Infrastructure Financing through Islamic

Finance in the Islamic Countries

150

4.5.5.3.Capital Markets

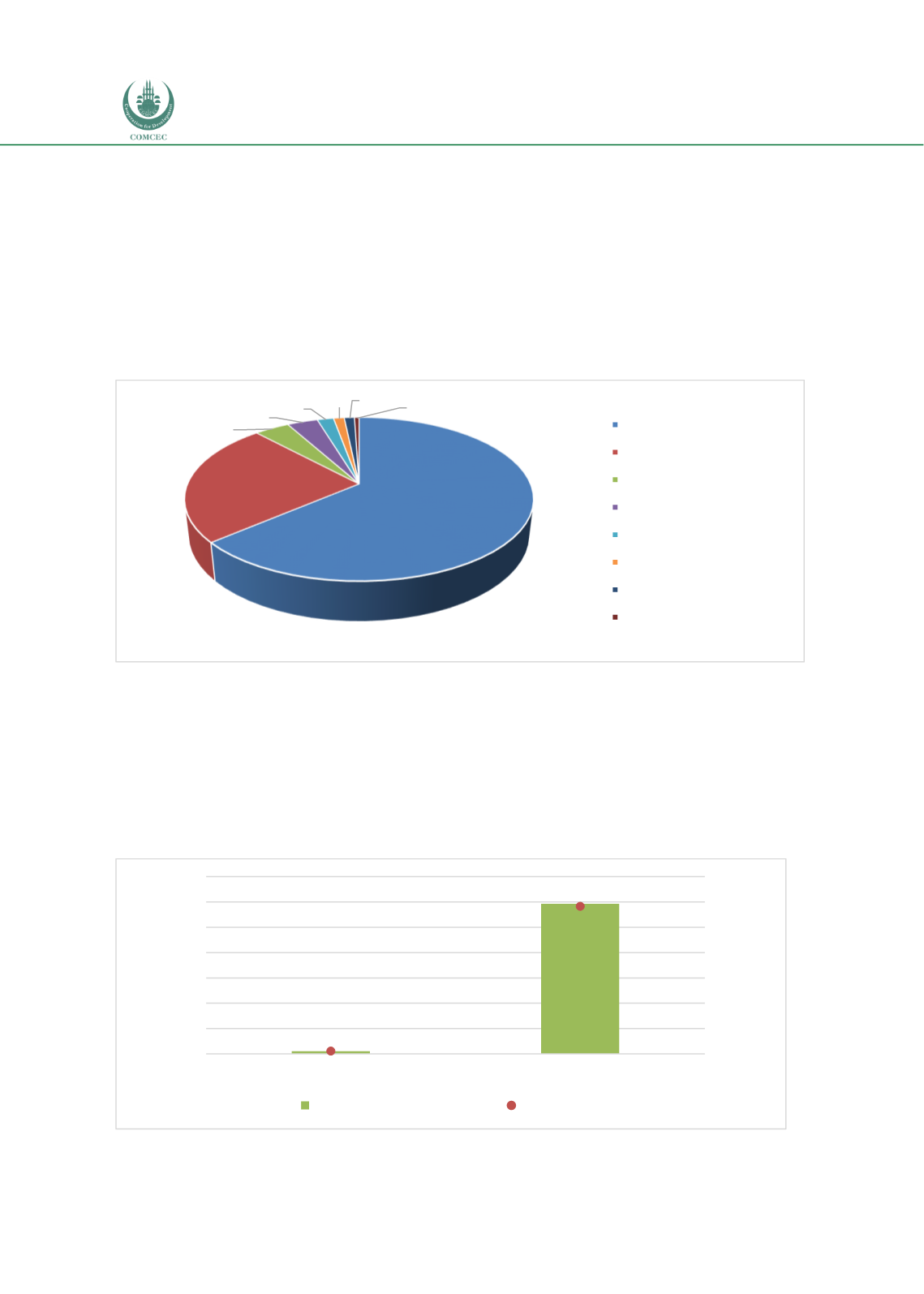

Capital markets contribute in financing the infrastructure sector through infrastructure

corporations, sukuk and GICs listed and traded on the KSE. Chart 4.5.6 shows the sector-wise

market capitalization of KSE listed companies that have a total value of SDG 19.837 billion.

While the banking sector dominates the market with almost 64% of the share, the

telecommunication and investment & development belonging to infrastructure sub-sectors

ranked second (24.4%) and third (3.9%) respectively.

Chart 4.5. 6: Market Capitalization of Listed Companies Categorized according to Sector

(2017) (%)

Source: KSE Annual Report 2017

4.5.5.4.

International Sources

Shariah compliant funds from international sources are provided by IDB. Chart 4.5.7 shows the

project financing that Sudan received from the IDB since its inception in 1976. While 100

projects worth USD 1.185 billion were funded during 1976-2016, two projects valued at USD

21.5 million have been financed since 2016.

Chart 4.5. 7: Number of Projects and Financing from IDB: Sudan (USD million)

Source:

https://isdbdata.github.io/monograph2017.html63.7%

24.4%

3.9%

3.4%

1.8% 1.2% 1.1%

0.5%

Banking sector

Telecommunication

Investment & Development

Commercial

Insurance

Industry

Agriculture

Brokerage Companies

21.5

1,185.7

2

100

0

20

40

60

80

100

120

0

200

400

600

800

1,000

1,200

1,400

Total Project Financing 2016+

Total Project Financing (1976-2016)

No. of Projects

USD (Million)

Total Financing (US$ Million)

No. of Projects