Infrastructure Financing through Islamic

Finance in the Islamic Countries

55

capitalization of domestic companies for low income countries, the figure for OIC countries is

45.1% of the GDP, which is the lowest relative to other country groupings. It should also be

noted that the market capitalization of the OIC countries represents the average of 18

countries only, with no data available for the remaining countries. The relative size of the

banking sector and non-bank financial institutions of OIC countries is represented by the credit

provided to the private sector by these sectors. Overall the banking sector is larger than the

nonbank financial institutions sector in OIC countries with the credit to the private sector

provided being 38.3% and 17.7% of the GDP respectively. While the sizes of the banks and

non-bank financial institutions for OIC countries are better than the averages for low income

countries (21.0% and 6.0% of the GDP respectively), they are lower than all other income

groupings.

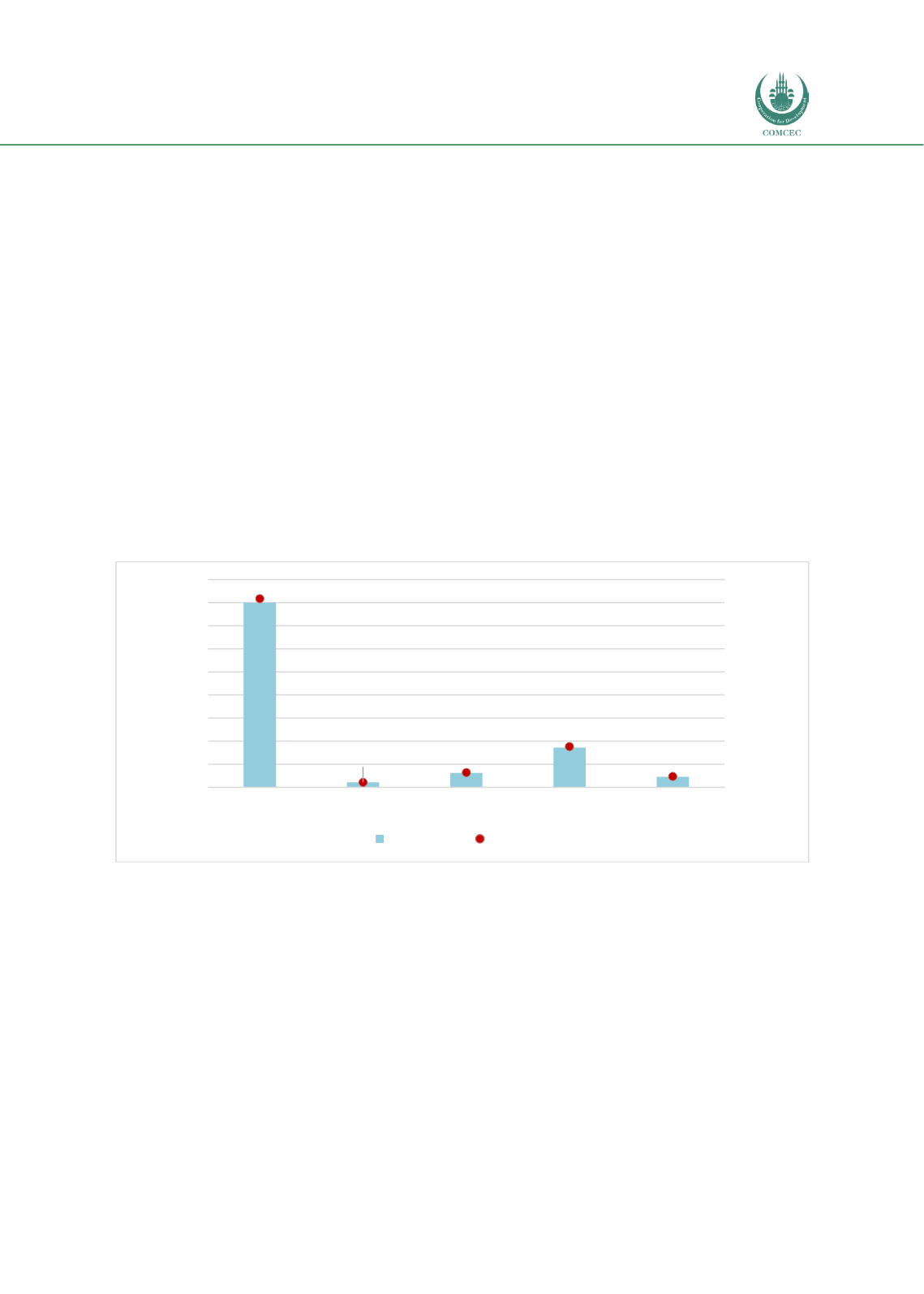

The global size of the different sectors of the Islamic financial industry is shown in Chart 3.9.

With a total value of USD 2.202 trillion of the Islamic finance assets in 2016, the Islamic

banking sector dominates the industry, constituting 72.6% of the total followed by the sukuk

valued at 15.7% of Islamic financial assets. Other Islamic financial institutions (IFIs) that

include investment banks, leasing companies, etc. have assets worth USD 124.4 billion with

Islamic fund assets being valued at USD 91.2 billion.

Chart 3.9: Islamic Financial Sectors Size (2016) (USD billion)

Source: ICD & TR (2017)

3.5.

Islamic Banking Sector and Infrastructure Financing

The distribution of 494 Islamic banks across different regions is shown in Chart 3.10. While the

MENA region excluding the GCC has the largest number of banks, holding USD 511 billion in

assets, 101 banks in the GCC region have assets valued at USD 795.7 billion. Southeast Asia has

81 Islamic banks holding USD 200.2 billion in assets followed by 65 Islamic banks in South

Asia with assets worth USD 47 billion.

The scope of using banks to finance infrastructure projects increases the larger the bank is.

The data shows that the average assets of an Islamic bank are valued at USD 3.24 billion which

is relatively small. As indicated, financial institutions can invest in infrastructure projects

either by direct financing or buying project securities issued by the Project Company. Given the

1598.9

42.5

124.4

344.8

91.2

72.6%

1.9%

5.7%

15.7%

4.1%

0%

10%

20%

30%

40%

50%

60%

70%

80%

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

Islamic banking

Takaful

Other IFIs

Sukuk

Islamic funds

Percentage of total

USD (Billion)

US$ (Billion)

Percentage