Infrastructure Financing through Islamic

Finance in the Islamic Countries

154

period and the continuous economic uncertainties. Sudan remains one of the potential

countries for infrastructure investment using different Islamic financing and investment

instruments if Sudan’s National Strategic Plan (2007 - 2032) succeeds in achieving economic

diversifications and economic stability. Despite the huge funds spent by the government on

infrastructure projects in the last decade, the infrastructure development needs in Sudan have

exceeded the capacity of the state budget and the domestic financial sectors’ capacities.

Although PPP is not codified or regulated, different PPP projects have been implemented

through GLCs, particularly during the early stage of the government privatization policy. For

example, Sudatel, which is considered as one of the best and most successful infrastructure

projects, was financed jointly by the government and private sector. Since the whole financial

system in Sudan is Shariah-compliant, the current legal and regulatory regime is supportive to

the Islamic finance industry. However, the contribution of Islamic banks in direct

infrastructure investments has been relatively small, with only 3.59% of the assets invested in

the sector. The financial institutions contribute to infrastructure development indirectly by

investing in sukuk and GICs issued by the government.

The SFSC plays an important role in enabling the issuance of different Islamic financial

securities. The government and infrastructure-related GLCs use the services of the SFSC to

issue various types of Shariah-compliant certificates. While the government uses the funds to

control liquidity at the macroeconomic level and to finance the annual budget, some securities

are linked to the development of the infrastructure sector.

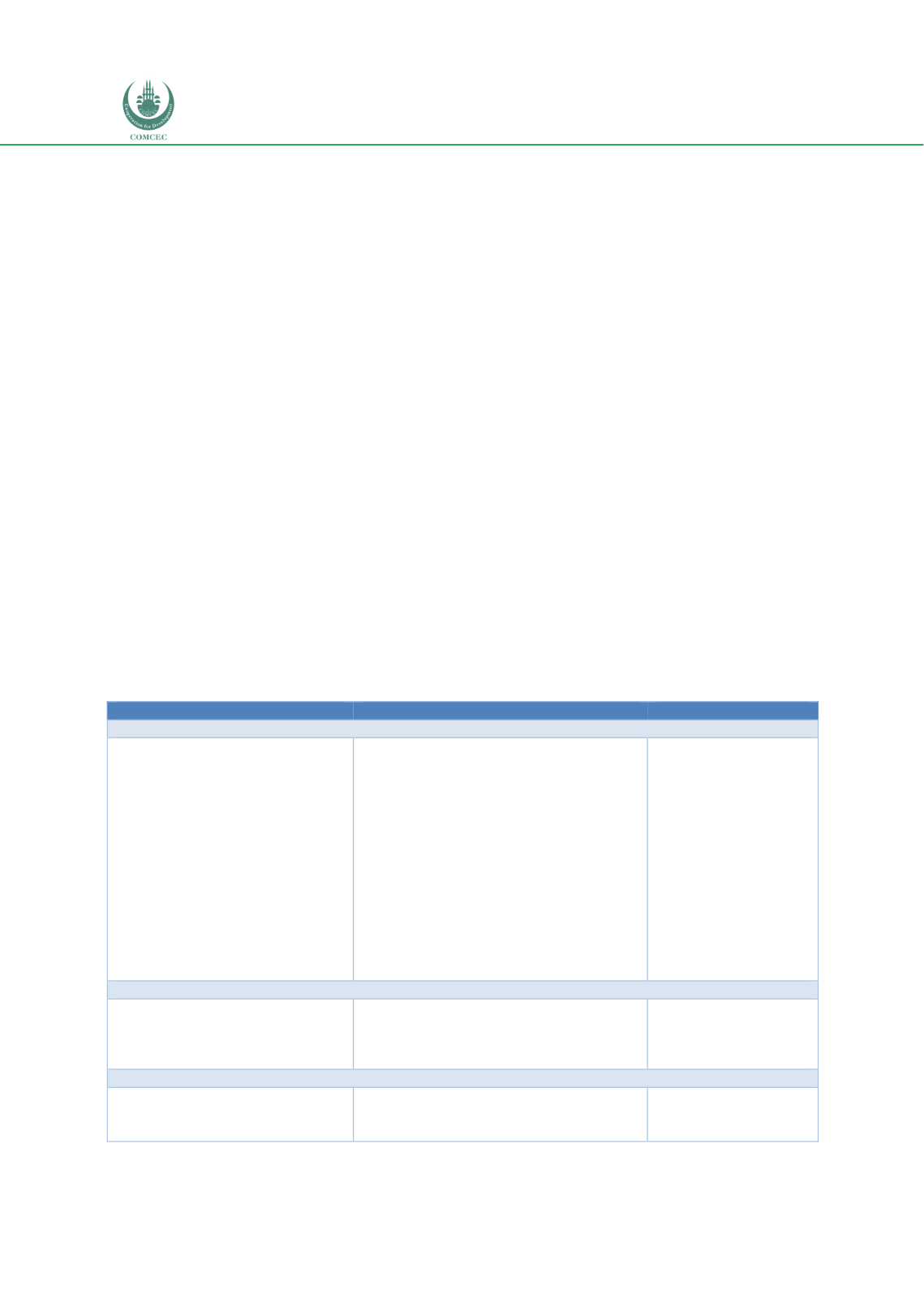

The issues and recommendations to further enhance the role of the financial sector in

infrastructure development in Sudan are presented in Table 4.4.5 below.

Table 4.5. 5: Issues and Policy Recommendations: Sudan

Issues

Recommendations

Implemented by

Infrastructure Related Strategies and Policies

Sudan plans to increase the role of

the

private

sector

in

infrastructure development and is

improving

the

regulatory

environment for PPPs with

assistance from PPIAF.

Since infrastructure projects are

complex and long term, there is a

need to provide guarantees to

other project specific risks to

encourage

private

sector

participation in infrastructure

investments.

Develop Shariah-compliant contract

templates that can be used for different

types of infrastructure projects.

Provide guarantees and insurance to

mitigate risks in project financing.

Takaful and guarantees can cover some of

the project risks such as political risks,

and partial credit risks would encourage

Islamic financial institutions to invest in

the infrastructure sector.

Relevant government

bodies in coordination

with IDBG

Relevant public

bodies

Private sector takaful

companies

Legal and Regulatory Regimes

Islamic bank contribution to

infrastructure development can

be increased by

syndicated

financing.

Create a sound legal and contractual

framework for syndication to increase the

participation of Islamic banks in

infrastructure projects.

Relevant government

ministries

Islamic Financial Institutions

Restricted investment accounts

can be used for infrastructure

projects since the investors of

Increase the share of restricted

investments accounts in Islamic banks.

Banking regulators

Islamic banks