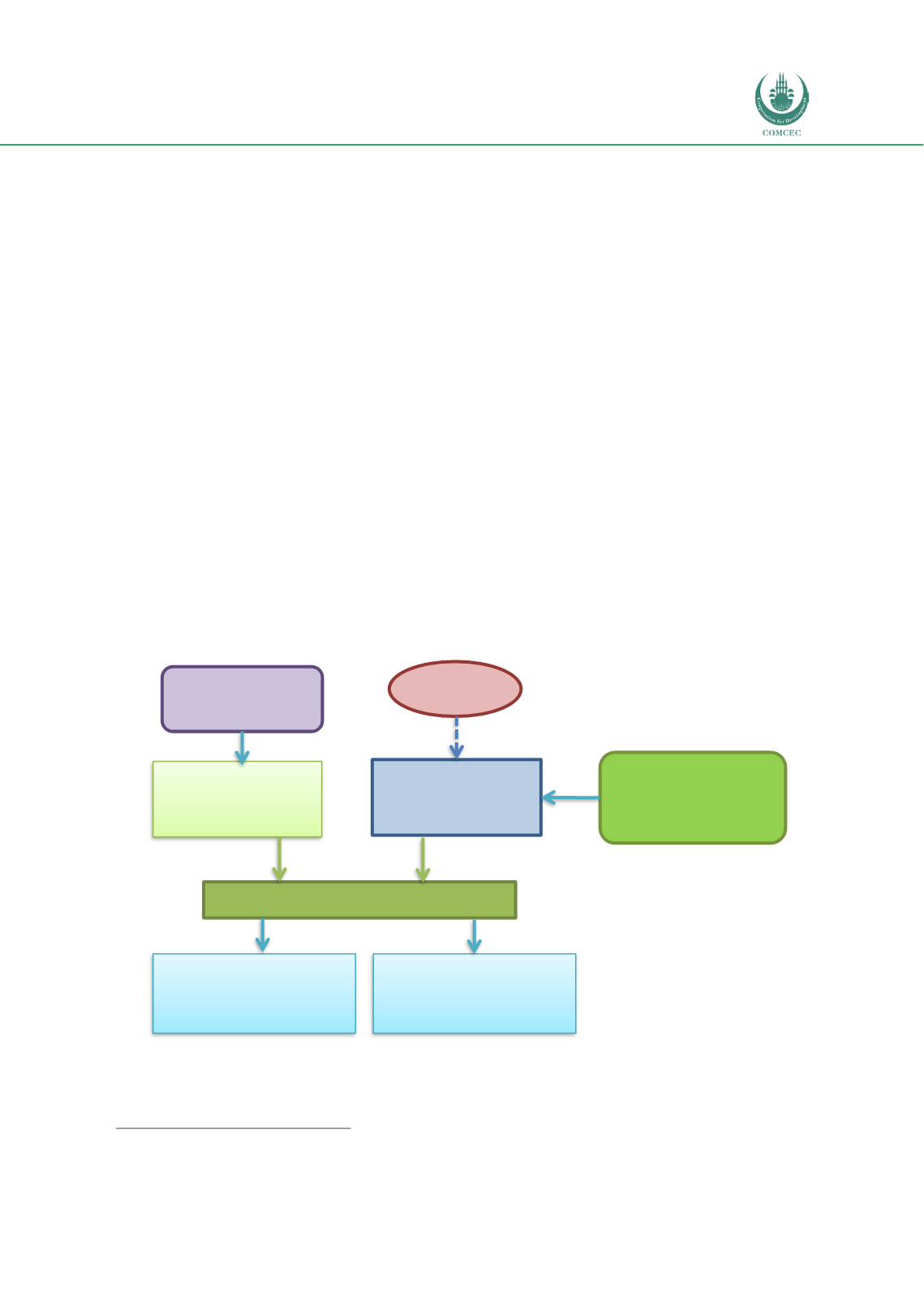

Pakistan. The sukuk had a maturity of 8 years with an additional 2 year grace period. Chart

3.16 provides an overview of the Neelum Jhelum Sukuk.

NJHPC and PBICL formed a

musharakah

whereby 75% of the share of the musharakah assets

were sold to the investors and the obligor contributed the remaining 25% in kind. The

investors’ share of musharakah assets worth PKR 100 billion was sold as the beneficial interest

of the project in two pools A and B. The projects assets were held in a trust by PBICL which

acted as a trustee for the benefit of the investors. An ijarah contract leased the investors’ share

of the assets to NJHPC and accordingly the semi-annual variable rental payments. The sukuk

was structured as a diminishing

musharakah

with a lag, with the principal redemption starting

from the third year. The investment agent was responsible for taking out

takaful

to cover the

risks related to ownership assets. The sukuk was rated AAA by JCR-VIS, a local credit rating

agency.

Chart 3.16: Neelum Jhelum Sukuk Structure

Source: Adapted from Ahmed (2017)

17

This case study is taken from Ahmed (2017).

Islamic Financiers

(16 Banks)

WAPDA

Investment Agent (Pak

Brunei Invest. Co. Ltd.)

Project Company

(NJHPC)

Musharakah

Pool A

PKR 86.67 billion

Issuer: 25%

Investment Agent: 75%

In kind (assets)

PKR 100 billion

GoP

Guarantee

Pool B

PKR 46.67 billion

Issuer: 25%

Investment Agent: 75%