Infrastructure Financing through Islamic

Finance in the Islamic Countries

56

large investments needed in most infrastructure projects and as most Islamic banks are

relatively small, banks usually participate in these projects through syndications whereby a

group of banks come together under an agent bank to finance a large project. Usually, a lead

financial institution will organize a syndicate and invite other financial institutions to

participate under a participation or investment agency agreement. In Islamic finance, the

relationship between the lead institution and the others can be in the form of the wakala

(agency) or mudarabah structure. In the former, the lead bank acts as an agent for all the banks

in dealing with the financing with the Project Company, and, in the latter, the lead bank acts as

a manager (mudarib) on behalf of the other investing institutions.

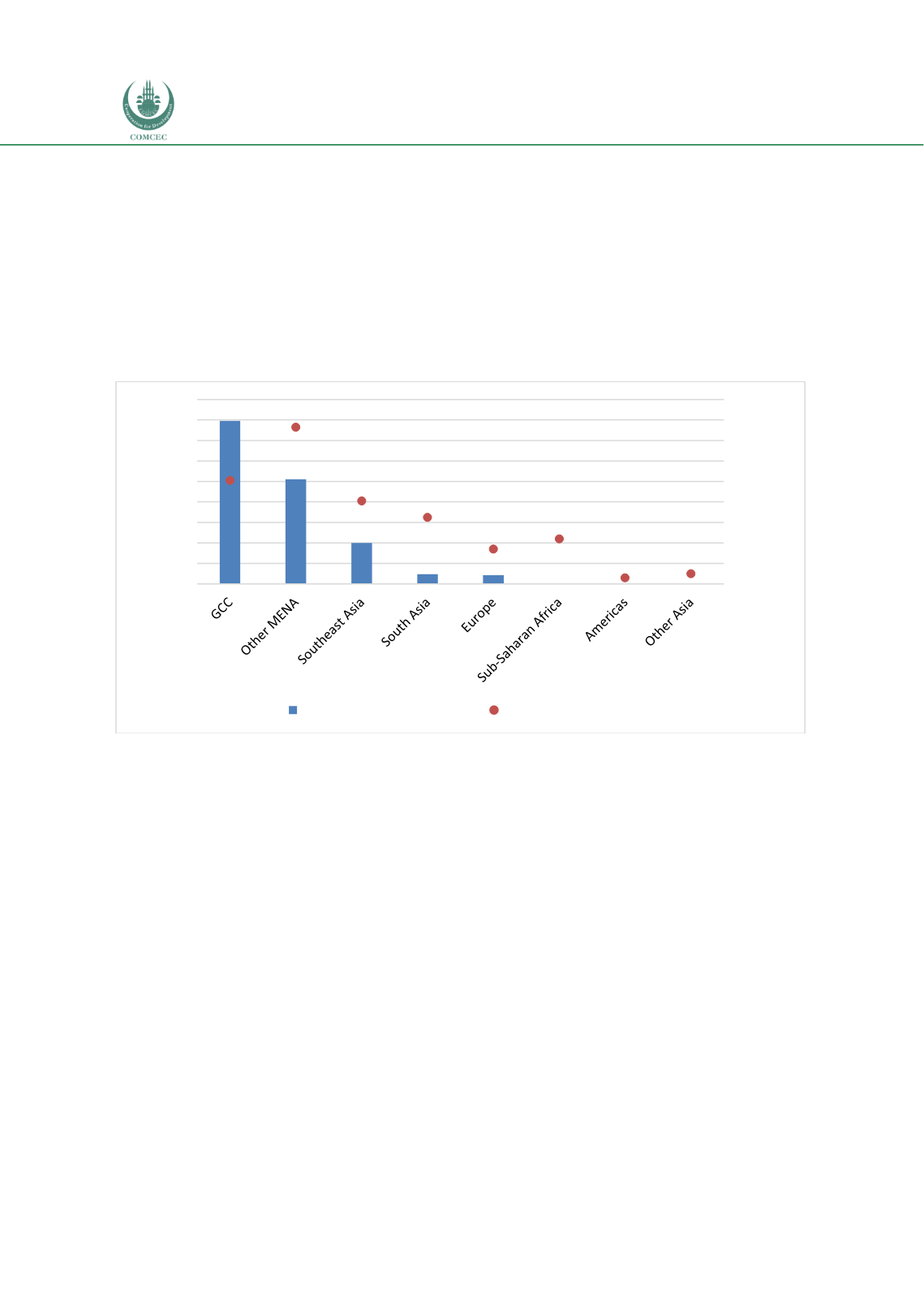

Chart 3.10: Distribution of Islamic Banks and Assets (USD billion)

Source: ICD & TR (2017)

Traditionally, syndicated finance is used at the second stage of the raising of funds by the

Project Company in the form of debt. In the case of Islamic finance, debt-based financing can

take the form of

istisna

,

murabahah

,

tawarruq

, and

ijarah

(Shah 2008) depending on the type

and need of financing. For example, if there is a need to finance an asset such as capital

equipment or raw materials,

murabahah

can be used in syndicate financing. In these cases, the

syndicate will purchases asset and then sell it to the Project Company at a mark-up. However,

if the assets cannot be identified and the Project Company needs cash, then

tawarruq

is used.

Due to the fixed nature of the debt-based structures, these may not be suitable to provide

finance with longer tenures. In these cases, syndicates can use the

ijarah

structure to finance

project assets with a variable rate of return.

Islamic banks can also participate in infrastructure investments with conventional financial

institutions through financing a tranche of the project whereby they invest in a part of the

infrastructure assets. The other parts of the investments would be provided by other financial

institutions which can also be conventional finance. In such cases, the transaction will be

divided into two components, one of which would be conventional and the other one Shariah

compliant (McMillen 2008). In order to segregate the conventional and Islamic components,

the part that is financed by the Islamic tranche has to be insulated from the rest of the project.

For example, a specific part of the project will be identified and a Shariah compliant structure

795.7 511.3 200.2 47.0

42.6

1.7

0.3

0.1

101

153

81

65

34

44

6

10

0

20

40

60

80

100

120

140

160

180

0

100

200

300

400

500

600

700

800

900

No. of banks

USD billion

Banking assets (US$ billion)

No. of Banks/Windows